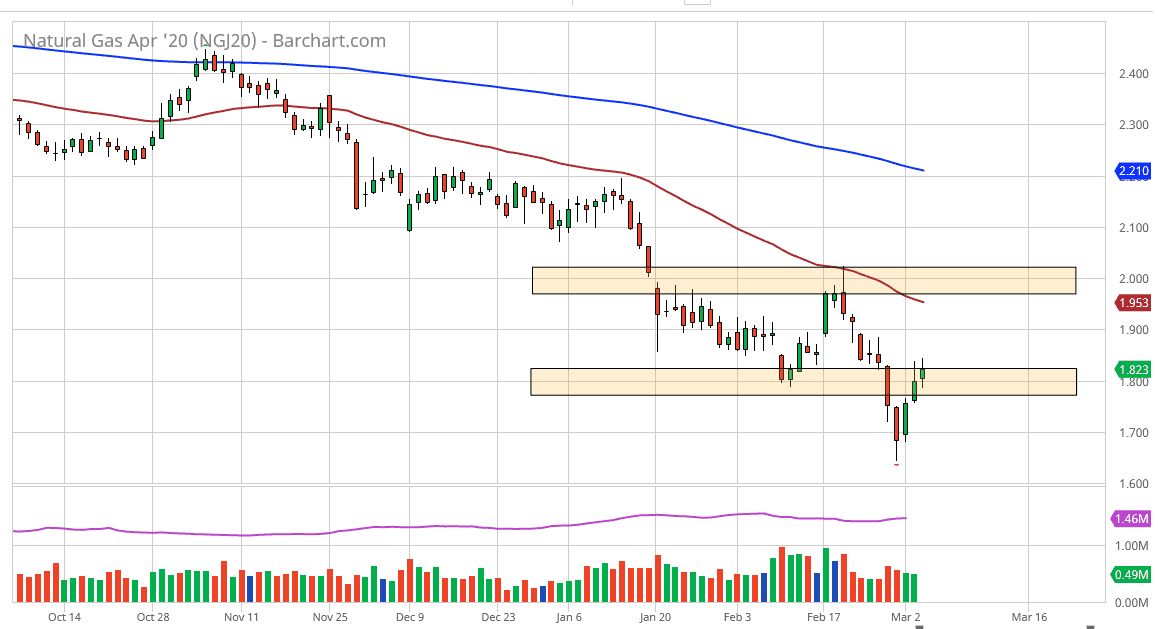

Natural gas markets have gone back and forth during the trading session on Wednesday but have struggled a bit above the $1.85 handle. This should not be a huge surprise considering that there is an overabundance of natural gas around the world and the markets cannot get out of their own way. I do believe that it is only a matter of time before market participants will sell into any rally, and I know that I will be waiting for a move above after any type of significant bullish inventory figure.

Natural gas is so oversupplied that it is going to take a slew of bankruptcies in the United States when it comes to drillers and suppliers in order to make natural gas markets rallied again. I don’t necessarily believe in natural gas and I do think that it is only a matter of time before we revisit the lows. That being said, if the market does get that slew of bankruptcies then I think natural gas markets will probably spike. However, we are heading into the warmer months of the year, at least for the northern hemisphere which is by far the largest consumer of the commodity.

To the downside I see the $1.75 level as a short-term support level but letting that get broken to the downside should open up the door for another five cents move to the $1.70 handle. Furthermore, then we will reach towards those lows as mentioned previously. That being said, if the market does rally from here and take off to the $1.90 level, I will not hesitate to start shorting and adding to a short position all the way to the 50 day EMA above, perhaps even the $2.00 level. I have no interest in trying to get cute with this market and try to buy and sell it, because quite frankly there is nothing out there to pick up natural gas demand anytime soon.

The market has simply been a “sell the rallies” type of situation for some time now, and I don’t see that changing anytime soon. I don’t necessarily think that we will break below the $1.60 level, but clearly fading rallies has worked and should continue to be the way that most shorter-term traders choose to focus on this marketplace. Be aware of the possibility of volatility as the inventory figures come out, but that should be short-lived.