Inspired by panic-induced decision making out of the US Federal Reserve, which slashed interest rates by 150 basis points in two emergency sessions to 0.00%, the Reserve Bank of New Zealand (RBNZ) followed suit with a 75 basis point interest rate cut to a record low of 0.25%. It further noted that the rate will remain at this level for the next twelve months. More stimulus, if necessary, will come in the form of a quantitative easing program by purchasing New Zealand government bonds. The NZD/JPY extended its breakdown sequence, and more downside is anticipated.

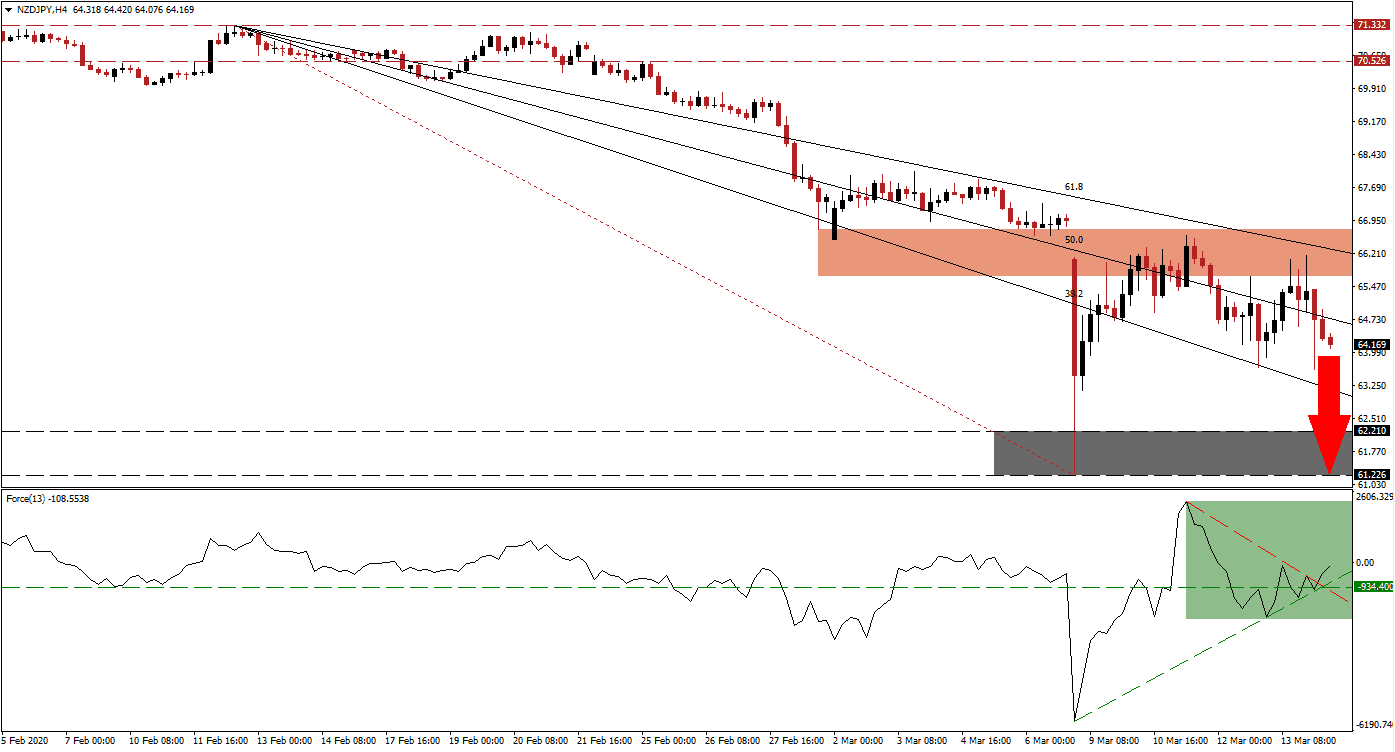

The Force Index, a next-generation technical indicator, contracted from its most recent peak. After moving below its horizontal support level, the Force Index recovered, assisted by its ascending support level. It pressured it back above its horizontal support level and through its descending resistance level, converting it into temporary support, as marked by the green rectangle. Bears remain in control of the NZD/JPY as this technical indicator maintains its position in negative territory.

Before the RBNZ opted for its emergency session, this currency pair was recovering off of its descending 38.2 Fibonacci Retracement Fan Support Level. The NZD/JPY was rejected by its short-term resistance zone located between 65.706 and 66.745, as marked by the red rectangle, which includes a price gap to the downside. The 61.8 Fibonacci Retracement Fan Resistance Level enforced the long-term bearish chart pattern. The Bank of Japan announced an emergency meeting today after the US Federal Reserve measures. You can learn more about a price gap here.

Price action is expected to challenge its support zone located between 61.226 and 62.210, as marked by the grey rectangle. Asian markets plunged after the announced central bank actions and futures markets in the US triggered another limit-down circuit breaker. Unless the Japanese central bank will announce measures to thwart a strengthening of its currency, the Japanese Yen is favored to attract safe-haven capital inflows. A stronger currency harms exporters, and Forex traders should prepare for more volatility in the NZD/JPY.

NZD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 64.150

Take Profit @ 61.250

Stop Loss @ 65.000

Downside Potential: 290 pips

Upside Risk: 85 pips

Risk/Reward Ratio: 3.41

A move in the Force Index above the 0 center-line, initiated by its ascending support level, is likely to result in a breakout attempt in the NZD/JPY. Due to the dominant bearish fundamental outlook, the upside potential in this currency pair is limited to the 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders should consider new sell orders if the Bank of Japan meeting causes a price spike unless a material change will be announced.

NZD/JPY Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 65.400

Take Profit @ 66.200

Stop Loss @ 65.000

Upside Potential: 80 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.00