Economists fear a deep recession in New Zealand due to the nationwide lockdown in an attempt to prevent the Covid-19 pandemic from spreading. Most sectors will face significant challenges in the coming months, but food processing, telecommunications, and isolated manufacturing remain resilient. While the Japanese economy may enter a recession first, the Japanese Yen continues to attract safe-haven demand, expected to increase during the next wave of selling across global financial assets. The NZD/JPY was rejected twice by its short-term resistance zone, from where a new breakdown sequence is pending.

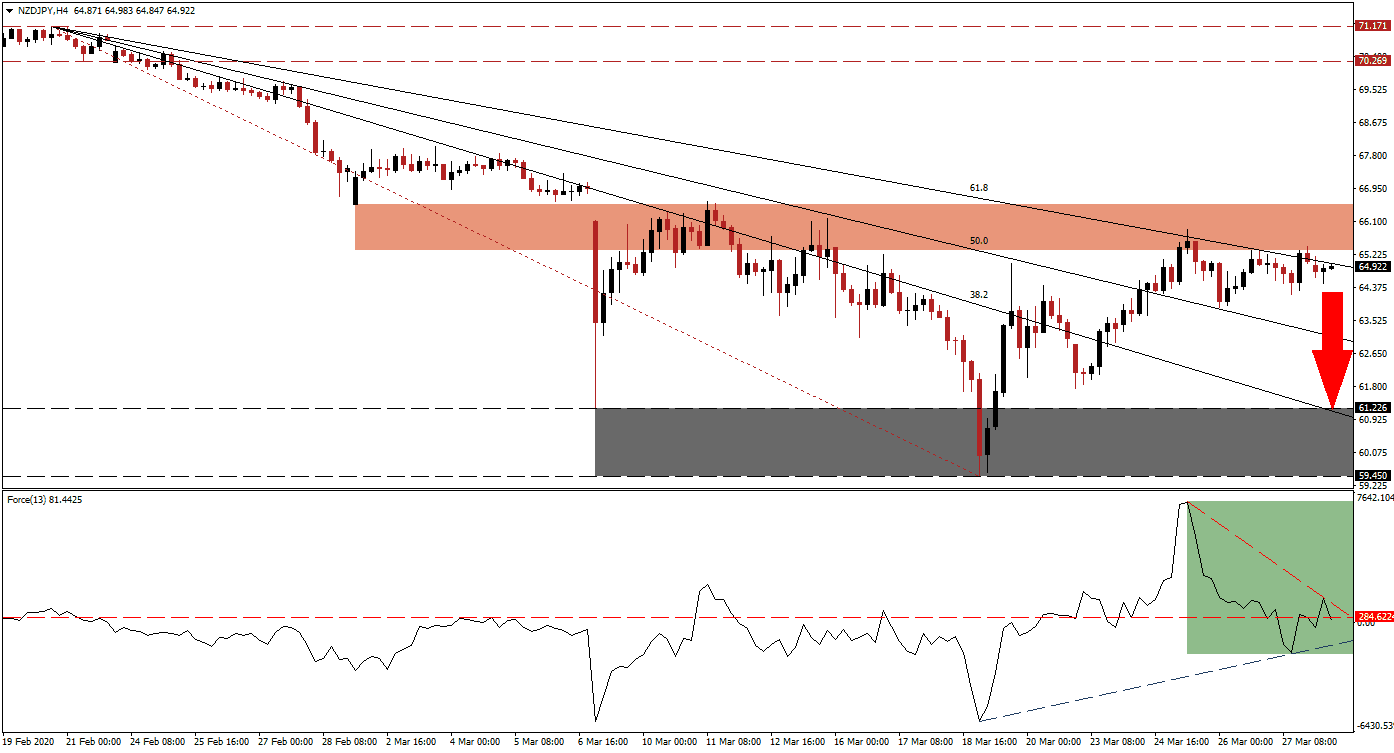

The Force Index, a next-generation technical indicator, spiked to a multi-week high before collapsing below its horizontal support level, converting it into resistance. Following a higher low, it attempted a recovery, which was reversed. The Force Index is now being pressured to the downside by its descending resistance level, as marked by the green rectangle. This technical indicator is anticipated to contract below its ascending support level, into negative territory, ceding control of the NZD/JPY to bears.

After price action converted its short-term support zone into resistance, the NZD/JPY was rejected five times. This zone is located between 65.350 and 66.525, as marked by the red rectangle. It also includes a minor price gap to the downside. Adding to breakdown pressures is the descending 61.8 Fibonacci Retracement Fan Resistance Level. Japan is preparing an economic relief package more massive than the one delivered during the 2008 global financial crisis. You can learn more about the Fibonacci Retracement Fan here.

Japan plans additional measures once the pandemic ends to boost hard-hit industries. New Zealand and Japan are well-positioned to exit the crisis ahead of many peers, but the safe-haven appeal of the Japanese Yen provides a bearish catalyst for the NZD/JPY in the medium-term. The 38.2 Fibonacci Retracement Fan Support Level already entered the support zone located between 59.450 and 61.226, as identified by the grey rectangle. It is favored to guide price action to the downside.

NZD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 64.950

Take Profit @ 60.950

Stop Loss @ 66.150

Downside Potential: 400 pips

Upside Risk: 120 pips

Risk/Reward Ratio: 3.33

Should the Force Index accelerate above its descending resistance level and maintain the breakout, the NZD/JPY is likely to close the price gap to the downside. With economic uncertainty high, the outlook for this currency pair remains bearish. Forex traders are recommended to consider any reversal from current levels as an opportunity to placed new sell orders. The next resistance zone awaits price action between 70.269 and 71.171.

NZD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 67.400

Take Profit @ 70.250

Stop Loss @ 66.000

Upside Potential: 285 pips

Downside Risk: 140 pips

Risk/Reward Ratio: 2.04