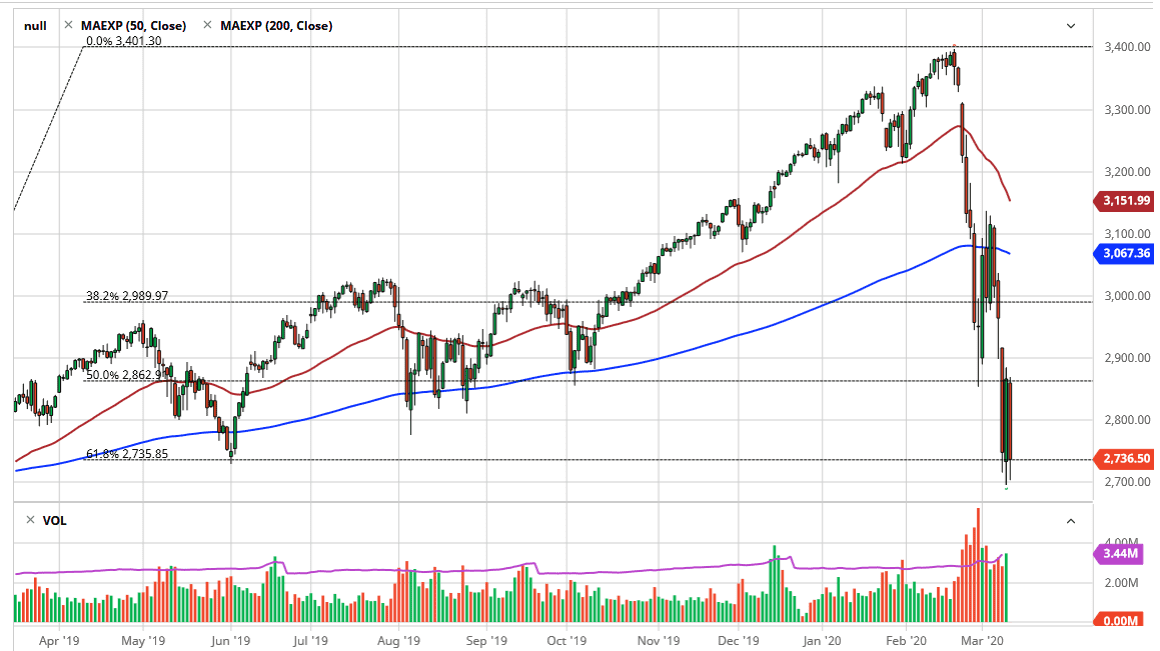

The S&P 500 has fallen a bit during the trading session on Wednesday, breaking down towards the 2700 level again before bouncing. This is an area that has been stubborn support, so if the level gets broken down below, that would of course be a very negative sign, and could send this market down towards the 2600 level, possibly even the 2500 level. With that being the case, the market is very likely to see a lot of acceleration to the downside if that does in fact happen. In the short term, any rally should be looked at with suspicion, as the 2900 level has been both support and resistance as of late.

The S&P 500 is suffering at the hands of a government in the United States that is not offering fiscal stimulus, but even fiscal stimulus can only do so much as while it may help cushion the economy after the fact, the reality is that people are not going to be gathering in large crowds as much as they once were, and that of course has a negative effect on economies in general. I think at this point it’s likely that we will see a lot of back and forth based upon the latest headline, so the most important thing you can do is keep your position size relatively small. This has been a market that simply can’t get out of its own way but also shows a certain amount of stubborn resiliency.

If we were to break above the gap that is just above the 2900 level, the 3000 level then comes into play. A break above that level would be impressive, but quite frankly I don’t see how that happens without some type of external help. It’s not going to be about the underlying companies themselves, this is all about the coronavirus, government stimulus, and central bank policy. We have gone beyond the idea of trading earnings reports, so keep in mind that the markets will be based more or less on Twitter and other noisy inputs. In other words, the volatility isn’t going anywhere and quite frankly it seems very unlikely to change of the next couple of days. If you have the ability to trade options, that might be a better way to go, simply because it will mitigate some of your potential exposure to a market that is moving erratically based upon headline readers that place trades via computer.