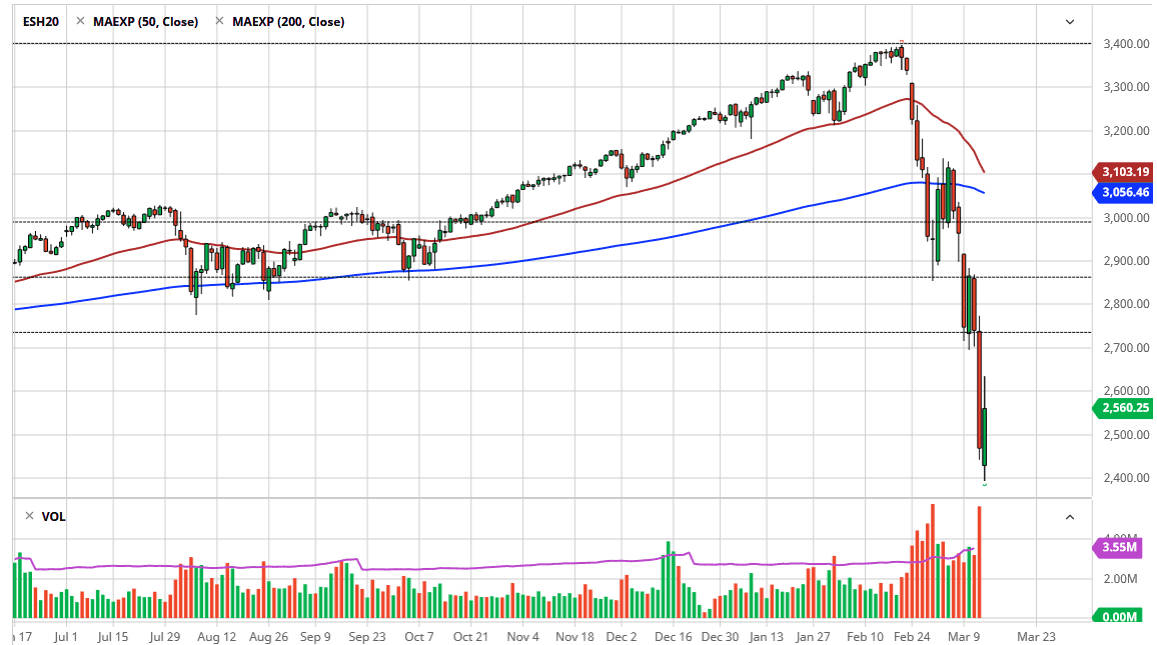

The S&P 500 has rallied a bit during the trading session on Friday, and what is probably going to be thought of as a potential “dead cat bounce”, or perhaps a “relief rally.” At this point, the market is hanging around the 2600 level, an area that has been important from time to time but quite frankly I think at this point were going to have to wait to see how the market gaps on Monday. The market is almost certainly going to gap, because quite frankly it’s hard to imagine that over the weekend we will get some type of news that throws the market around.

If we do rally from here, I think that the 2750 level will cause a lot of noise. In fact, it would not be a huge surprise to see the market goes looking towards that level only to turn around. If we do break above there, the gap above at the 2900 level would also be an area that the sellers will return. This is a market that almost certainly needs another leg down, but that doesn’t mean we need to do it right here.

If we do break down right away and clear the 2400 level to the downside, it’s likely that we go looking towards the 2300 level, perhaps even as low as the 2000 level. The market has essentially fallen right off of a cliff and I think that the market needs to rally or something like that in order to absorb some of the volatility. The candlestick from Thursday was horrific, and even though we have had a nice run on Friday, that doesn’t change anything, because when you look at the totality of the breakdown, it’s just a blip on the radio. At this point, I’m civilly looking for reason to get short but that may not be for a couple of days. These bear market rallies can be quite significant and violent. What you really want to see if you are bullish is stabilization and a grind higher. A grind higher that is boring shows real conviction and a lack of panic in the market. Ultimately, keep your position size small, I cannot stress that enough as your account could very well depend on it as algorithms continue to trade the latest headline, and one would have to think that headlines in the short term are going to be very good.