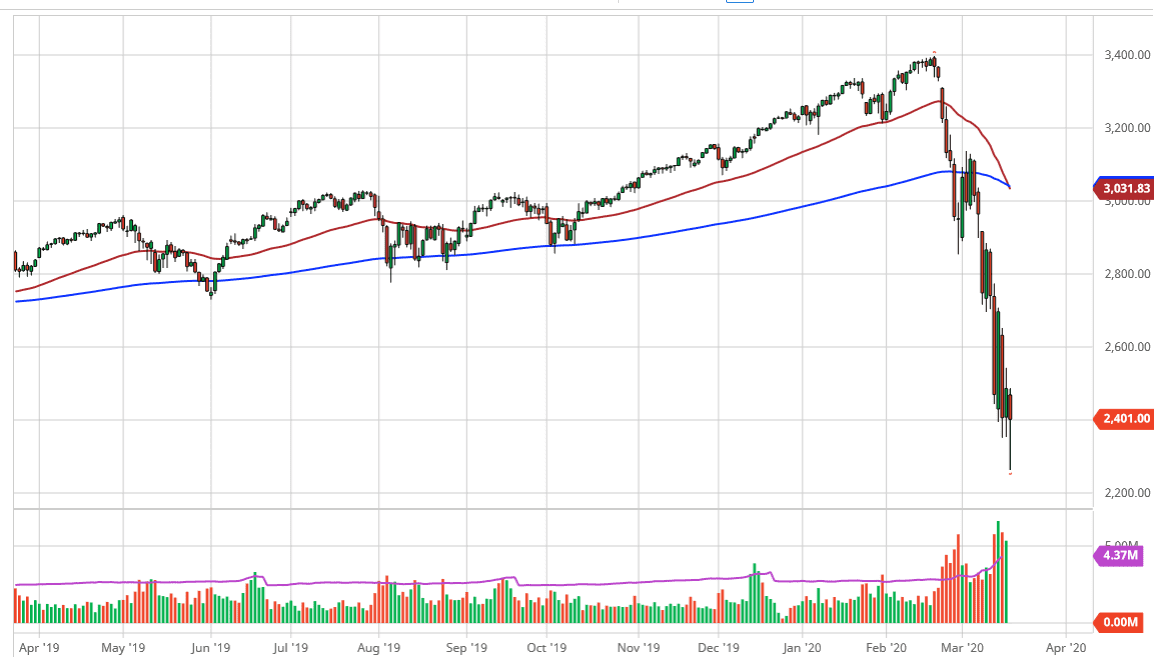

The S&P 500 has broken down during the trading session on Wednesday, slicing through the 2400 level and even the 2300 level. At this point, the market turned around to form a bit of a hammer, and that of course is a bullish sign. The 2400 level could be interesting, and if we can break above the 2500 level as possible that we may get some type of bounce that people can take advantage of as the S&P 500 has been sold off so drastically. Alternately, if the market breaks down below the bottom of the hammer, then it’s likely that the market goes down to the 2100 level.

The 20 3050 level was something that people were looking at, as it was a major support level going back to the lows of 2018. At this point, it did hold and then bounce a bit so it is possible that we could go to the upside. I certainly think that value hunters will be interested in this market, because quite frankly the market has sold off far too much. The ship the candlestick of course will attract a lot of technical traders, but I think given enough time it’s only a matter of some type of good news to one of those typical “rip your face off rallies” that you can get during the bear markets. If we break above the 2500 level, then the 2700 level would be targeted.

The S&P 500 continues to get battered due to the fact that traders simply have no idea what to do about growth due to the fact that a lot of the United States commerce will be shutting down. It’s almost impossible to give yourself some type of valuation to trade off of in this scenario, so having said that it’s likely that the market still moves on the latest headline, given that there are so many troubles out there just waiting to happen. Sooner or later, we will have a longer-term opportunity, but right now we are still trying to build up the process. I don’t think that we are quite ready to do that though, so a certain amount of caution will be needed. Short-term trade will favor fading rallies, but again, longer-term I think we will see a huge move. Remember, 2500 is going to be crucial to give us an idea as to where we are going, just as the bottom of the candlestick will be.