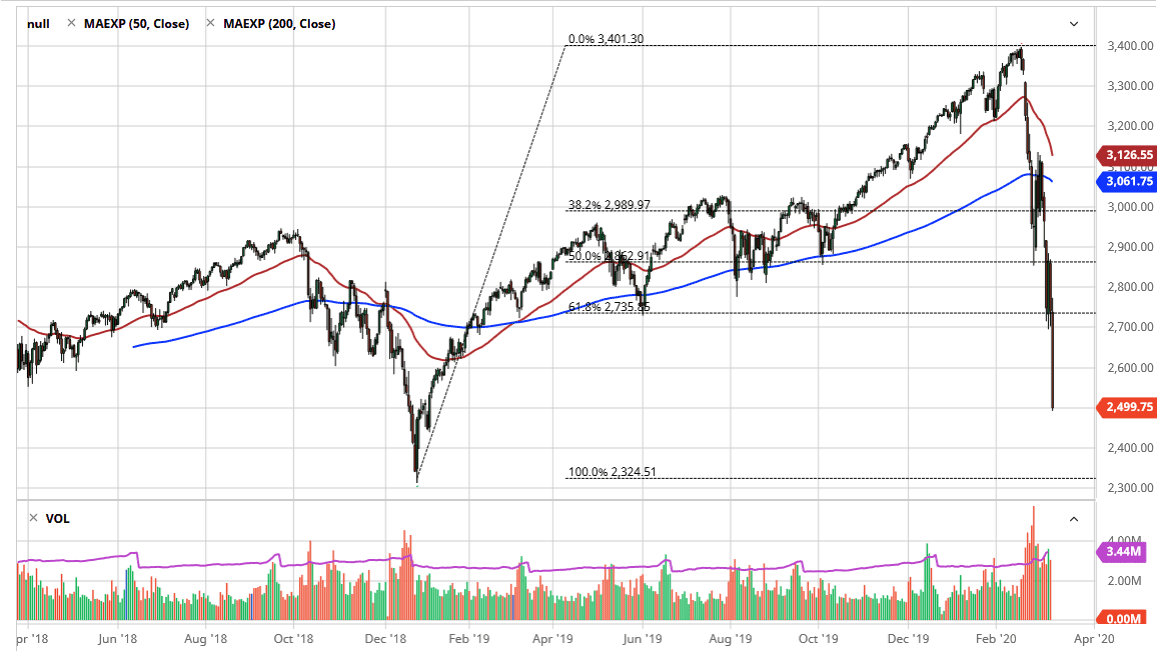

The S&P 500 is breaking down again, as the Tuesday session was brutal. The circuit breakers were fired offer early during the trading session, something that has happened twice this week, in a first since 1997. At this point, it looks as if the market is trying to decide whether or not 2500 is an area that will hold as support. All things being equal, I would not hold my breath waiting for that to happen, but I also recognize that a short-term bounce could make quite a bit of sense.

When it comes to anything related to the futures contracts, one should be very cognizant of the fact that Carrie and risk over the weekend could be an absolute disaster. The markets could continue to see a lot of volatility and therefore keep in your position size small is going to be crucial. All things being equal I believe that this market is going to continue to cause as much pain as possible, and the volatility is only getting worse, not better. The 2700 level above could be a target for buyers, if we get a bit of a bounce, but ultimately, I think that the markets will probably see some selling going into Friday as it’s going to be difficult to hang on to risk over the weekend. However, you can also make an argument for a bit of short covering for those who have decided to sell earlier in the week. In other words, Friday is going to be very choppy regardless of what happens and therefore it’s very likely that Friday is going to be more of a headache than some of the last few days have been.

Having said that, if the market was to break down below the 2500 level it opens up the door down to the 2350 level, which is the 100% Fibonacci retracement of the massive move higher. At this point, we are certainly seeing a lot of panic in the market, but I don’t think were done yet. To give you an idea of how things have behaved, we are almost back down to those lows of winter of 2018. At this point, the market still looks very vulnerable, but one things should be noted here: sooner or later we are going to stabilize and when we do this will be one of those major buying opportunities for those who are longer-term investors.