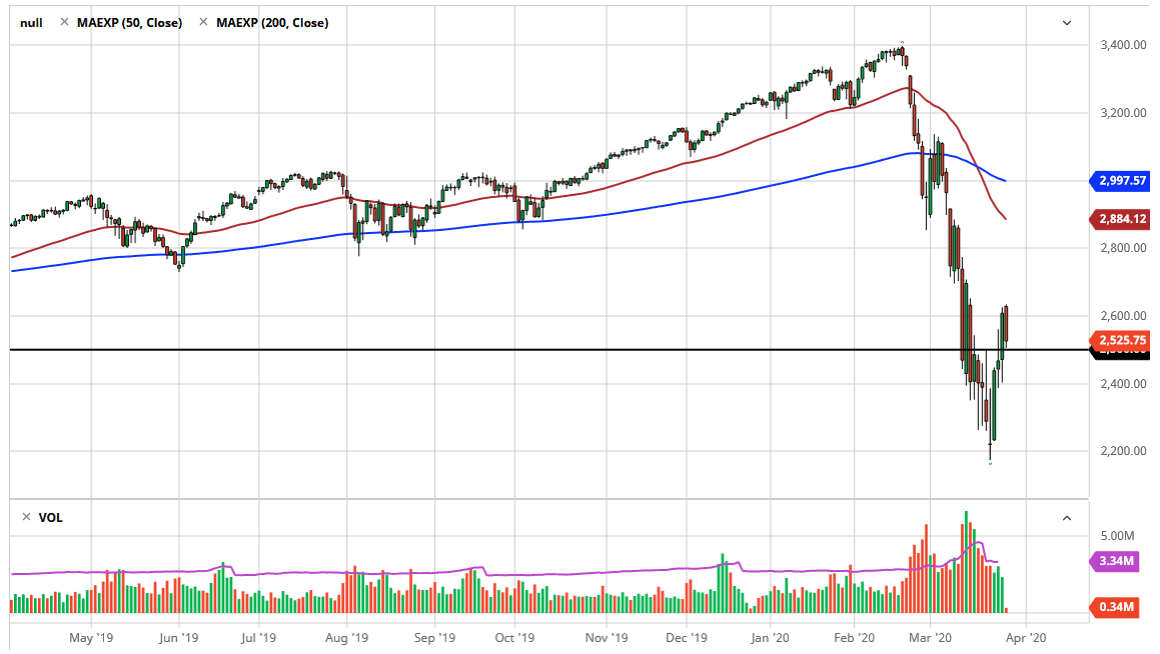

S&P 500 traders initially tried to push the market higher on Friday, but then turned around to reach towards the 2500 level. That is a very weak sign, but during the day we did try to build up of a bounce. However, by the time the market started to close down, sellers jump out very quickly in order to get away from anything involving risk into the weekend. Remember, we are still looking at the possibility of headlines that could cause major issues.

At this point, the candlestick closed towards the bottom of the range and that of course suggests that we are going to see a bit of continuation to the downside, but the 2500 level could cause some issues. The 2500 level of course is a large, round, psychologically significant figure, just as it had offered resistance previously. Ultimately, this will come down to whatever headlines came out over the weekend, not of which can be good. The fact that we give back the gains show just how weak this market is and how tentative the rally is going to be. After all, if you are willing to carry risk into the weekend, you can’t believe that this rally is going to last that long. I believe that the sellers will come back out and we will more than likely reach towards the low again.

The 2200 level should be massive support, but I think we will make a “higher low” in the meantime to trying to turn this thing back around. However, if we break down below the 2200 level that will send the markets much lower, perhaps down to the 2000 level underneath. At this point, it’s very difficult to imagine that this market is simply going to turn around easily, and at this point I think it’s only a matter of time before the sellers will come back in. The $2000 level underneath will more than likely be very difficult to break through. I do believe that eventually we will see some type of bottoming process, but that’s the thing to pay attention to here: it’s a process and it’s not something that happens instantly. With that, I am much more comfortable shorting than buying but I wouldn’t get too aggressive in the meantime as the market will more than likely continue to be very choppy to say the least.