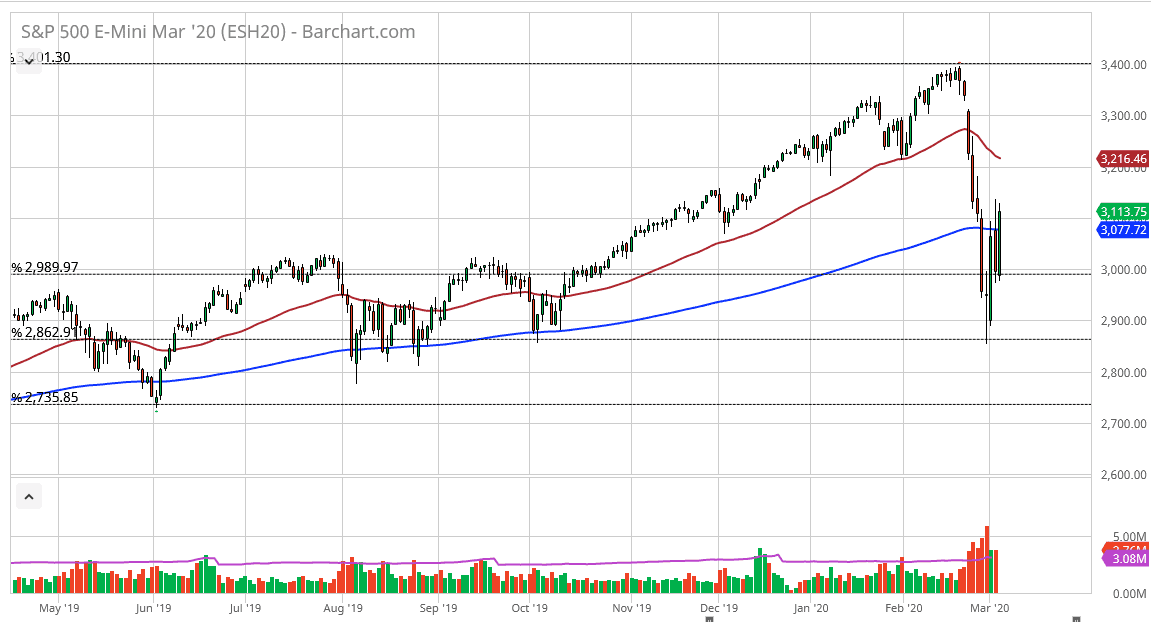

The S&P 500 has rallied significantly during the trading session on Wednesday again, breaking above the 3100 level. The 3100 level of course is a large, round, psychologically significant figure, but even more importantly from a technical analysis standpoint there is the 200 day EMA that has just gotten broken over. Furthermore, what’s truly interesting is that the market closed above the 200 day EMA for the first time in several days, showing that we are going to perhaps continue to see a bit of buying pressure.

Looking at the chart, I think we are building up pressure to the upside, and with the Federal Reserve stepping into cut rates by 50 basis points and perhaps looking likely to do so even further, it’s likely that the stock market will continue to sell rally based upon that sugar high that it does seem to need since 2008. At this point, we are looking very likely to go looking towards the 50 day EMA, which is currently at the 3200 level. Don’t get me wrong, this isn’t to say that the market can’t pull back, and I think a pullback at this point will probably be bought into. The 3000 level will now start to act as a bit of a support level, and perhaps even a “floor” in the market. We are at a crucial level in the past that had offered so much in the way of resistance, so market memory dictates that there should be a certain amount of support here.

I do believe that longer-term traders are looking at this as a discount due to the fact that there had been so much in the way of losses, in what has structurally been the same market that we were looking at ahead of the coronavirus. At this point, the market is likely to go looking towards the highs again, but I think we will probably slow down which quite frankly is a good thing. From all the pundits, it looks like this is going to be a repeat of what we had seen at the end of the year on 2018 if that’s the case, we are about to see a “V bottom ”, and we should see an explosive move to the upside sooner or later. I anticipate that the market will continue to attract inflows simply because interest rates are so low that bond markets don’t have much room to move. The 10 year is yielding 1%.