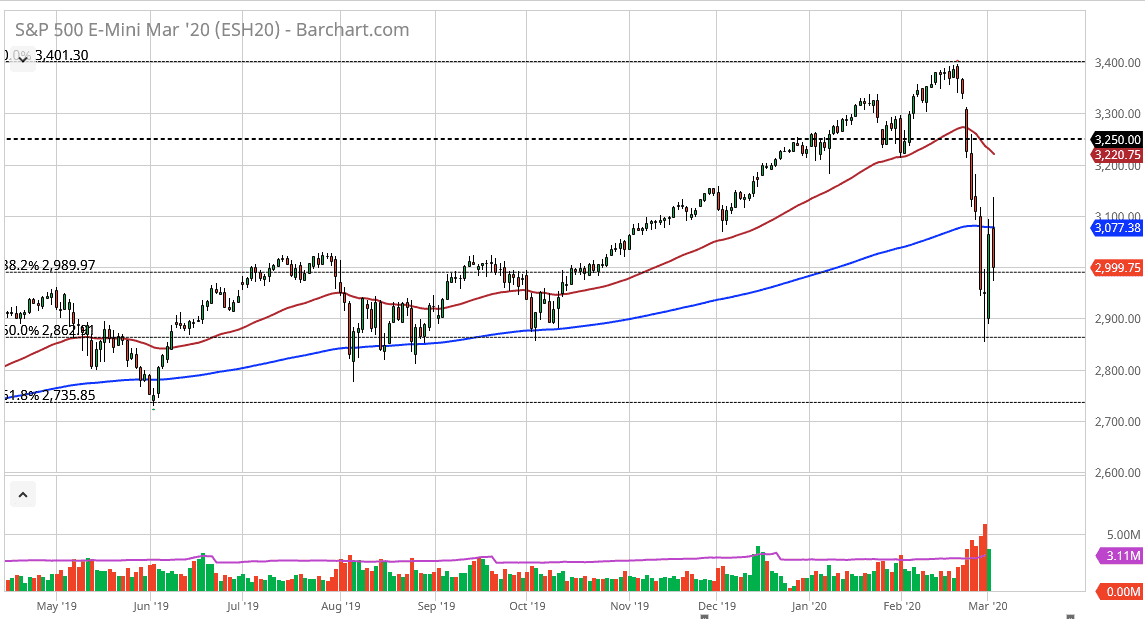

The S&P 500 rallied initially during the trading session on Tuesday, breaking above the 3100 level before pulling back down. Ultimately, the 200 day EMA has offered a lot of resistance and has shown itself to do so for the last two days in a row. It looks as if the stock markets continue to see a lot of uncertainty, and therefore it’s likely that the market breaking down below the 3000 level. At this point, the market is very likely to go looking towards the 2900 level because if the rate cut doesn’t send the markets higher, not much will. I believe at this point we are likely to see more carnage as markets make the argument that interest-rate cuts won’t cure viruses, as strange as that may sound to the average trader.

That being the case, I think that it is only a matter of time before we test the lows again. If we break down below the lows on Friday, then it’s likely that the bottom falls out and we go looking towards the 2700 level. Ultimately, this is a market that I think fading rallies will continue to be the way going forward unless of course we break above the highs during the trading session on Tuesday. If that happens, then I think the market is very likely to go looking towards the 50 day EMA which is currently trading near the 3200 level. I don’t like this market at all, and I think that stock still have further to go to the downside so with that being the case I think looking for opportunities to short will be the best way going forward.

I do not trust stocks right now, and I believe at this point it’s likely that the volatility is only going to increase, and at this point the market seem to be in the realm of massive uncertainty, which leads to massive volatility, which typically leads to massive losses. While I am not willing to call this a repeat of 2008, it certainly is starting to feel a lot like it. The coronavirus will continue to cause massive headaches for the market, and I think at this point the markets are starting to really suffer at the hands of something that’s almost impossible to price and figure into the overall risk profile the market.