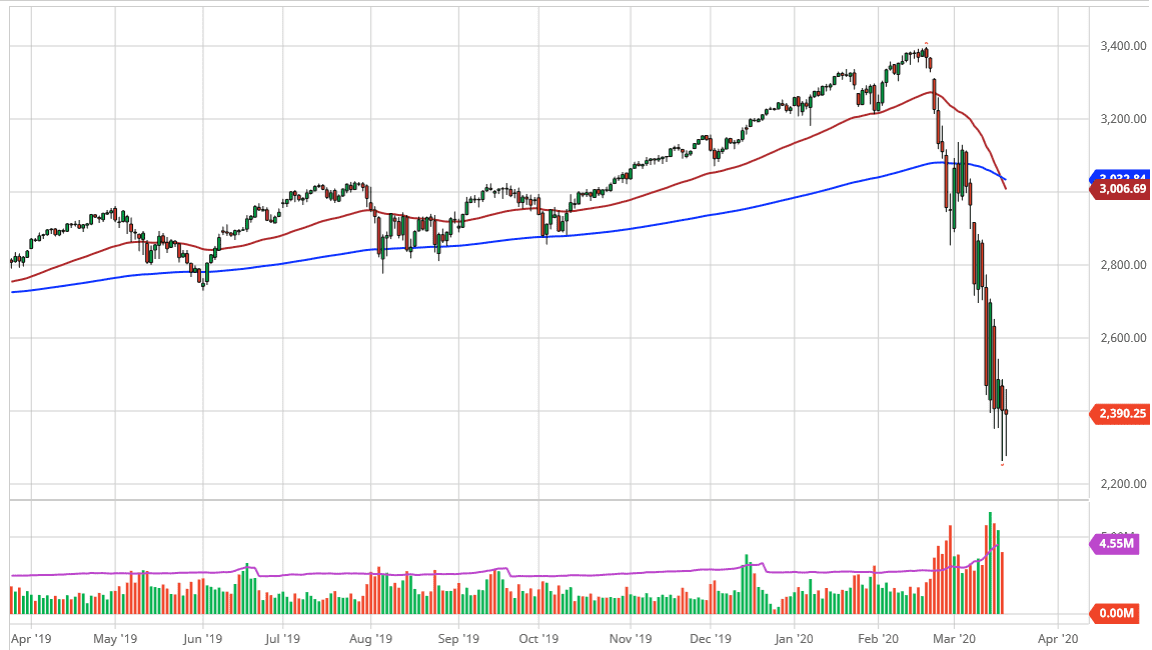

The S&P 500 continues to find buyers at the 2350 level, an area that is crucial due to the fact that it was the blow from Christmas Eve of 2018, which was a major bottom in the market. I think at this point it’s very likely that the market will probably be enticing to certain traders, and it’s likely that’s what we are seeing. The question now is whether or not we are going to see some type of stabilization and a bounce, or if it’s just a pause before another breakdown.

Looking at this chart, I do recognize that the week has shown a certain amount of resilience and that is a good sign. If we can break above the 2500 level, I think that will push more people into this market, perhaps reaching towards the 2600 level, perhaps even the 2700 level. I recognize that the market is oversold, so it’s possible that we could see some type of relief rally to say the least. In fact, it would not be surprising at all to see that happen during the trading session on Friday due to the fact that there might be a lot of short covering going into the weekend. Example, the US government could do something that lifts the market and you could find yourself in trouble as the futures market gapped higher on Monday morning.

While I think it is a bit premature to start calling a bottom here, I do think this is a natural place to find this relief rally, so I would not be surprised at all for a nice short-term buying opportunity. Having said that, if we were to break down below the lows on Wednesday, then it opens up the door to a move down to the 2100 level underneath which has been important in the past, and I think that support level extends all the way down to the psychologically important 2000 handle. Granted, we could see some type of big scare that make that happen, but I think at this point the markets are starting to show enough resiliency that a bounce is more likely than not. I wouldn’t put a lot of money into this market, but clearly there is going to be some type of opportunity. There is a gap above that has yet to be filled which is right around the 2950 handle, and in a “bear market rally”, that could happen.