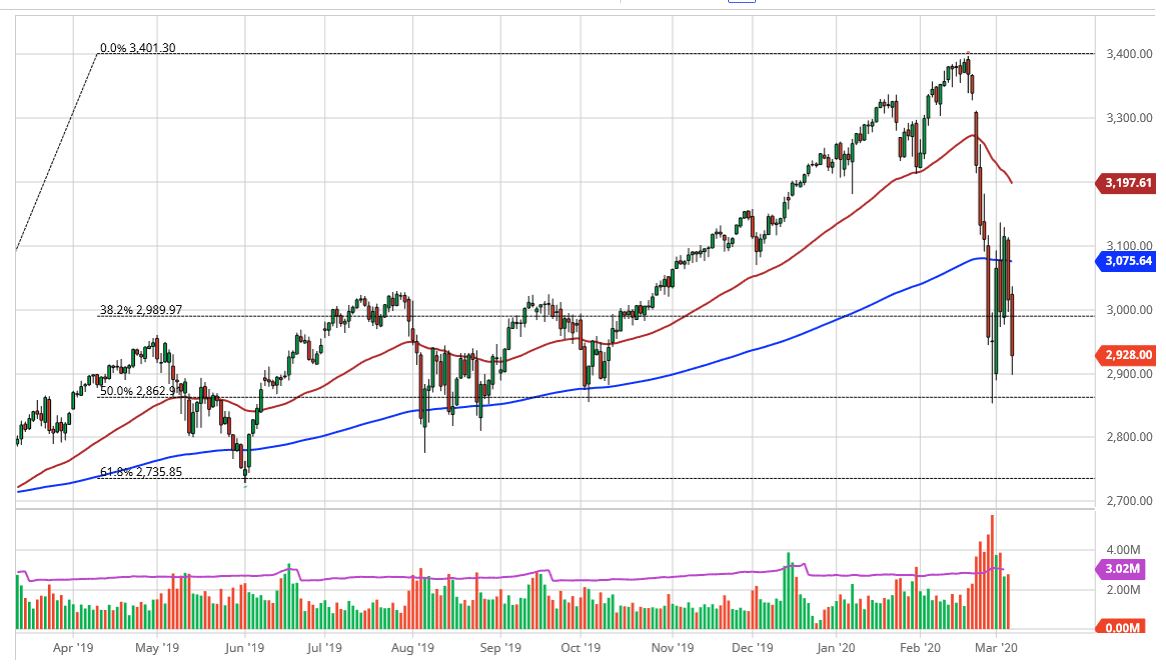

The S&P 500 broke down on Friday to test the 2900 level. This is a market that looks extraordinarily bleak, and it’s possible that we will see a further breakdown. By breaking down below the hammer from a couple of weeks ago at the lows, then the market is likely to go down to the 2700 level. All things being equal, we could get a short-term bounce, but I think that the 200 day EMA has proven itself to be a bit of a concern, as we have pulled back from that technical indicator several times.

With this, I suppose that we will continue to see a lot of volatility going forward but I think that the easiest trade is going to be fading short-term rallies. Any signs of exhaustion will be jumped upon by traders, as we continue to worry about the coronavirus crushing global trade and demand for most things. After all, crude oil markets have broken down rather significantly as well, and that’s a sign of the week global growth. We are starting to price and the idea of a recession globally, and that has continued to cause major issues when it comes to stock indices not only in the United States but other places as well.

Longer-term traders will probably look at the 2500 level as a strong area of support as well, so any type of bounce is probably a buying opportunity. The market breaking above the recent highs would give us more of a “buy-and-hold” type of scenario, but that’s something I expect to see anytime soon. Ultimately, this is a market that looks as if it is trying to build a bit of a bearish flag, which would be a major breakdown just waiting to happen. I see it more in the NASDAQ 100 truth be told, but if that market unwinds, it’s hard to believe that this market won’t.

We did bounce slightly, but in the big scheme of things it wasn’t much to get excited about, and could even be due to short covering more than anything else, not something to set up a trade in. At this point, I think a lot of back and forth is probably in order, and as a result short-term range bound trades could be had, but I think beyond that you are probably better off to stay away from this market until a little bit more clarity comes back into play.