The S&P 500 is going to be a complete mess during the day on Friday if the last couple of sessions have been any indication. We have seen wild swings time and time again, and with the jobs number coming out on Friday I cannot imagine a scenario where things suddenly get easier to deal with. After all, the market will continue to see a lot of different inputs that will have people wondering what the Federal Reserve is going to do. After the surprise 50 basis point rate cut, it’s interesting to see how the markets have reacted.

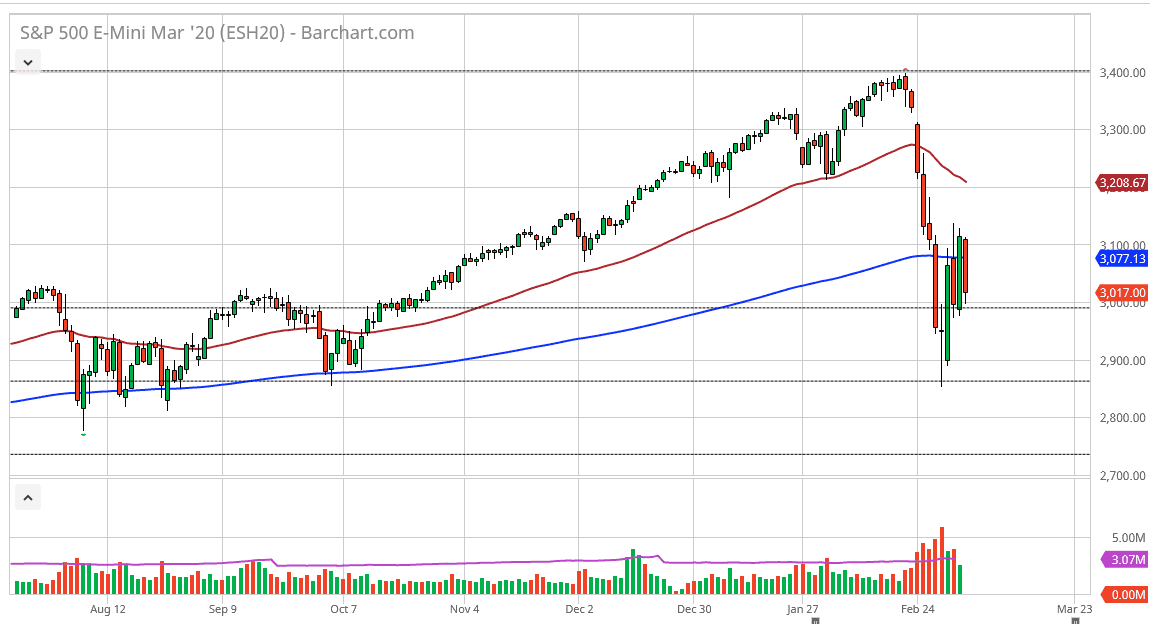

The typical reaction would be for the stock markets to rally after that interest rate cut, but it’s obvious that there isn’t that much in the way of confidence. That being said, the jobs number could cause issues, but I think at this point one would have to assume that we are going to continue to go back and forth between the 3000 level on the bottom and the 3100 level on the top. If we break out of one of these ranges on a daily close, it gives us a little bit of a heads up as to where we might be going next. This is a very dangerous day to be talking about trying to trade this market, so I believe that waiting for the close on Friday could give us a lot of answers.

With that being said, the jobs figure will probably be something that people need to pay close attention to as it could give us an idea as to whether or not the Federal Reserve will have any excuses whatsoever to cut rates. That being said, I believe that if there is a knee-jerk reaction after the announcement, it will probably get turned around. However, it’s very unlikely that the market is going to be easy to trade with the lack of clarity, and at this point I think one has to seriously look at the idea of the stock markets having some type of major move. We are currently dancing around the 200 day EMA which causes enough confusion on its own. I do not like the idea of retail traders playing around in this market right now, and it makes more sense to base any trades on longer-term charts rather than shorter-term ones.