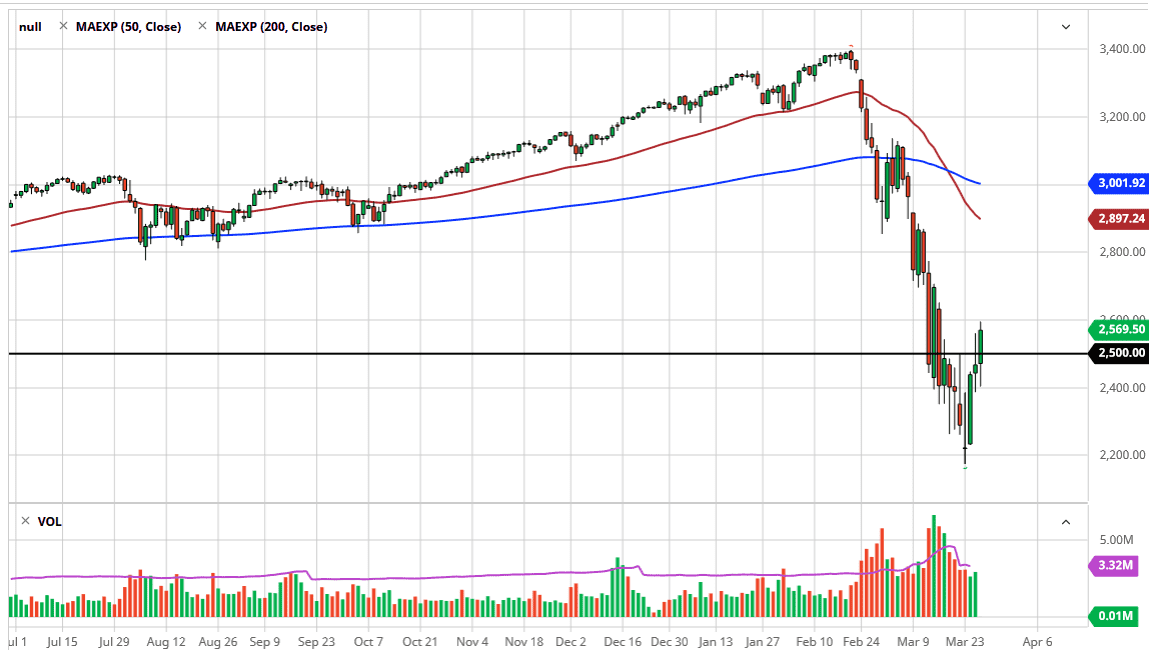

The S&P 500 has initially pulled back during the trading session on Thursday but found enough support near the 2400 level to turn around and rally towards the 2600 level. If we can break above there, the 2750 level is a target, as it is an area that has been important in the past. Furthermore, although we have seen a nice move to the upside and the Federal Reserve is coming back into the market, offering liquidity, it’s likely that a bottom will come on some type of pullback.

Where the bottom is, we don’t know yet but as always make a “higher low” than the previous low at 2200, that’s a good sign for this market. To the upside, I see the gap at the 3000 area as a target longer-term, which also features the 200 day EMA right above it. Ultimately, that should be enough to push this market lower, as quite often we will have that ferocious bullish run which is quite often labeled as a “bear market rally”, only to see the market fall right back down. That being said, it comes down to whether or not we see some type of stabilization with the coronavirus issue or if things get worse. It’s likely that we will get higher numbers coming out the United States, and that of course will cause some issues.

That being said, we probably have some bullish momentum ahead of us, and I believe that the 2750 level will be a significant battlefield. Don’t be surprised at all if the market tests that on Friday, and then gets sellers jumping into the market. At this point, I think there are far too many reasons above the think that the market will run into a lot of trouble above and it’s only a matter of time before exhaustion sets in. That exhaustion is something you can take advantage of, perhaps watching the market reaching down towards the 2500 level. The size of the candlestick is impressive, so that is something to pay attention to but again, I think that it will be a surprised at all to see a little bit of a pullback heading into the close. At this point, we’ve had a nice rally, but we still have a long way to go to change things permanently. It’s easy to believe that it’s only a matter of time before headline noise causes issues again.