With the global liquidity rush pressuring the US Dollar higher across the board, it created a distorted image in the Forex market. Expectations for direct intervention by the US Federal Reserve and US Department of the Treasury to weaken the currency are on the rise. While the US is not known for direct manipulation, extreme conditions exist, creating an environment for market interference. The Bank of Japan is more active in the Forex market, and an overt currency war may result. After the USD/JPY completed a breakdown below its resistance zone, a more massive correction is anticipated.

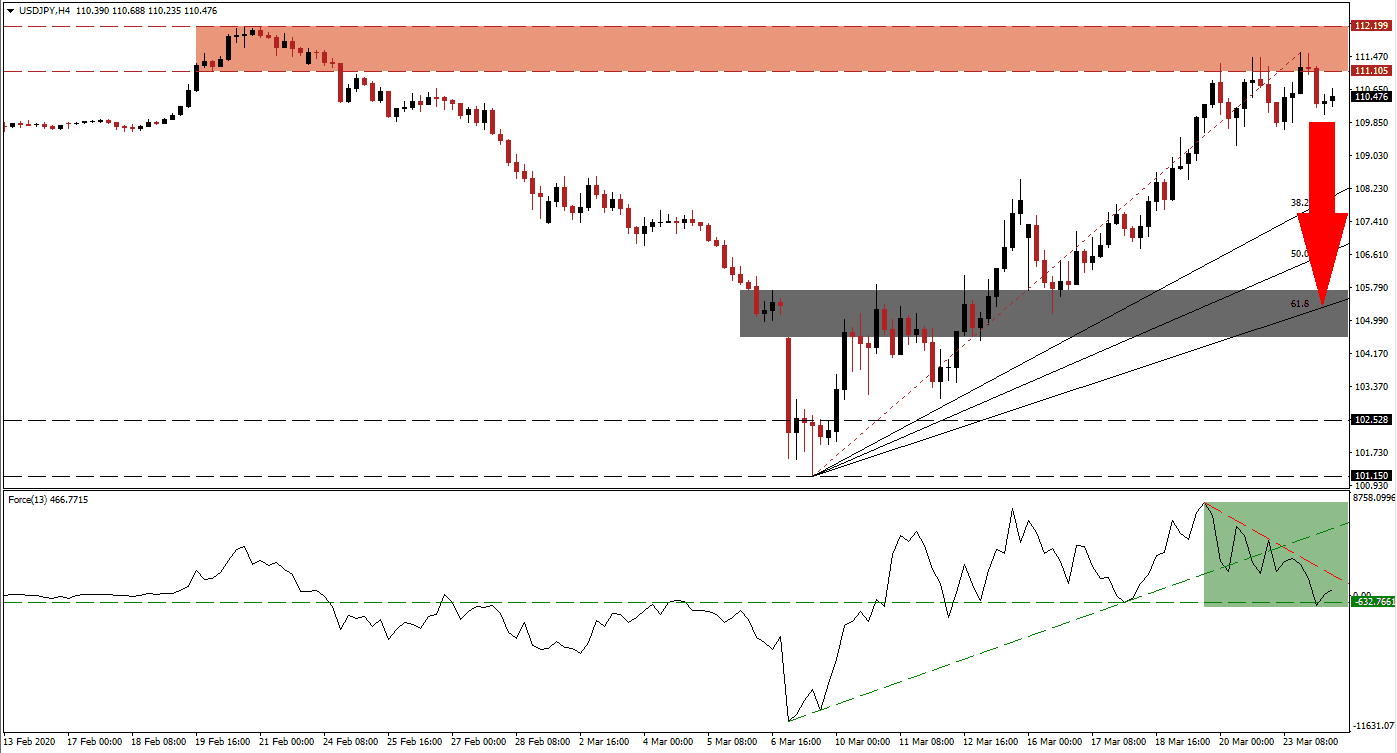

The Force Index, a next-generation technical indicator, retreated from its peak and was pressured below its ascending support level, as marked by the green rectangle. Adding to breakdown pressures in this currency pair is the descending resistance level, which is expected to force a conversion of the horizontal support level into resistance. This technical indicator is on track to cross below the 0 center-line, ceding control of the USD/JPY to bears. You can learn more about the Forced Index here.

Republicans and Democrats in the US Congress are divided over the proposed $2 trillion stimuli, as evident by two failed votes in the Senate. Democrats voiced concerns over corporate bailouts at the cost of employees. Adding downside pressure to the US Dollar is the central bank’s announcement of open-ended unlimited bond purchases, which will include a broader range of assets. The USD/JPY is favored to extend the breakdown below its resistance zone located between 111.105 and 112.119, as marked by the red rectangle.

Price action is well-positioned to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. Forex traders are advised to monitor the intra-day high of 108.454, the peak of a previously reversed breakout. A sustained move below this level is likely to result in the addition of new net sell orders in the USD/JPY. It will provide the necessary downside momentum for this currency pair to contract into its short-term support zone located between 104.566 and 105.728, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is passing through this zone, which also includes a price gap to the downside.

USD/JPY Technical Trading Set-Up - Breadown Extension Scenario

Short Entry @ 110.500

Take Profit @ 105.500

Stop Loss @ 111.600

Downside Potential: 500 pips

Upside Risk: 110 pips

Risk/Reward Ratio: 4.55

A move in the Force Index above its ascending support level, currently acting as resistance, may result in a temporary price spike in the USD/JPY. Forex traders should consider any price spike in this currency pair as an outstanding selling opportunity on the back of drastically deteriorating fundamental conditions for the US Dollar. The next resistance zone awaits price action between 112.938 and 113.259.

USD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 112.400

Take Profit @ 113.250

Stop Loss @ 112.000

Upside Potential: 85 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.13