Safe-haven demand continues to support the Japanese Yen, but the advance is exhausted following last week’s rout across the global financial system. Therefore, a short-term counter-trend advance in the USD/JPY is anticipated to unfold. The bullish momentum recovery in this currency pair suggests a short-covering rally before the long-term downtrend can continue. Japanese data showed a steep contraction in capital spending for the forth-quarter, adding to upside pressures. You can learn more about a short-covering rally here.

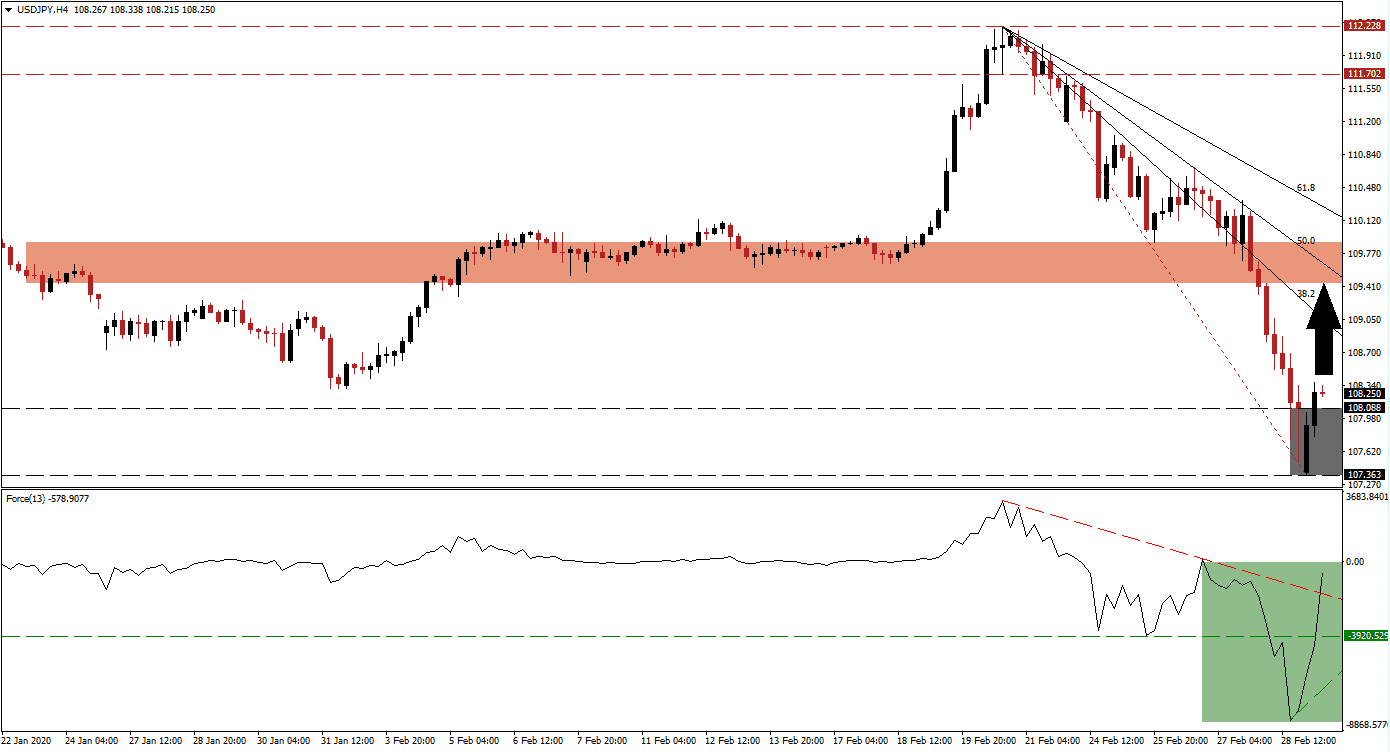

The Force Index, a next-generation technical indicator, confirms the likelihood of an advance out of extreme oversold conditions. After collapsing to a 2020 low, the Force Index quickly spiked, converting its horizontal resistance level into support. Momentum sufficed to elevate this technical indicator above its descending resistance level, as marked by the green rectangle. A push into positive territory is favored to place bulls in control of the USD/JPY, resulting in an extension of the breakout. The emergence of a new ascending support level is providing a floor under potential reversal.

Expectations for an interest rate cut by the US Federal Reserve have spiked with some estimates calling for three 25 basis point cuts in 2020. This will apply consistent downside pressure in the US Dollar. Any breakout extension in the USD/JPY above its support zone located between 107.363 and 108.088, as marked by the grey rectangle, should be viewed as a short-term event. Economic disruptions from Covid-19 will have a delayed impact on economic data, but China’s PMI reading provided a first indication of the severity.

This currency pair is anticipated to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. A push into its short-term resistance zone located between 109.447 and 109.891, as marked by the red rectangle, is likely to follow. The 50.0 Fibonacci Retracement Fan Resistance Level is on the verge of crossing below this zone, enforcing the long-term downtrend in the USD/JPY, and marking a likely end to the advance. You can learn more about a resistance zone here.

USD/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 108.250

Take Profit @ 109.450

Stop Loss @ 107.850

Upside Potential: 120 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.00

A contraction in the Force Index below its newly formed ascending support level is favored to initiate the next breakdown sequence in the USD/JPY. With the long-term outlook increasingly bearish, resulting from US Dollar weakness and safe-haven demand for the Japanese Yen, any price spike will offer Forex traders an outstanding short-selling opportunity. Price action will face its next support zone between 106.071 and 106.484 from where more downside cannot be ruled out.

USD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 107.450

Take Profit @ 106.150

Stop Loss @ 107.850

Downside Potential: 130 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 2.88