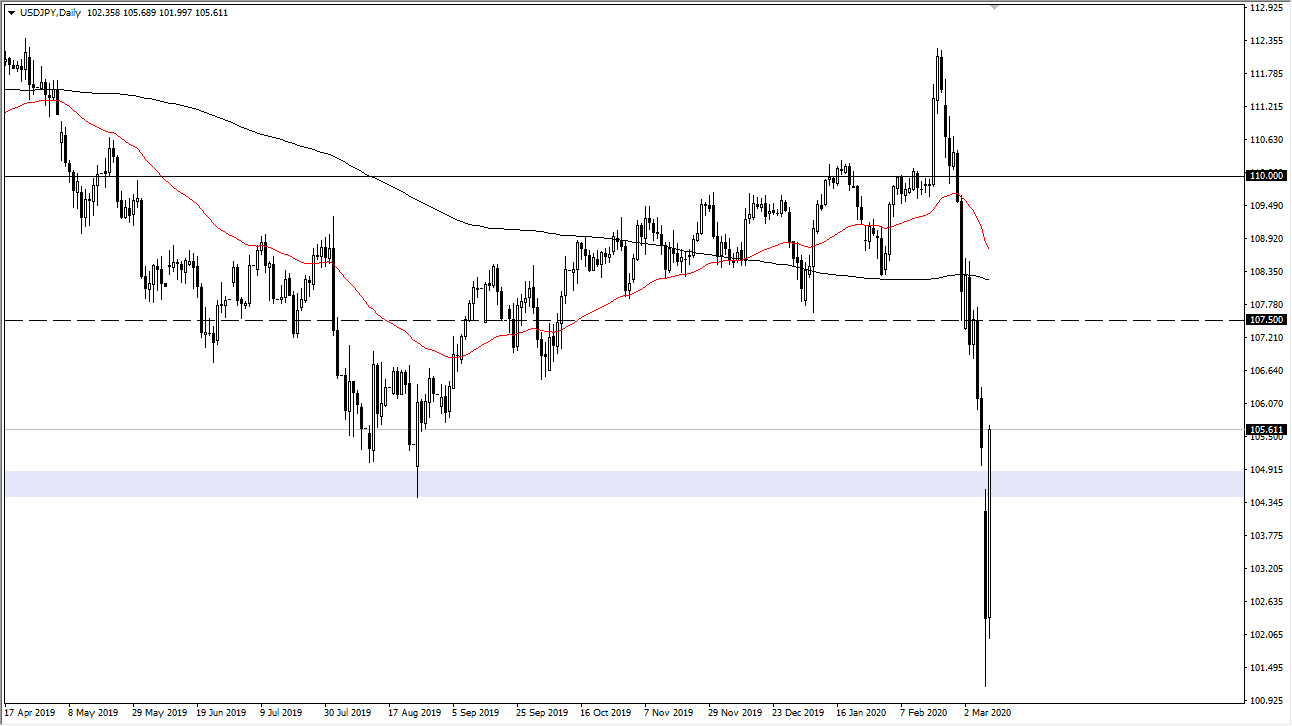

The US dollar exploded to the upside against the Japanese yen during trading on Tuesday, filling the massive gap from Monday. At this point, the question now is whether or not the market roles right back over, or does it try to attack the ¥107.50 level. That of course is an area that’s worth paying attention to, as the market has been attracted to both of these levels.

Keep in mind that the US dollar is highly sensitive to the Japanese yen, and therefore you should pay close attention to the risk appetite as the two currencies are so important to each other in this scenario. Ultimately, I do believe that the ¥107.50 level is probably about as high as this pair can go, assuming that it can keep the gains. Furthermore, you have to pay attention to the fiscal moves by the US government that Donald Trump has promise, and if they are not enough it should send markets reeling yet again. So far, the Trump administration has not handled the coronavirus situation very well, so they need to truly impress in order to have this market turn around and break to the upside.

Looking at the size of the scandal, it is rather impressive, but one would think that this type of volatility is probably going to become much more common than people think. These types of markets can go on for a while, and quite frankly this reminds me a lot of the financial crisis in 2008. All things being equal though, the market isn’t done making a lot of noise and therefore I think I would have to advise caution in this pair specifically. If we close below the ¥105 level, that will be a very negative sign and could send this market much lower. If we were to finally break above the ¥107.50 level, then we may have a bigger move but one thing is for sure here: the next couple of trading session should be crucial for this pair, but at this point it seems as if we are moving on the latest headline, which means that trading is going to be very difficult to say the least. Keep your position size very small, and only add as the trade works out in your favor, regardless of the direction. For what it’s worth, the Bank of Japan gets involved at one point or another below the ¥100 level.