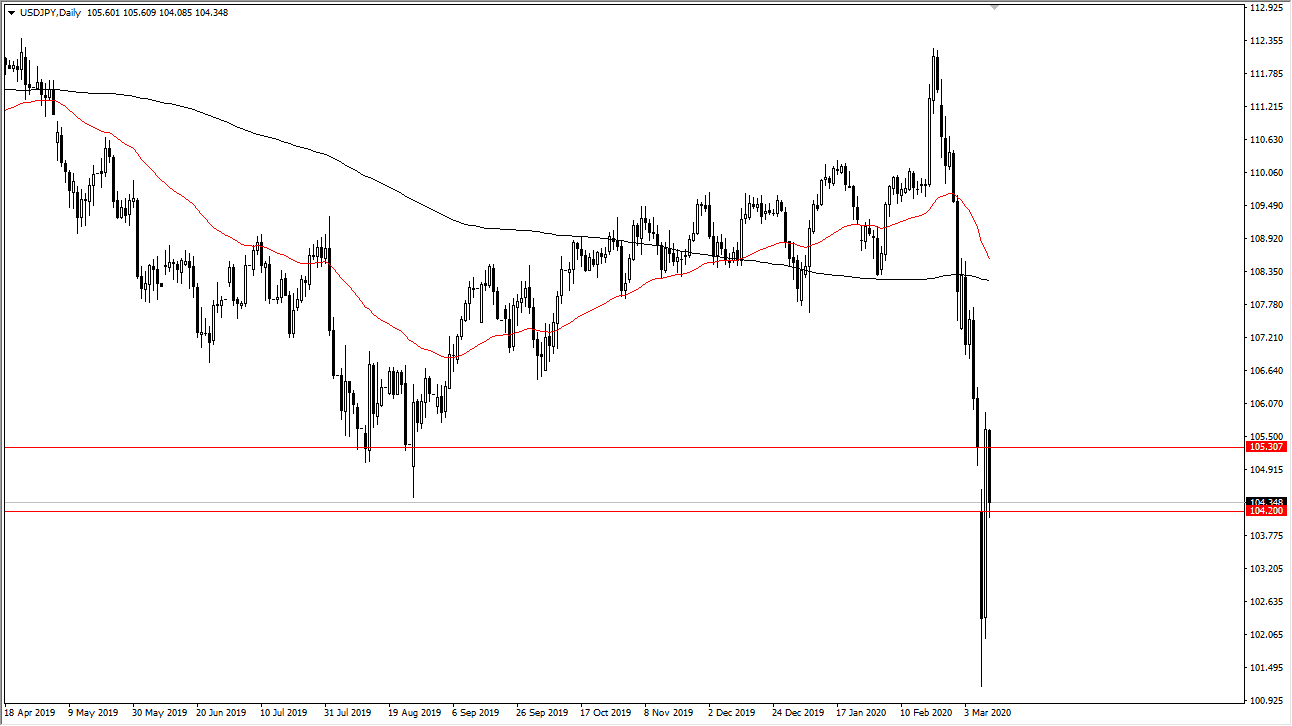

The US dollar has fallen during most of the trading session against the Japanese yen as traders out there try to figure out with going on next. The situation with financial stimulus in the United States continues to be a major driver of where markets go, and at this point we ended up dropping down towards the bottom of the gap that we had filled during the previous session. Markets breaking down towards the ¥104.20 level and finding support makes sense, considering that there is a gap there. If we can break down below that level, then it’s likely to go looking towards the ¥102 level underneath which is a large, round, psychologically significant figure, and the scene of a bounce. I think the markets will continue to go back and forth in general, as the latest headline seems to be thrown the market around.

All things being equal, I think that if we do break out to the upside, the market is likely to struggle after an initial push higher. Any strong fiscal stimulus should send markets higher based in a “risk on” type of sentiment, and therefore that could lead to selling of the Japanese yen. In that case, the market is very likely to bounce but I think that the ¥107.50 level is an area where we would see fresh selling. That of course is only if we get good news.

On the other hand, if we break down below the lows of the trading session on Wednesday, we could very well see this market drop down rather quickly. This would of course be due to fear more than anything else. At this point, I do think that it’s difficult to put on a full-size position as this market is going to be extraordinarily erratic and because of this it feels much like the 2008 trading situation. The biggest problem of course is that the coronavirus is going to keep people from gathering, and that includes workplace environments and of course shopping. This is going to play havoc with the growth of economies around the world, and that of course has a lot of people concern in general. The Japanese yen is of course a “safety currency”, and that means that we should see it be favored in general. Again, we may get a nice run to the upside but that should be faded in general.