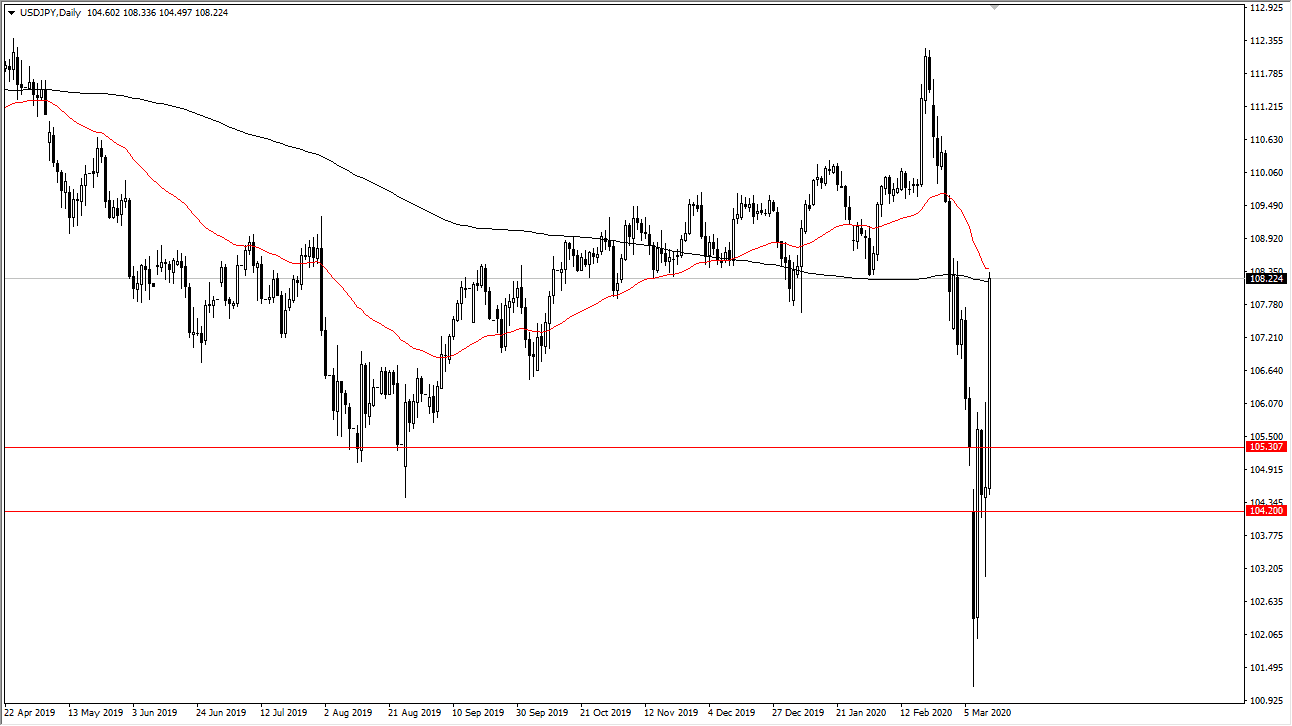

The US dollar has skyrocketed against the Japanese yen during a frantic session on Friday, reaching towards the 200 day EMA in the blink of an eye. Quite frankly, this is a market that continues to see a lot of volatility, and I don’t think that’s going to get any better anytime soon. The coronavirus has slowed down economic growth, and that of course will continue to play havoc with pairs like this. I think that the market probably is overdone, so don’t be surprised at all to ¥10 level will cause a certain amount of resistance, just as the recent highs well.

I have been trading for 15 years, and this feels very much like the 2008 markets. In that environment, the only way to survive was to cut your position size too much smaller level. I think that’s the prudent thing to do here as well, because while a lot of the emails that I receive suggests that an enormous fortune was to be made today, the reality is that you could have just as easily been on the other side of the trade. This doesn’t mean that you need to stay out of the market, it’s just that you need to realize that the volatility has skyrocketed, so therefore you need to be very cautious.

The weekend is coming, and quite frankly something bad could come out. If that’s the case, then this pair could gap down 100 pips at the open very easily. It is because of that reason that I would not be a holder over the weekend. If you paid attention to the analysis yesterday, then you know that I used the Thursday candle as a bit of a “binary indicator”, meaning that I was a buyer on a break above the top of the candlestick and a seller below the bottom of it. We have already reached the target that I had of roughly ¥107.50, so at this point I am flat. If we gap lower, it’s likely that Monday will see this market selloff back towards the ¥106 level. Alternately, if we continue to go higher then I think the next target is ¥110. Regardless of what happens next, it’s probably going to be very noisy. While we have had a massive turnaround in the stock markets, they are still very shaky to say the least and the rally wasn’t much in face of the selloff. This pair does tend to move with that sentiment.