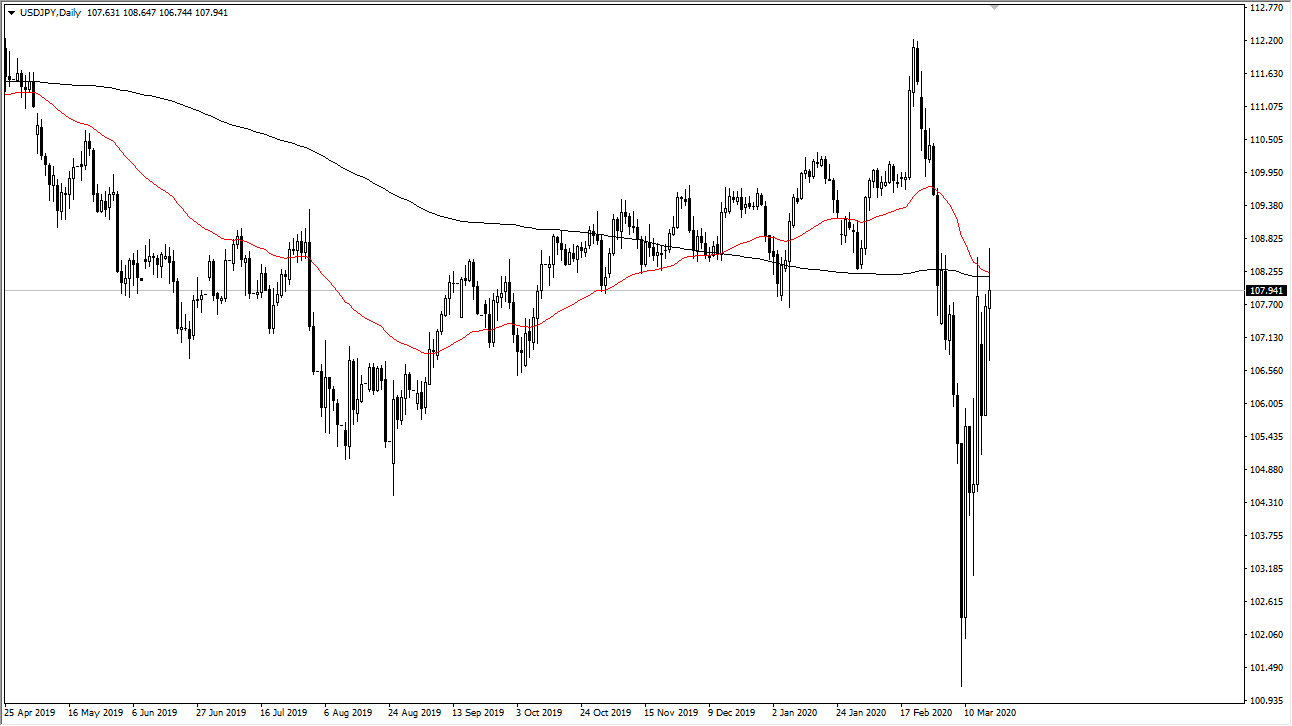

The US dollar has been all over the place as of late, especially against the Japanese yen. All you need to do is look at the last couple of weeks to see just how volatile the market has been in general. The US dollar against the Japanese yen is a barometer of risk appetite in general, rising with it, and falling when it disappears. However, recently we have seen more of a push into the US dollar overall, and that’s had a bit of a “knock on effect” over here in favor the US dollar, although it goes against the conventional thought process.

The 200 day EMA sits just above and that of course will attract a certain amount of attention. Looking at this chart, you can also see that the 50 day EMA sits just above so it does make sense that perhaps there are a couple of different reasons to think that the resistance will come into play I think at this point it’s likely that sellers will pay a significant amount of attention to it. However, if the market breaks above the highs of the trading session for Wednesday, then it’s likely to go looking towards the ¥110 level.

This point, I do think that the market is a bit overextended so a break down below the bottom of the candlestick for the trading session on Wednesday could be a nice selling opportunity. At this point, the market should then reach towards the ¥106 level, perhaps even the ¥105 level given enough time. Overall, the markets are running on emotion only, so having said that it’s likely that the pair will only continue volatility more than anything else. Overall, keeping your position size small is going to be crucial, and perhaps aiming for bigger targets makes sense. This is because we can find ourselves moving 100 pips at a time in the blink of an eye. That being said, I do think that we are getting a bit overdone, so I think it’s only a matter of time before exhaustion in this move starts to set in. I would be a bit surprised if we can get above the ¥110 level without some type of major positive movement in the US dollar. At this point, I anticipate that the ¥106 level will be the first target for sellers as it is structurally sound and important.