The US dollar broke down significantly during the trading session on Friday as fear continues to be a major driver of markets. The Japanese yen is likely to continue to be a safety currency, and at this point it looks like the US dollar is being punished by a few comments late in the day by Jerome Powell suggesting that the Federal Reserve was willing to jump in and support the markets however they had to. The Japanese yen has been strengthening against almost everything anyway, so this is just a simple knock on effect from those markets.

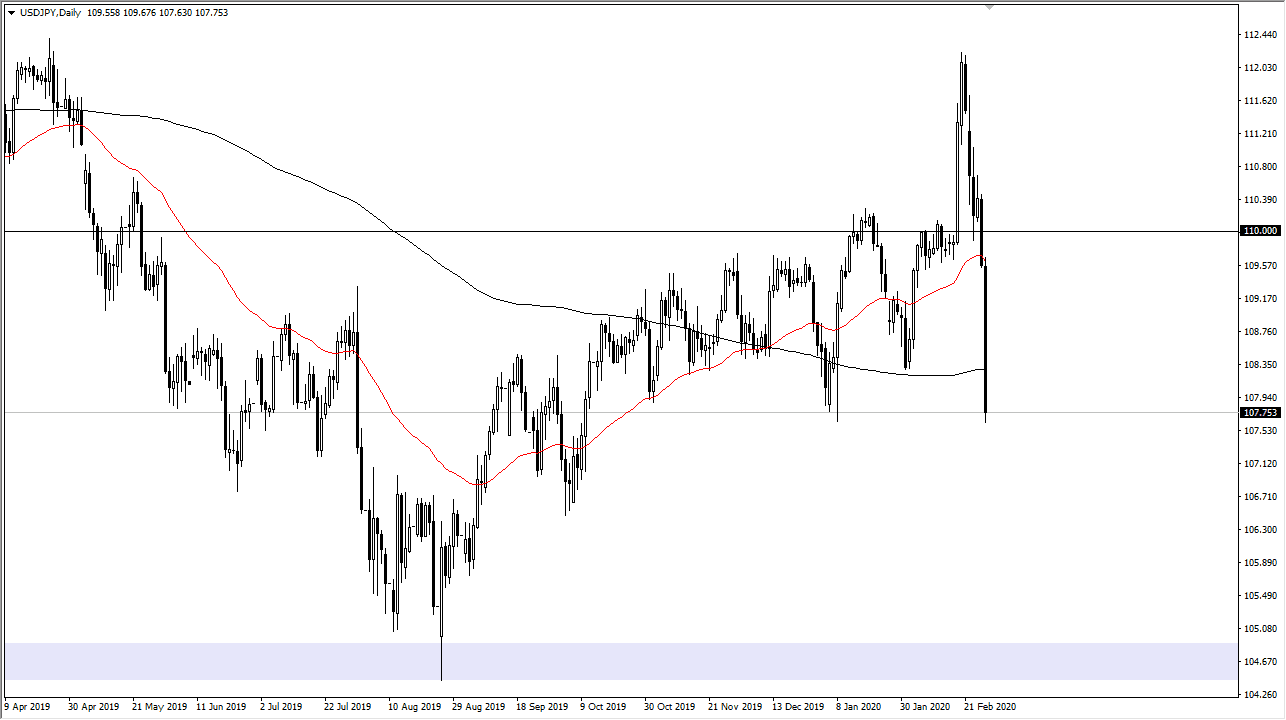

Looking at this chart, you can see that we are testing the ¥107.50 level as we close out the week, and it’s very likely that we could break down from here. Having said that, the markets are overextended so don’t be surprised at all to see some type of short-term bounce, which I think will probably be sold into. The 200 day EMA should offer resistance and most certainly the 50 day EMA would. At this point in time, this is a market that is extraordinarily negative, so I don’t have any interest in buying unless of course the Bank of Japan do something drastic, something that is very well possible.

Looking at the longer-term charts, the ¥105 level underneath is the bottom of the larger consolidation area, just as the ¥115 level above is the top of that consolidation. The ¥110 level is essentially what it can be thought of as “fair value”, as it is the middle of that range and it will be a little bit of a magnet for price. All things being equal, this is a market that very likely will be looking for some type of direction on Monday, and it will almost certainly be very erratic at the open. Cutting your position size down to a smaller amount is probably the only thing you can do if you choose to trade. Looking at the chart, I don’t see an argument for buying this pair, and quite frankly any rally at this point in time will more than likely be a potential selling opportunity at the first signs of exhaustion. Monday is going to be out of control more than likely, so it’s probably best to wait for some signs of stability if you do in fact try to go long. Remember, the US dollar/Japanese yen pair is highly correlated to the S&P 500 as well.