The US dollar has been all over the place during the month of March, as traders are trying to figure out what to do about global growth and global risk appetite. After all, the markets continue to see a lot of headlines that cause major issues for traders around the world, and of course with this pair having the Japanese yen involved, it suggests that the barometer and risk appetite comes into play more often here than other places. You can see that the pair has bounced and then pulled back a bit, but ultimately this is a market that is also following some very important technical levels.

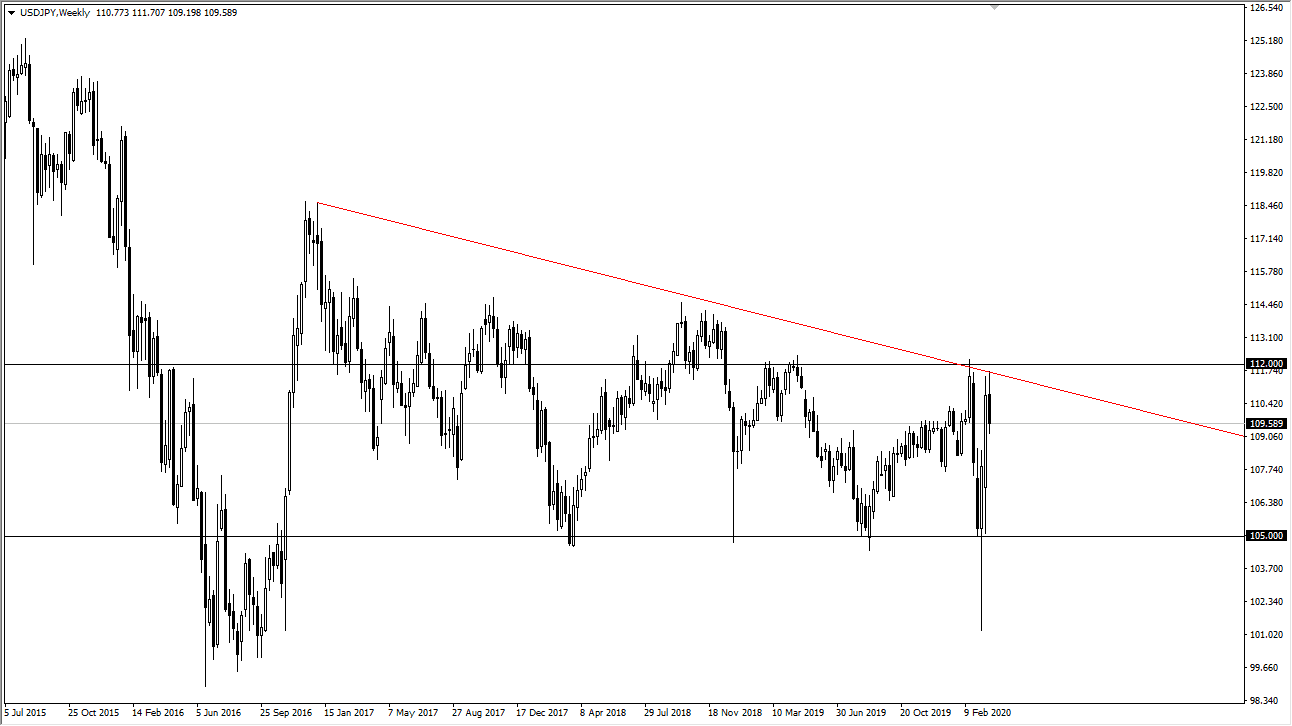

The ¥112 level above is significant resistance and has been several times. The fact that we have pulled back a little bit does not surprise me given the fact that there has been so much concern in both directions. After all, the United States is now starting to flood the market with US dollars in order to take out some of the concerns about funding and of course global debt. As the United States starts the slowdown, it’s also possible that the greenback suffers because of that. Violent rallies in the stock markets of course continue to cause a lot of problems. I believe that we are going to continue to see a lot of noise when it comes to this market, but I do think that we are going to start carving out a nice range. Ultimately, there is also a downtrend line that seems to be holding so therefore that’s also something to pay attention to.

If we were to break down below the ¥105 level, then we could go down to the ¥102 level. I do expect the ¥105 level to hold though, unless of course we get some type of major massive “risk off” event, something that is most certainly possible still. That being said though, with the Federal Reserve willing to step in and try to buy everything it can, I think it’s only a matter of time before we get some type of break out to the upside, but I don’t know that happens in the month of April. This might be more of a later in the summertime story. One thing is for sure, it’s going to be very noisy and therefore position size is going to be crucial to pay attention to. Do not over levered yourself, this is not the time to be aggressive.