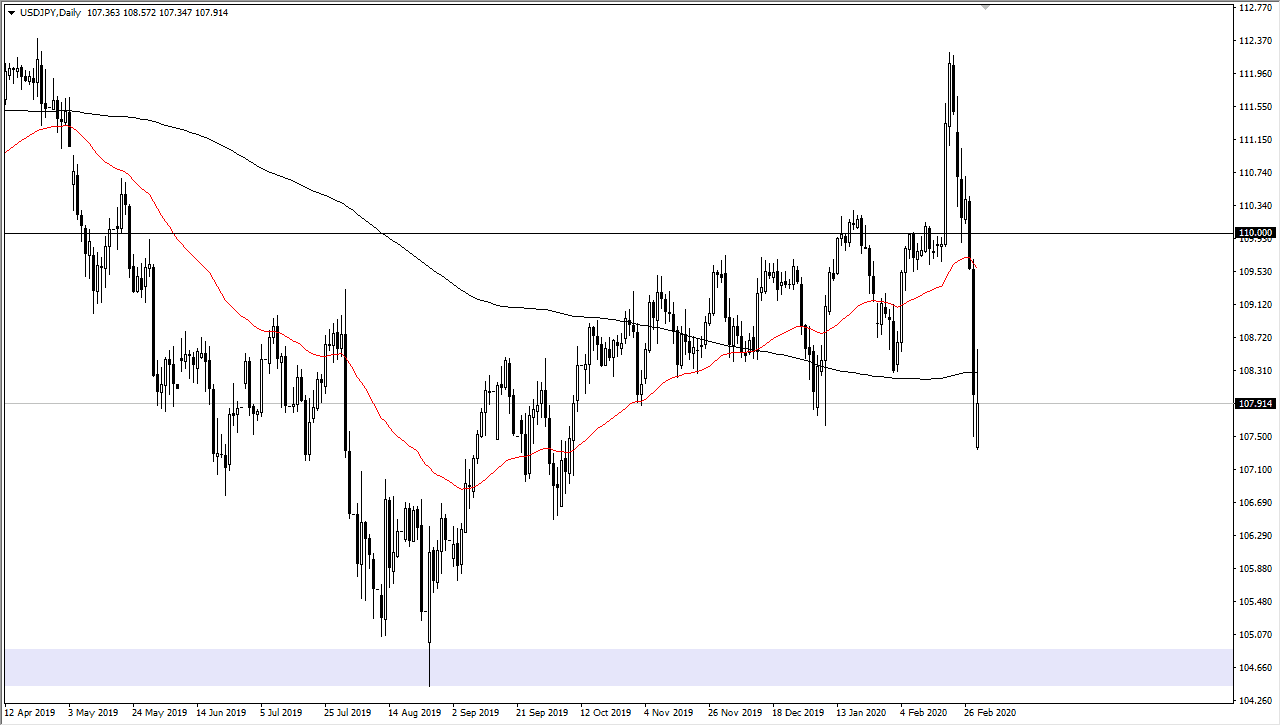

The US dollar has gapped lower against the Japanese yen on Monday, only to turn around and rally above the 200 day EMA before pulling back yet again. The market simply has no idea what to do with itself right now, as there is so much in the way of negativity at this point. Ultimately, this pair is highly sensitive to risk appetite in general, as the Japanese yen is considered to be a “safety currency.” Furthermore, it does tend to move with stock markets in general, as the markets are rallying, this pair will quite often go higher. That being said, it does look skittish and unstable to say the least. With that in mind, I believe that the pair will continue to go lower as we have tested the 200 day EMA and could not break above it. However, a break above the 200 day EMA could be a sign that the whole thing is turning around again, and we are looking towards the ¥110 level.

With all that being said, to the downside I would anticipate the ¥105 level to be the absolute “basement” when it comes to trading this pair, as we have from a longer-term standpoint trading between the ¥105 level on the bottom and the ¥115 level on the top. Because of this, it makes quite a bit of sense that the market continues to fade rallies but eventually we should get more impulsivity. Yes, it was a nice short-term rally during the trading session but the negativity that we had seen last week is not over with. In fact, it’s not until we break above the ¥110 level that I would consider the market likely to go much higher. At this point, fading rallies probably continues to work but there are going to be sudden impulsive moves that could wreak havoc on your account if you are not careful. In other words, the best thing you can do is keep your position size relatively small, as it will mitigate any serious damage that could happen due to a sudden announcement. With that, the technical damage that was done last week should not be ignored, so at this point in time it’s likely that paying attention to that will be the most important thing you do, right along with the position sizing that is necessary in this type of situation.