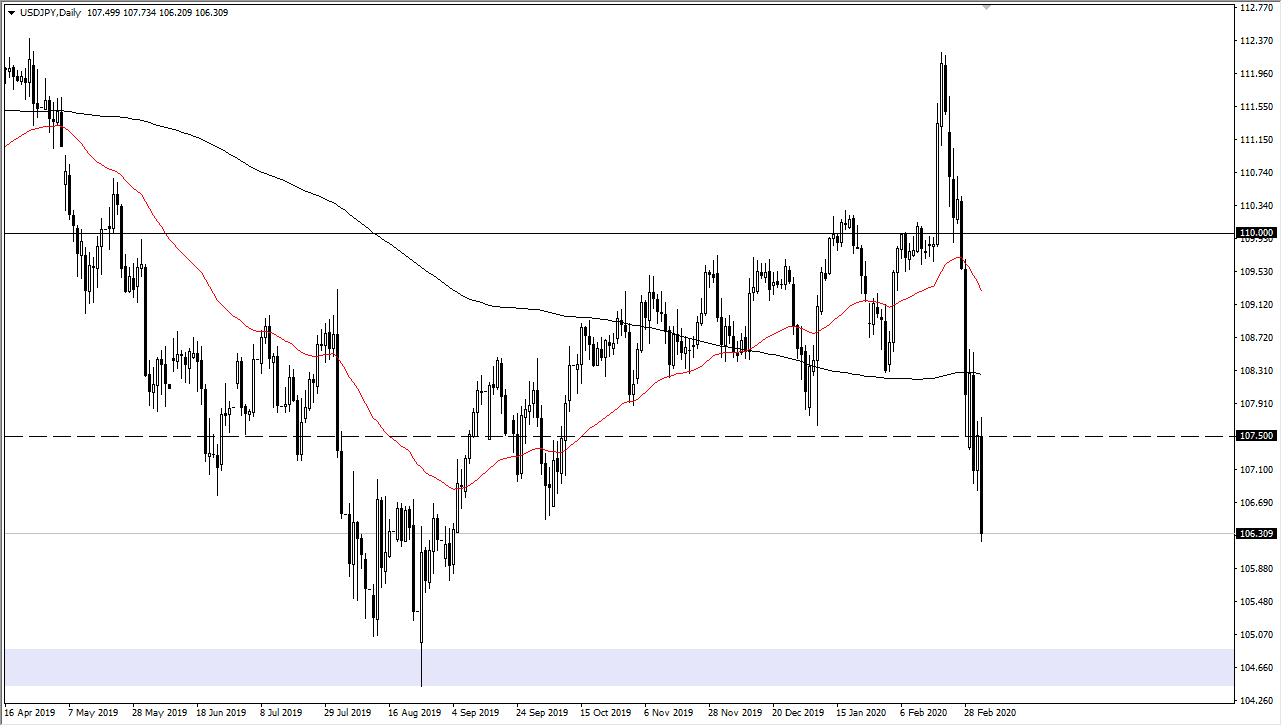

The US dollar broke down significantly heading into the jobs number as the Japanese yen safety currency came into play. Furthermore, I think this has a lot to do with the Fed Funds Rate futures suggesting that we are going to see a 50 bps rate cut coming rather soon. At this point, the market is very likely to continue to see sellers on rallies, as we are closing towards the bottom of the candlestick. Keep in mind that on top of all of this we have the jobs number coming out on Friday and it makes quite a bit of sense that we would find more volatility.

Any rally at this point I think will be a nice selling opportunity, especially at the ¥107.50 level, an area that previously had been supported. It should now offer resistance, and you should keep in mind that the jobs number almost always offers some type of volatility that the market will come in to see. At this point, I do believe in fading rallies and I think it’s likely that we go down to the ¥105 handle. Ultimately, I have no interest in trying to pick up this market in the short term, as the market is far too bearish.

Hourly chart shows figure negativity

The Australian dollar has broken down during the day to show signs of weakness yet again and I think that the Japanese yen will continue to attract a lot of attention due to the fact that it is considered to be a safety currency, and of course the markets are looking for safety at this point. Ultimately, if we were to break above the ¥107.50 level, then we could get a significant bounce, but that seems to be very unlikely. Rallies will more than likely be sold into during the jobs number, and perhaps even during the Asian session as people continue to see a lot of things to be worried about out there.

Jobs numbers tend to cause a lot of noise but the one thing that seems to be a constant at this point is that the US dollar is being sold off and I do believe that is probably something that will continue to be a mainstay of this market as interest rate differentials are starting to shrink between the greenback in so many of its competitors out there.