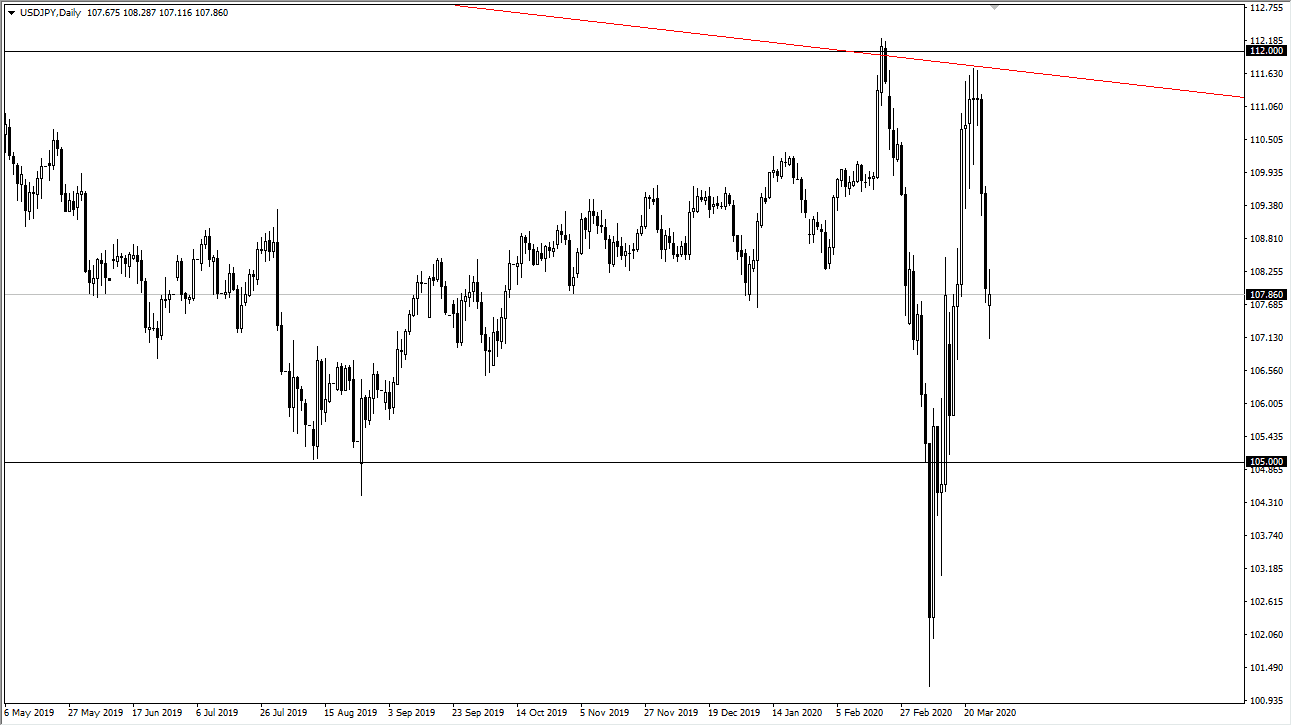

The US dollar was all over the place during trading on Monday as traders are trying to figure out what to do next. The US dollar gapped lower to kick things off for the week against the Japanese yen, only to turn around and rally but fall then rally and etc. Looking at this chart, the ¥108 level does seem to be somewhat important, and keep in mind that the pair is highly sensitive to risk appetite. The question now is whether or not we will continue to see “risk on” or potentially “risk off” trading.

On a break down below the bottom of the candlestick for the trading session on Monday, I believe that this market will probably go looking towards the ¥105 level eventually. On the other side of the equation, if we were to break above the top of the range for the trading session, then it’s possible that we go looking towards the ¥111 level. One thing is for sure, it certainly looks as if we need to make some type of decision before, we go up in the larger direction. All things being equal, this is a market that looks as if it is trying to build up momentum to make a decent move.

Looking at this chart, it’s obvious that we are basically at “fair value”, and other words in the middle of the overall range. It is because of this that I am going to let the market decide what is going to do before putting money to work. You can see just how violent it has been lately, and therefore it’s difficult to imagine how we can be confident enough to put in a huge position and as a result you should be cutting down your size. That being said, we are talking about potential 300 PIP move so it does make sense that we can be a bit more patient with our trading positions. That being said, if we spent a bunch of time within this range, that would make me even more interested in a break of this candlestick for Monday. All things being equal, the Monday session just seem to be a little listless and lost. It wasn’t just this currency pair, but markets overall as we simply just don’t have anything along the lines of clear direction as the coronavirus continues to cause a lot of questions when it comes to global growth.