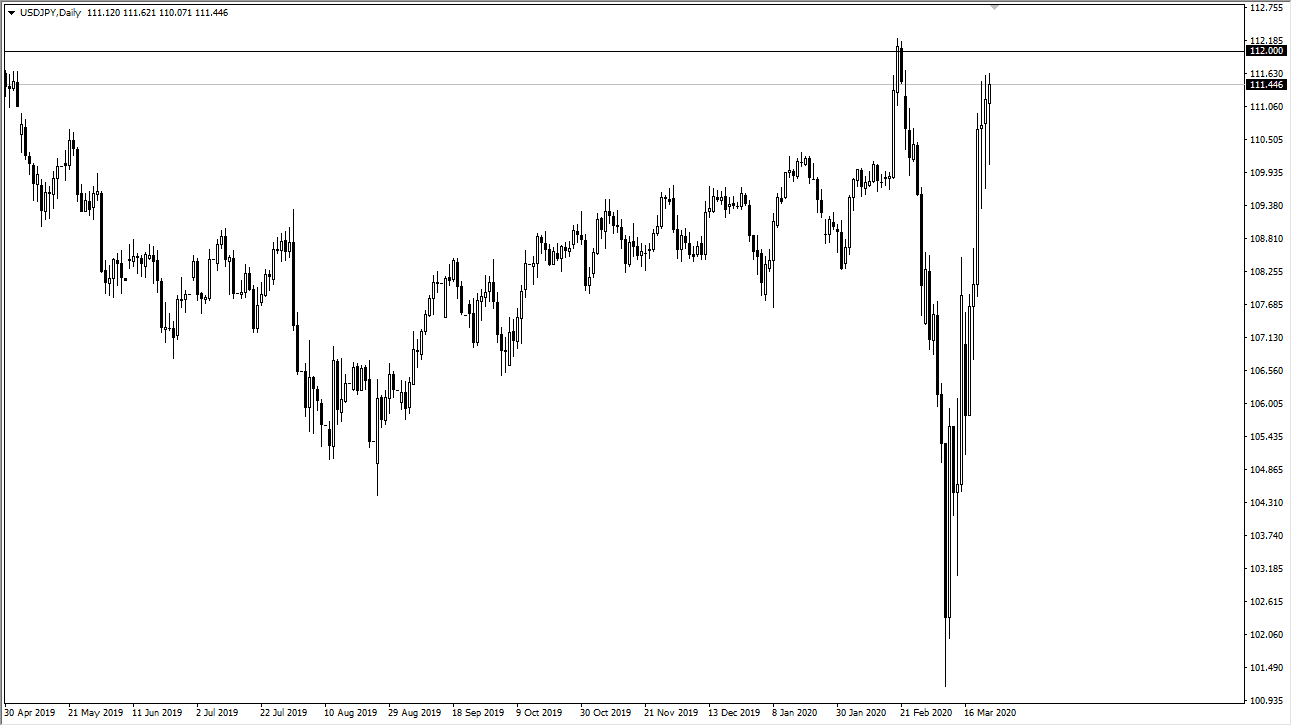

The US dollar initially fell during the trading session on Tuesday, but yet again had seen buyers near the ¥110 level to turn things around and form a massive hammer. At this point, the pair looks as if it is trying to stretch crack to break above the ¥112 level, which would be a major breakout. At that point, the market is very likely to go looking towards the ¥114 level, perhaps even ¥115 after that. However, when you look at the shorter time frames, we are starting to form a bit of a rising wedge, which is actually a bearish candlestick pattern. While candlestick patterns are only worth so much, it does suggest that we are trying everything we can to break out but can’t quite get through the resistance.

At this point, I think that if we break through the bottom of the candlestick for the trading session on both Monday and Tuesday, we will eventually see the markets fall rather hard, perhaps reaching down towards the ¥108 level. This would coincide more than likely with a bit of a “risk off” trade, which quite frankly isn’t a huge surprise at this point, considering that the headlines have been so horrific. At this point, the question is whether or not the US dollar continues to be sought after as a undersupplied commodity for debt markets, or if things calm down.

Looking at the chart, you can also see that if we were to break above the ¥112 level it would be quite an impulsive move. Having said that, although the buyers have been somewhat relentless, it’s difficult to imagine that we aren’t starting to get a little stretched and exhausted at this point. I think that even if we do break out to the upside eventually, and I do recognize this is a very real possibility, a pullback towards the ¥108 level would not be a huge surprise. In fact, I believe it would be relatively healthy for the market to do so before rallying. At this point, I suspect that a breakdown would probably have much more momentum than a move higher, but again the way that this market has been thrown around due to headlines, it’s anybody’s guess at this point. In this scenario, you are better served by keeping your position size reasonably small, as the volatility is going to be extreme at times.