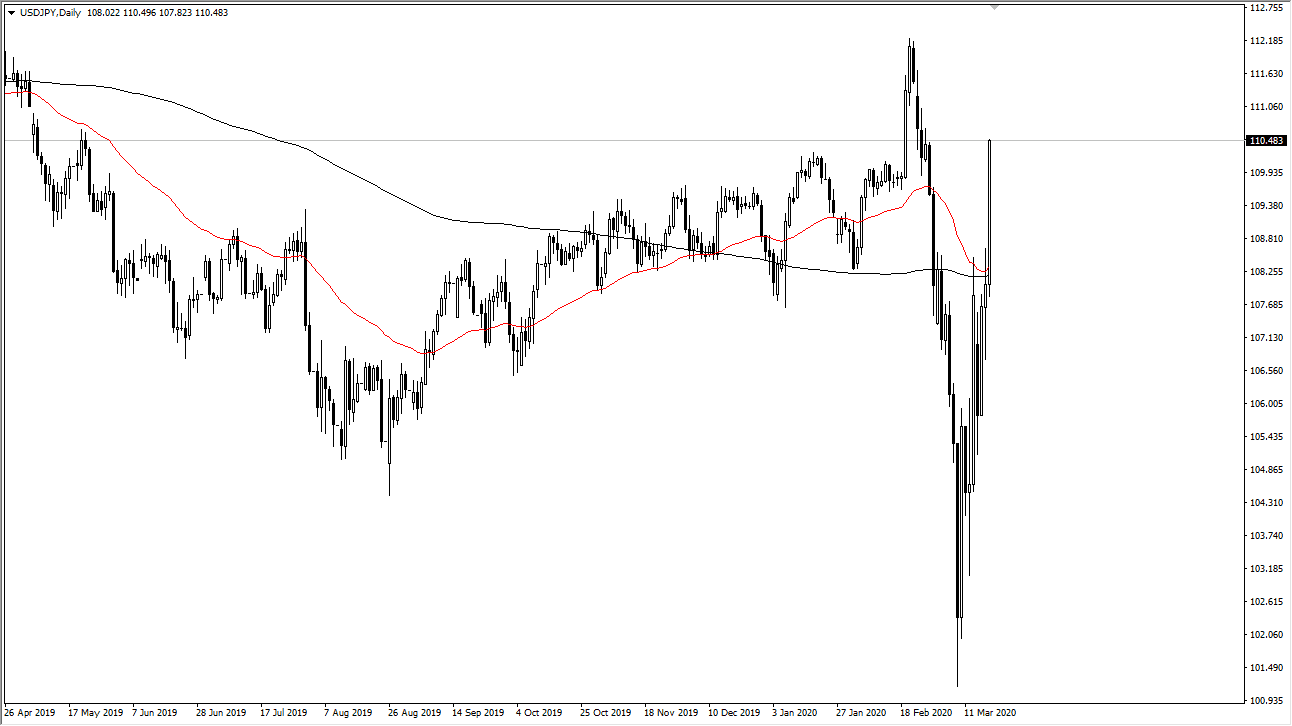

The US dollar rallied significantly during the trading session on Thursday as we continue to see a lot of volatility out there. There is such a huge demand for US dollars that this pair is moving counter to the normal correlation. For example, typically one stock markets recover the way they did during the trading session on Thursday, this pair will rally as the need for safety out of the Japanese yen will abate. However, the last couple of weeks have seen the US dollar rally against the Japanese yen regardless of what the markets have been doing. They have been selling off the S&P 500 rapidly, and at this pace it’s likely that the demand for US dollars has outweighed anything along the lines of the normal correlation to between markets.

The size of the candlestick of course is something to pay attention to, but quite frankly this is a market that has been overdone for some time and therefore it’s likely that we will see some type of fade come soon. The ¥112 level has been resistance recently, so unless there is some type of real “melt up” in the US dollar, we are probably getting very close to the end here of the rally and perhaps a pullback is imminent. It could be heading into the weekend that we see it, if for no other reason than to collect profits. That being said, if we break above the ¥112 level, this thing could take off towards the ¥115 level, perhaps continuing the move that we had seen before the massive swings over the last couple of weeks.

This is probably one of the more dangerous pairs to be involved in right now, just simply because there seems to be nothing but emotion driving the pair. If that’s going to be the case, you might be better off trading the Japanese yen against other currencies as they are behaving a little bit more along the lines of normalcy. Because of this, the market is one that you should probably be trading with small amounts of currency at best, assuming that you should even go there. I do think that this will be the epicenter of all Japanese yen related pairs though, so at the very least you can use it as an indicator as to how to trade some of the other markets, at least from a directional point of view.