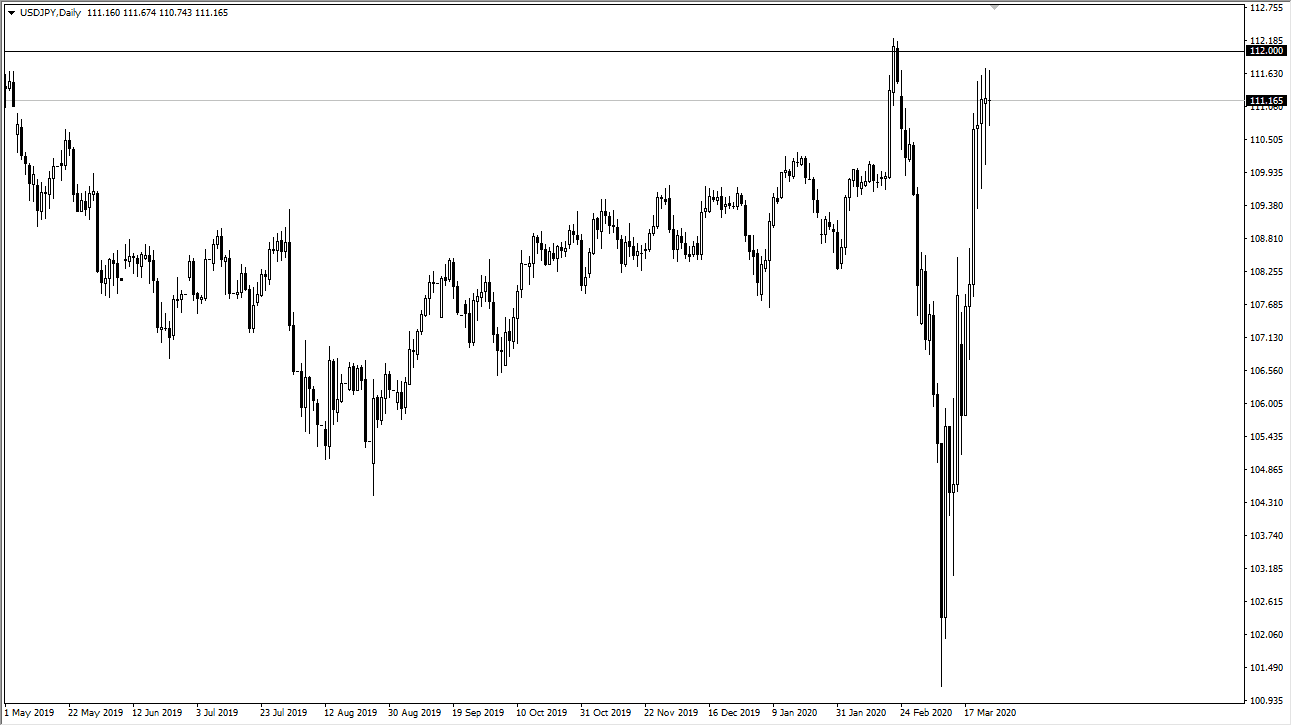

The US dollar continues to bounce around just below the ¥112 level, an area that seems to be a bit of a brick wall. At this point, it’s getting to be a bit tedious as we are in a scenario where the market has been relentless in his attempt to break out, but simply can’t do it. One would have to say that the tenacity of buyers has to be somewhat admired, but at this point one would also have to think that it’s only a matter of time before they give up, and the bottom falls out. If that happens, we could see a rather significant break down happened rather rapidly.

The Japanese yen is being sold off mainly due to the US dollar, and all of the stimulus that seems to be going on around the world, in a potential bid to prop up stock markets and thereby risk appetite. Furthermore, the demand for US treasuries has been through the roof, and that helps lift the greenback itself as well. At this point, I think we are overdone but I recognize that if we get above the ¥112 level, there will be a flood of new money in this market to run things much higher.

One thing is for sure, the market clearly is struggling up in this area and therefore I think fading rallies will probably be the easiest thing to do, but it’s obvious that if we make a fresh, new high you should reverse the position. If we do take off to the upside it’s likely that we go looking towards the ¥114 level next. In fact, it could be a rather rapid move as traders try to get involved and what would be an obvious break out. That being said, it does look like we are starting to run out of momentum, and that typically means that a pullback is coming. At the very least, we need to either pull back in order to build up pressure or go sideways in order to kill time. When markets are so overextended like this, there needs to either be a calming of tensions so that new money comes in, or value offered on a pullback. There’s really no other way for the market to go unless there is some type of absolute panic in one direction or the other to break a market out.