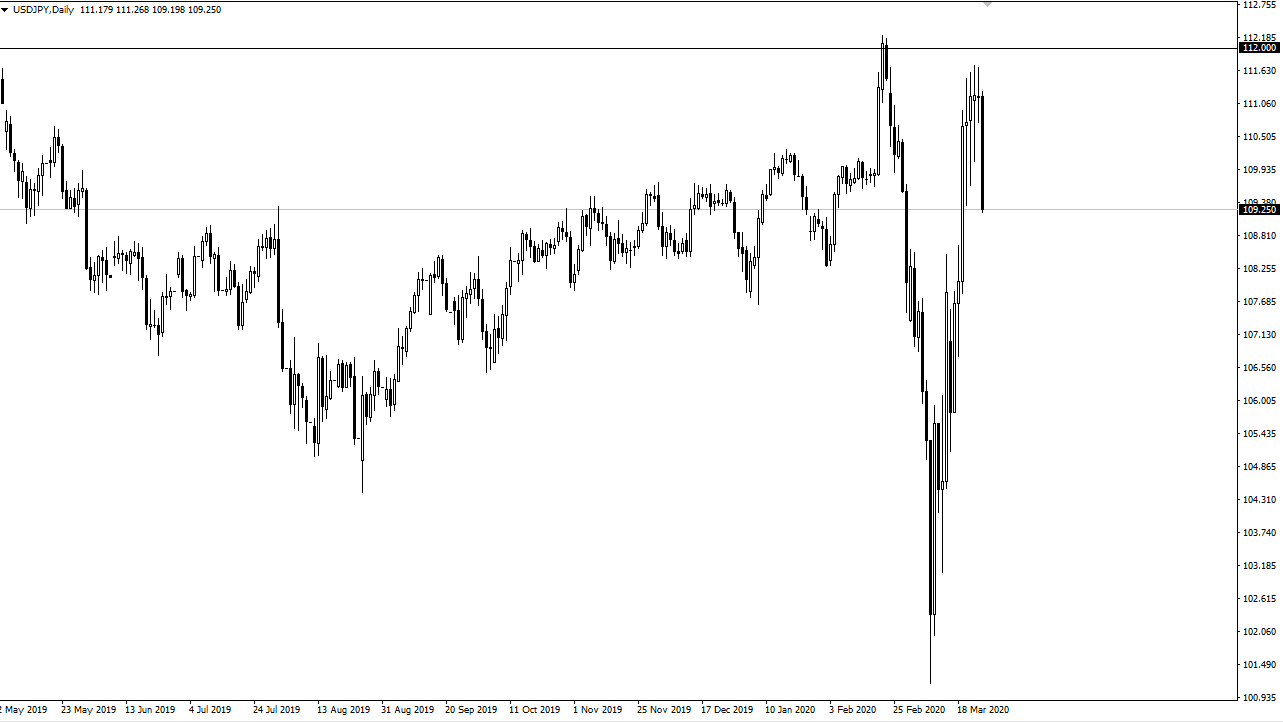

The Japanese yen strength in significantly against the US dollar on Thursday, after seeing several hammers print in a row reaching towards the upside. Ultimately, the ¥112 level has offered far too much in the way of resistance, and therefore it looks to me as if a lot of people found themselves underwater rather quickly. This should lead to more selling, but we may get a short-term bounce in the meantime. I believe that people will be looking to get short above, and most certainly short below the massive candlestick for the session on Thursday.

To the downside, I believe that the ¥108 level is the initial target, followed by the ¥107.50 level after that. The market clearly has seen a lot of volatility over the last several sessions, and even though the market was so resilient in its drive to break out to the upside, the fact that those traders have all gotten hurt should perpetuate the downside. Ultimately, the Japanese yen is still considered to be a safety currency but with the Federal Reserve flooding the market with US dollars we may see the dollar get hammered in general. That is the idea in general, so we will have to see if it translates over here as well. In the sense, this could make the market move somewhat counter intuitively, which it had been doing previously.

The US dollar spike against the Japanese yen as people hoarded US dollars in a panic, which is the opposite of what you normally see. Now that the US dollar is being flooded into the markets, it’s likely that the value of that currency will continue to drop. By breaking through the bottom of those hammers, it suggests that we could see more aggressive selling going forward. I think this makes sense, because the market simply do not know what to do right now. I believe this is going to be the way going forward, a lot of back and forth choppiness that traders would be best served to look for over extensions as we just saw. Ultimately, we are looking at a market that probably has a huge range be informed between 112 on the top and possibly as low as 102 on the bottom. Yes, the markets are going to remain that noisy until the global pandemic situation slows down and things returned to somewhat normal conditions.