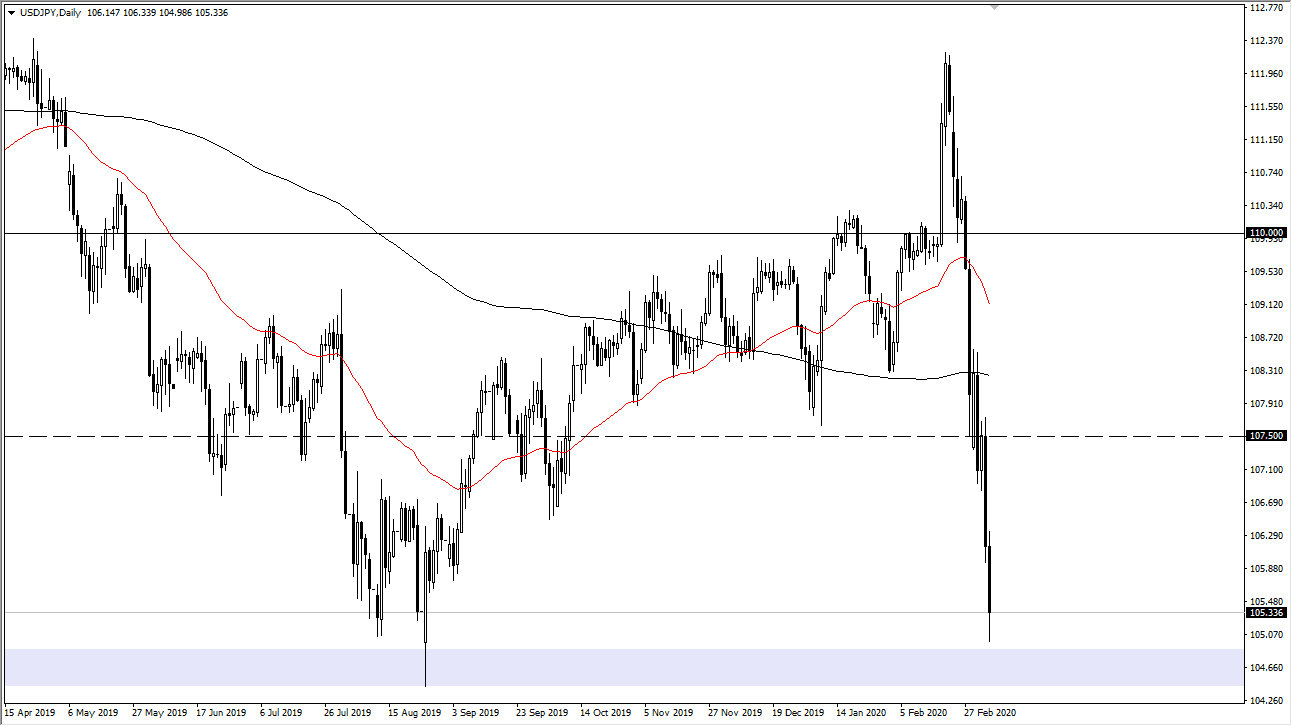

The US dollar has broken during the trading session on Friday, reaching down towards the ¥105 level. That is an area that is important due to a longer-term consolidation area between that level and the ¥115 level. With this, the market should find some buyers in this area but there is a massive “risk off” appetite around the world right now. One way to look at this is that even though the jobs number were extraordinarily positive during the trading session, this pair normally moves right along with that number and it couldn’t.

The market breaking down below the ¥105 level would be a very negative sign, perhaps reaching towards the ¥102 level. At this point, the market is oversold but I also recognize that there is still quite a bit of negativity out there that will continue to pressure this market. I think a short-term bounce is probably more likely than not, but I see significant amount of resistance above at the ¥107 level, perhaps even the ¥107.50 level. At this point, the market is likely to continue to be very noisy.

At this point, the market is likely to continue to be very volatile, but at this point the Japanese yen breaking down could bring in the Bank of Japan, which does not like this market to reach down towards the ¥100 level. At this point, I anticipate a lot of noise and back-and-forth trading, and one thing that I think may have saved this pair is the fact that it was Friday and traders were looking to book profits on the way out the door. I believe the beginning part of the week will be somewhat positive for this pair, if nothing else in a sign of a “relief rally.” However, that will be faded as the US dollar is still trying to price and another 50 basis point interest rate cut, which means that has much further to go. As the US dollar was overvalued in that scenario, it will have to be brought down in price. It’s not until we would break above the ¥108.30 level that I would consider buying this pair. We would need to see some type of massive move in equity markets as far as a “risk on” situation to even consider buying this pair as the markets will run away from the Japanese yen in that situation.