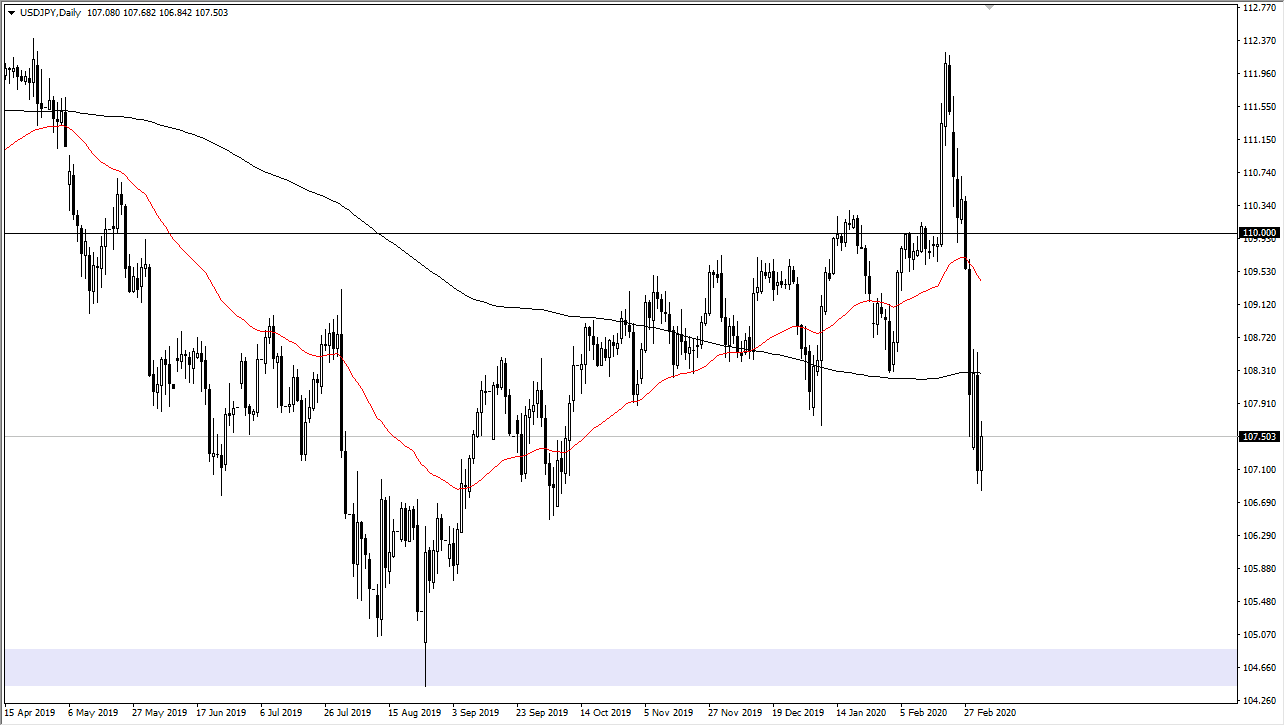

The US dollar has rallied slightly during the trading session on Wednesday as we may have gotten a little bit oversold. However, it’s very likely that the market will continue to find sellers above, as the 200 day EMA sits at the ¥108.30 level. That is an area where I would anticipate seeing quite a bit of selling pressure based on technical trading. Otherwise, if the market were to break above the candlesticks of the last couple of days, then we could go looking towards the 50 day EMA above.

Alternately, it’s likely that the market probably drop down to the ¥107 level, which will cause a certain amount of bounce. This is an area that will cause psychological support, but I don’t see any reason for to hold longer term. At this point, the market has fallen quite hard, as the Federal Reserve has been forced into cutting 50 basis points. Currently, the futures markets are pricing in another 50 basis points for interest-rate cuts, and the Federal Reserve has shown that it will in fact do whatever it is Wall Street wants them to do.

Hourly chart still looks week

The Hourly candlesticks have been going sideways over the last couple of days, and at this point I think the ¥107.50 level is worth paying attention to because it is essentially halfway between the major ¥110 level and the ¥105 level. Longer-term, we have been bouncing around between the ¥105 and ¥115 for quite some time, and it looks as if we are in fact going to try to go looking towards the bottom again. This doesn’t mean that we can’t bounce in the short term, and it would not be a huge surprise to see buyers jump in and pushing towards the ¥108.50 region where I anticipate more sellers coming back in. This is a pair that will move in sync with risk appetite, and it is worth noting that risk appetite got quite a bit better during the session on Wednesday again, but things turned around so quickly based upon headlines it’s difficult to hang on to this market with any type of positivity. With that, I much more comfortable selling after a bounce that I am doing anything else at this point in time. I remain cautious at best.