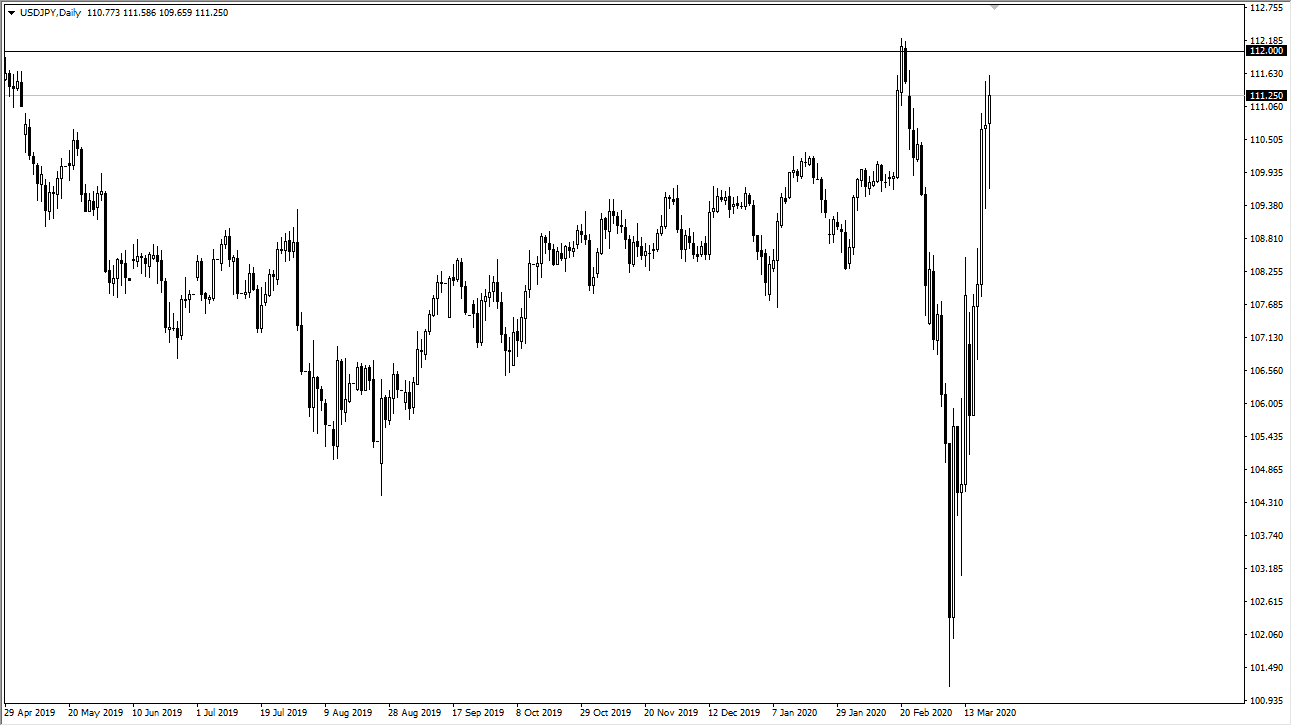

The US dollar pulled back a bit initially during the trading session on Monday but found enough support near the ¥109.50 level to turn around and rally again. The market closed New York trading above the ¥111 level, which means we are in fact getting close to the top of what looks to be a larger range at the ¥112 level. I think at this point looking for signs of exhaustion on a daily close may be an opportunity to start selling as money would go looking towards the yen, perhaps in a safety bid. The US dollar is obviously overbought but at this point there is so much demand for the greenback you can’t simply jump into the shortsighted this trade willy-nilly.

If we were to break down below the bottom of the candlestick for the trading session on Monday, then the market is likely to drop down to the ¥108 level, perhaps even further than that. That being said, a lot of traders have gotten absolutely smoked trying to buy the Japanese yen as it had typically been viewed a safety currency, but right now there are so many questions about Asia and of course there are so many emerging markets out there that have dollar denominated debt that it’s difficult to bet against the greenback. Remember, it’s the world’s reserve currency and as the economy comes to a standstill, dollar hoarding has only gotten worse.

Having said that, we are most certainly overbought in this marketplace. Even if we do continue to go higher over the longer term, this pair desperately need some type of pullback in order to find fresh buying. That being said, if we were to close above the ¥112 level, then the market could go looking towards the ¥114 level, on the way to the ¥115 handle. While I certainly think that is a possibility, I still believe that a lot of bullish traders out there would rather see a bit of a pullback.

With the daily gyrations in the stock markets, you can look at that as a proxy as to whether or not this pair will stabilize. It clearly hasn’t yet, as we are threatening to wipe out the entire massive move that had started what seems like just five minutes ago from this level. As far as buying is concerned, you simply cannot do it until we clear that ¥112 level or get that pullback.