The US dollar went back and forth during the trading session on Monday, as the Federal Reserve cut interest rates by 100 basis points in a surprise move just ahead of the market opening. At this point, the market is likely to see a lot of back and forth in this pair, due to the fact that the Japanese yen is used as a “safety currency”, and therefore we will continue to see a lot of noise. Ultimately, this is a market that I think will continue to see a lot of interest at various points, as it has recently.

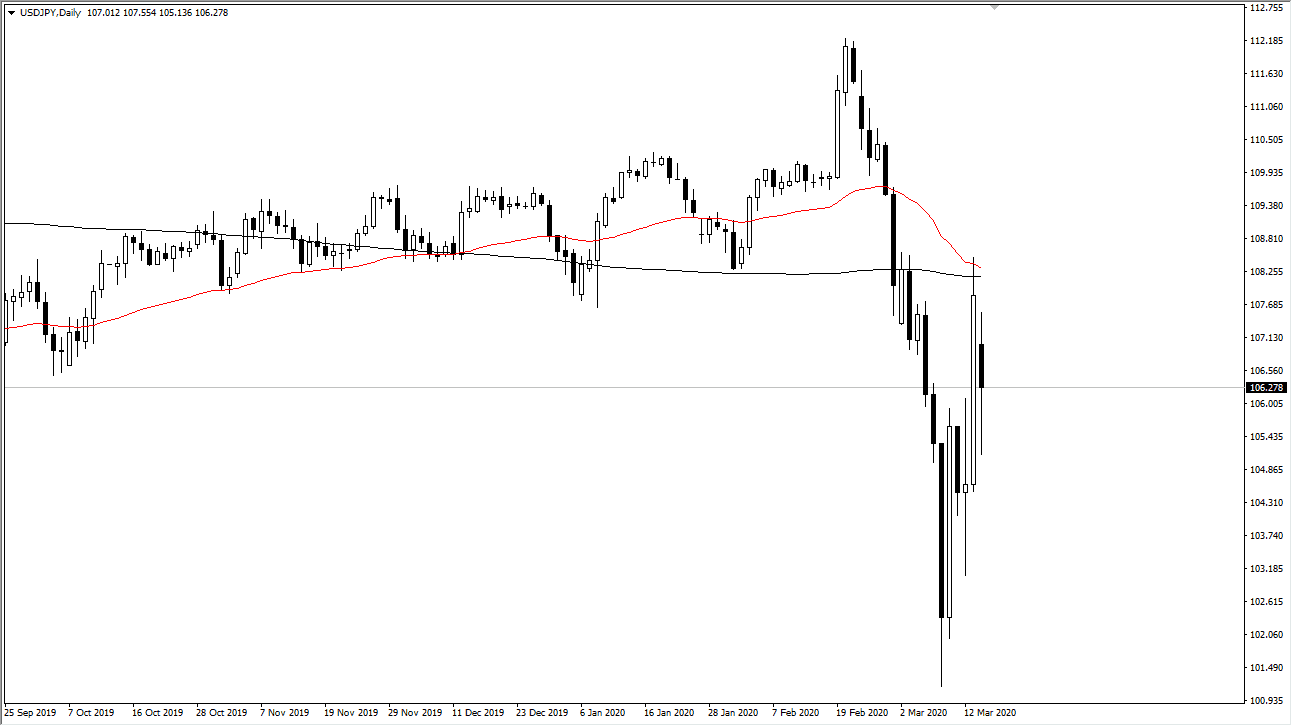

Looking at the chart, you can see that the Friday session had tried to break above the 200 day EMA but failed. At this point I think the ¥108 level, basically the same thing, is going to continue to offer a bit of a “ceiling” in the market. That being said though, the market did reach down towards the ¥105 level before bouncing. I think this is going to be how this pair behaves going forward, simply slamming back and forth based upon the most recent headline. Because of this, the only thing you can do is be aware of the important levels on the chart. These two levels are crucial for trading, so pay attention to those support and resistance barriers. If we do break down below the ¥105 level, then it opens up a move back down towards the ¥103 level. Below the ¥100 level, the Bank of Japan starts to get involved eventually. On the other hand, if we do get a lot of good news, that could send this market breaking out higher.

If we can close on a daily chart above the 200 day EMA, pictured in black on the chart, then the market is likely to go looking towards ¥112 level. I find it very difficult to believe that’s going to happen though, at least in the short term considering that there is so much confusion out there. Confusion breeds negativity and choppy trading conditions. Because of this, I think it’s going to be easier for this pair to break down than it is up, but anything is possible at this point as we are moving on the latest headline. Keep your position size small and protect your account as market conditions like this can have you reaching a margin call much quicker than you expect.