The recent sharp collapse of the U.S dollar and stock markets to the point where Wall Street became an arena of terror, forced the US government, led by Trump, to intervene to provide new optimism into the hearts of investors. As US President Trump has proposed cutting taxes on middle-income payrolls. In this context, Larry Kudlow, the Trump administration's chief economic advisor, told reporters at the White House on Tuesday evening that helping unsatisfied wage earners is a top priority, along with exempting salary from taxes. He said they are also thinking of helping small and medium-sized companies and possibly some troubled industries. Despite optimism, Simon Johnson, professor of economics at the Sloan School of Management at the Massachusetts Institute of Technology, an expert in financial and economic crises, said: "Everything the Trump administration has proposed so far is very small." The US dollar found some support, and accordingly the USD/JPY moved quickly to the top, reaching the 105.91 level after its record collapse to the 101.17support. The pair is currently stable around 104.45 at the time of writing.

The Japanese yen is still the most profitable currency in the current period in light of the increasing human and economic losses globally from the outbreak of COVID-19, which infected 118 thousand people and caused the death of more than 4000 people, including 29 Americans, and spread in 100 countries around the world. What contributed to the recent U.S dollar and stock markets collapse was the growing fear that the US economy will be paralyzed, as happened in China, the source of the epidemic, and that this event will lead the global economy to inevitably stagnate.

In a White House press conference, after another day of a collapse in the US stock market, which led the Dow Jones Industrial Average to decline sharply with the worst daily performance since 2008, as it lost more than 2,038 points, Trump made a possible reduction in the payroll tax as the focus of an emergency economic plan for his team . This was an idea that Trump considered last summer as an occasion to avoid an economic slowdown, with some experts warning that the United States is heading towards a recession that could harm Trump’s chances of being reelected. But Trump quickly reversed course and praised the strength of the US economy, blaming the Fed and its chairman Jay Powell for not cutting interest rates.

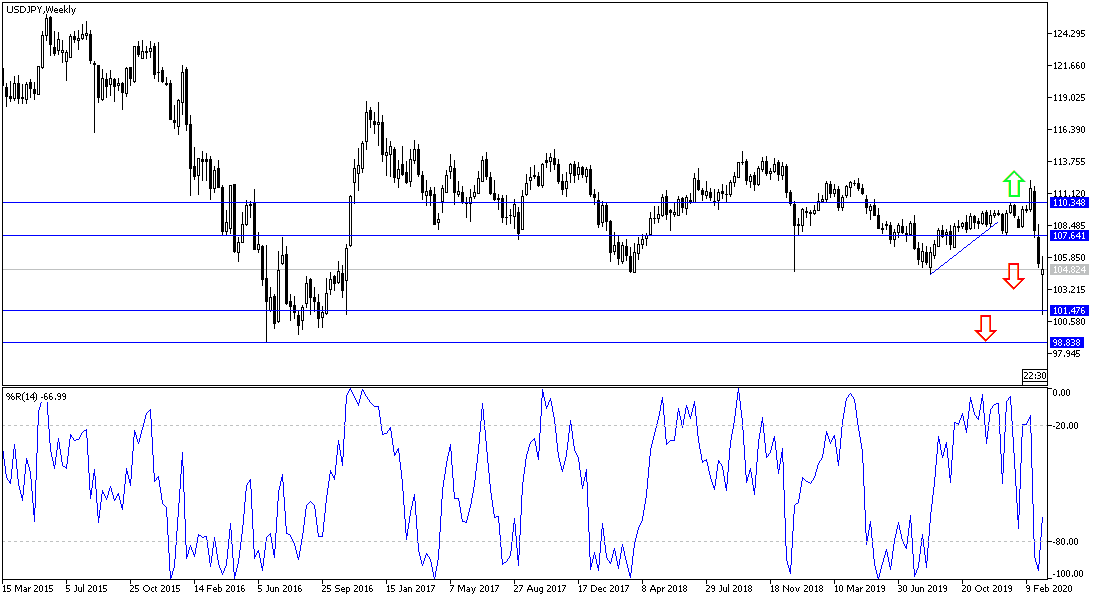

According to the technical analysis of the pair: The USD/JPY pair is still moving inside a violent descending channel and still has a lot of time to reverse the current overview, especially if more numbers of COVID-19 cases were announced in the United States. The Japanese yen is the most prominent safe haven in such times, and the support levels 103.70, 102.55, and 101.00 are still legitimate targets for the bears in light of their control over performance. There will not be a real break of the trend and a reversal without breaking through the 107.75 resistance, as shown on the daily chart below.

As for the economic calendar data: the focus will be on US consumer price index numbers with expectations that the US inflation will continue to fall below the Fed target.