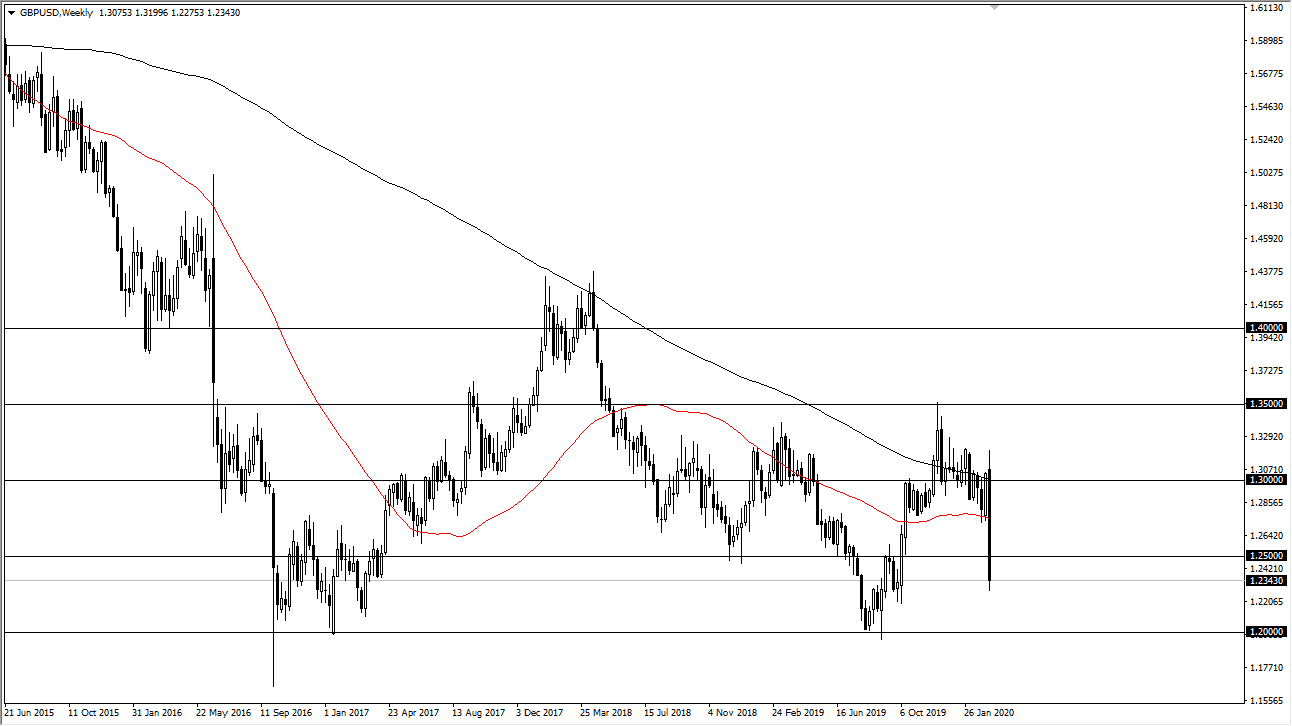

GBP/USD

The British pound had a horrific week, slicing through the 1.25 level. Furthermore, Friday even saw the market reach down towards the 1.23 level. I think at this point we are probably going to see a little bit of a bounce from the British pound, but I believe that the sellers will return at the 1.25 handle. If we break above there, then the British pound probably goes looking towards 1.2750 level. One thing is for sure, this is a negative candlestick, and it certainly shows that there is probably more selling to come.

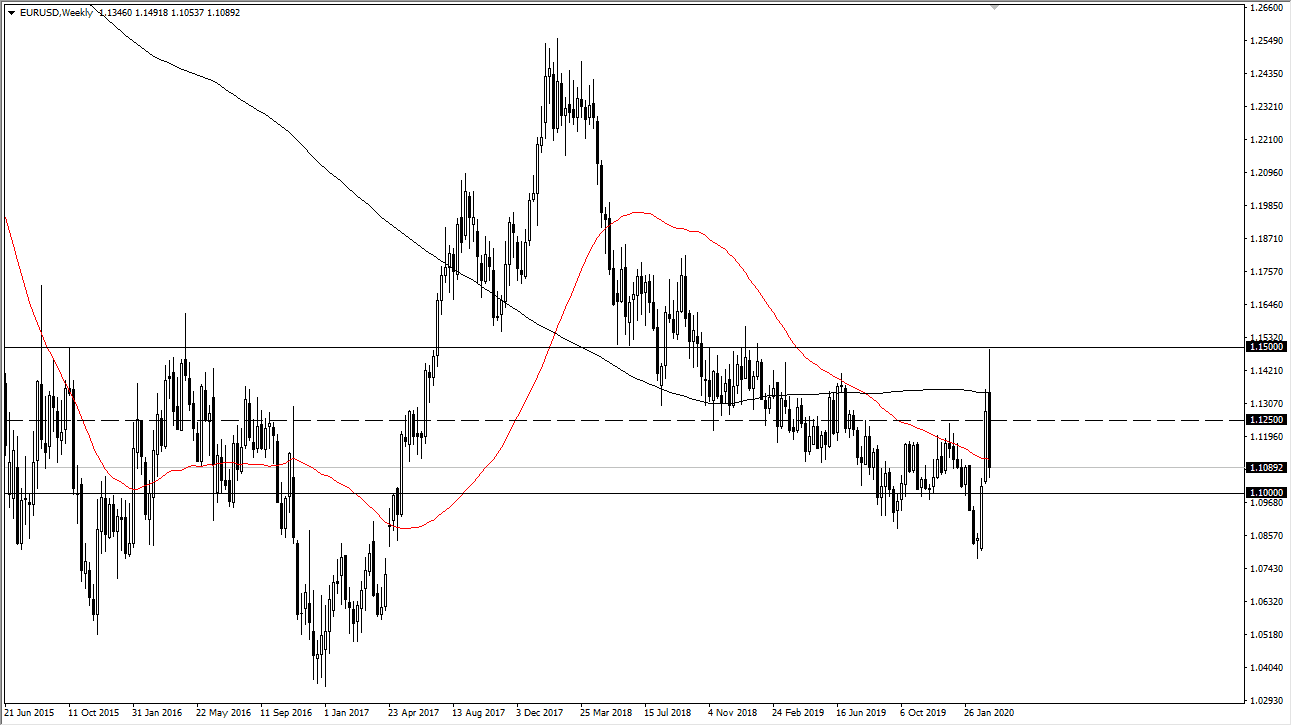

EUR/USD

The Euro initially rally during the week, but we have seen a lot of volatility yet again. Christine Largarde failed to raise interest rates out of the ECB, so that cause some issues, and then the Germans are talking about blowing out there budget, so that has caused a bit of negativity as well. At this point, the question is whether or not we can stay above the 1.10 level. If we can, then this is a market that could turn around and go back towards 1.1250 level. All things being equal though, it’s going to be very noisy market, as we are going to spend this weekend possibly a few more trying to figure out what the range is going to be.

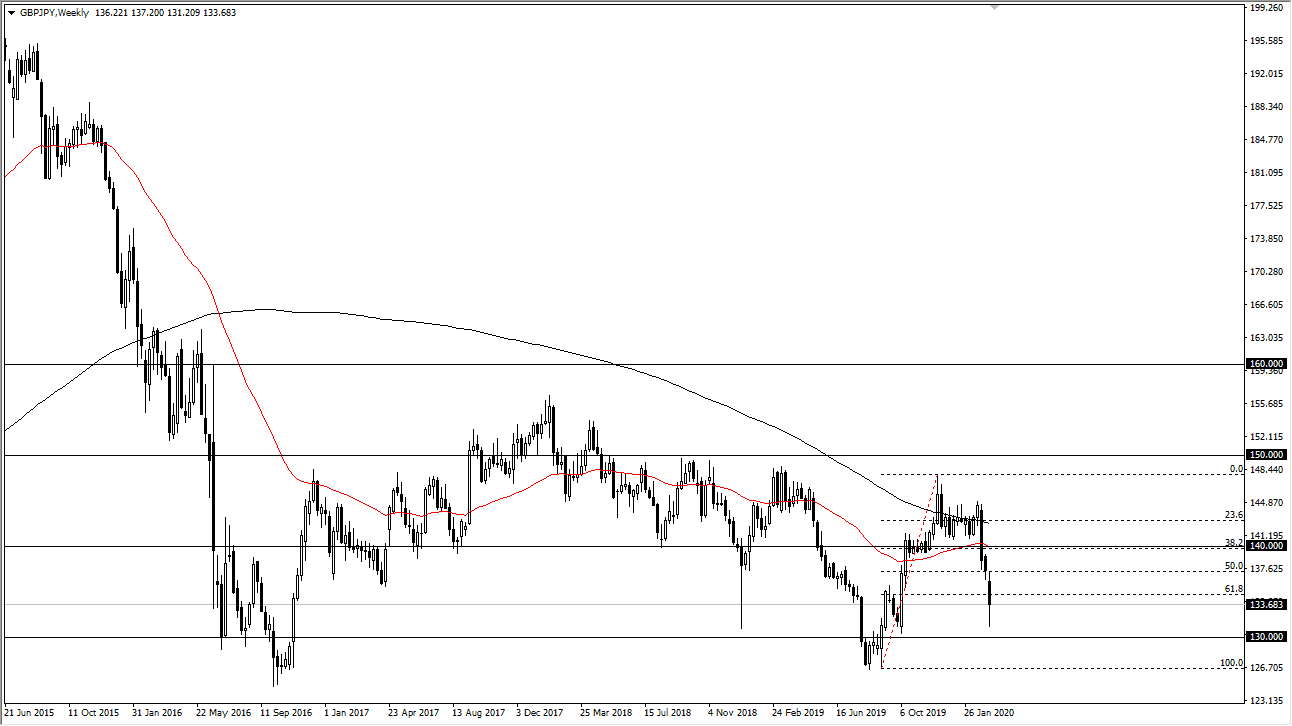

GBP/JPY

The British pound gapped lower against the Japanese yen, bounced a bit, and then broke down significantly during the week before bouncing again on Friday. I believe that the ¥130 level is your “floor” at the moment, and that the ¥135 level is probably going to be resistance. I would play both of these levels to form a range, but if we were to break above the ¥135 level it’s very likely that the market then goes looking towards the ¥137 level next. Keep in mind that this pair is highly sensitive to risk appetite, so this will go up and down with the markets, but I think at this point any relief rally will probably be sold into, not only in this market but many others.

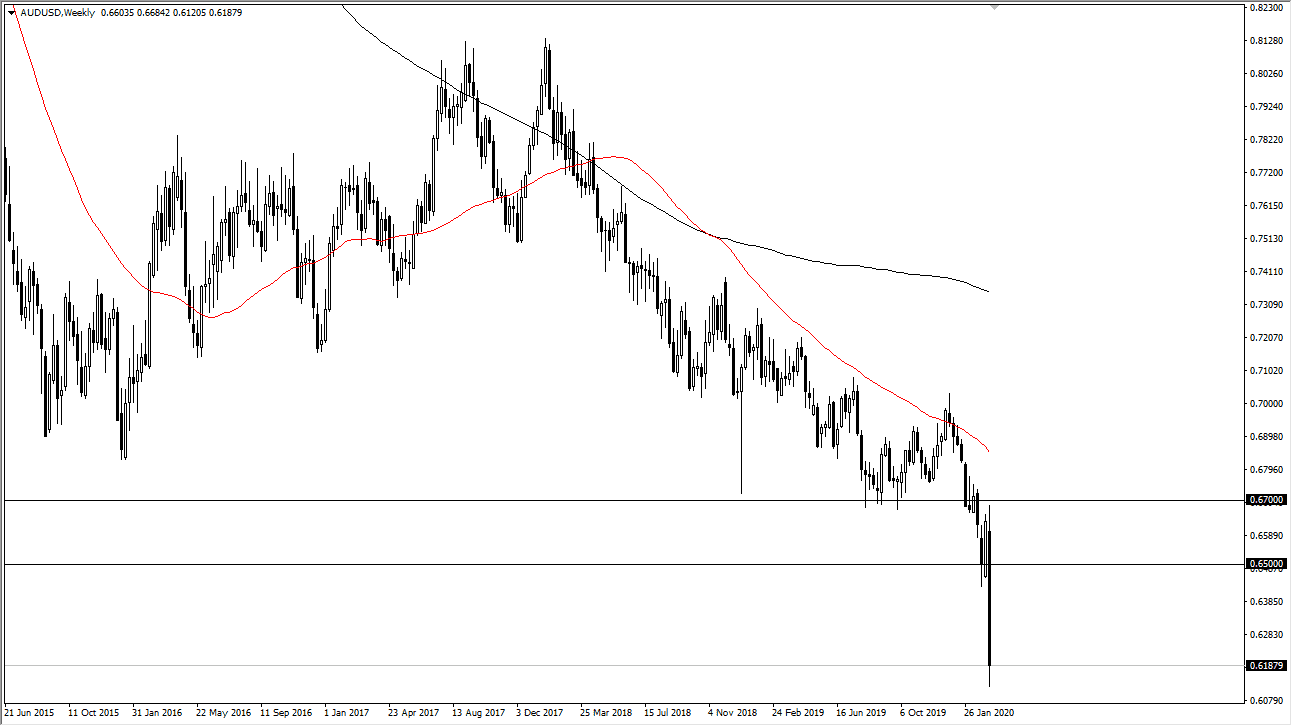

AUD/USD

The Australian dollar has fallen apart during the week, breaking well below the 0.65 level and even crashing towards the 0.62 level. The 0.60 level underneath is massive support based upon the financial crisis bounce, and we are actually that low now. I think we will probably see a short-term rally if we get any type of good news, but I find it very hard to think that the Aussie is going to break above the 0.65 handle anytime soon. I continue to fade rallies.