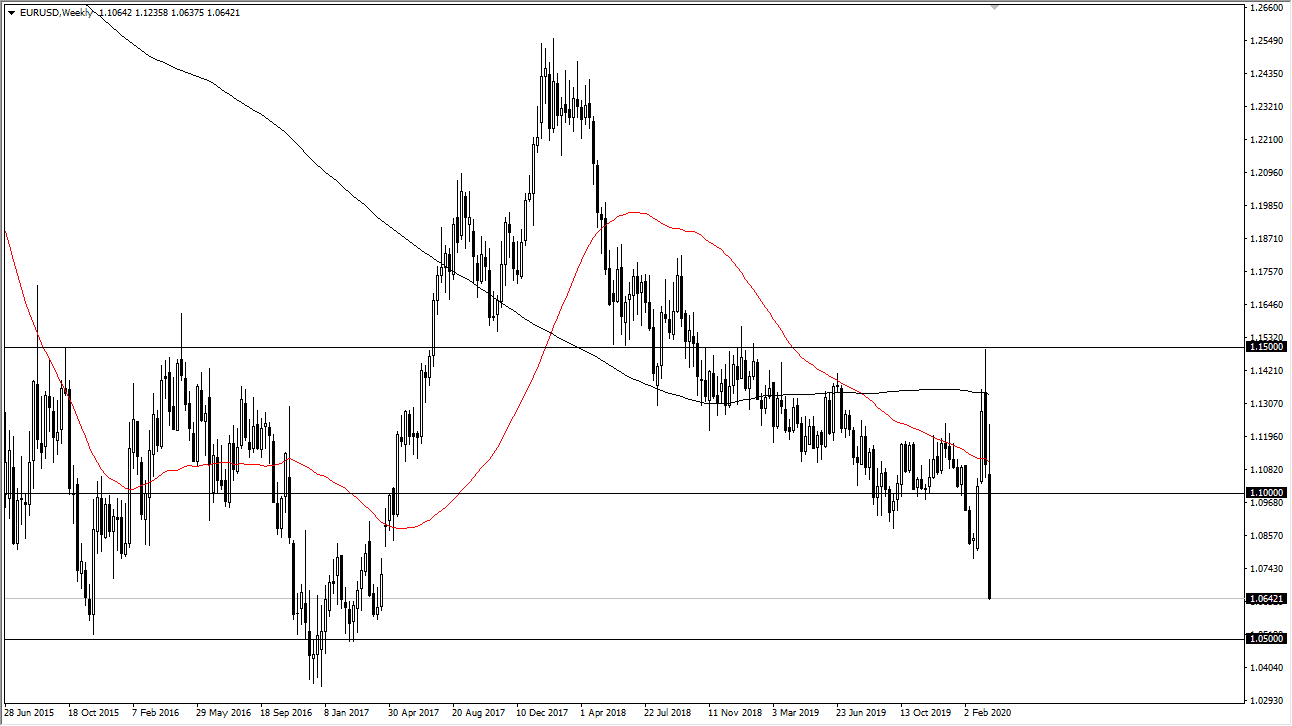

EUR/USD

The Euro has been absolutely crushed during the previous week, showing plenty of signs of weakness, after initially trying to break above the 1.13 handle. At this point, the market then turned around to slice through the psychologically important 1.10 level. As we close out the week, the market is at the 1.0650 area, and looks likely to test a major support level near the 1.05 level underneath which is a monthly support level. I think going forward, any time the Euro gets a bit of a boost, sellers will return to fade those rallies as the European Union is essentially shut down.

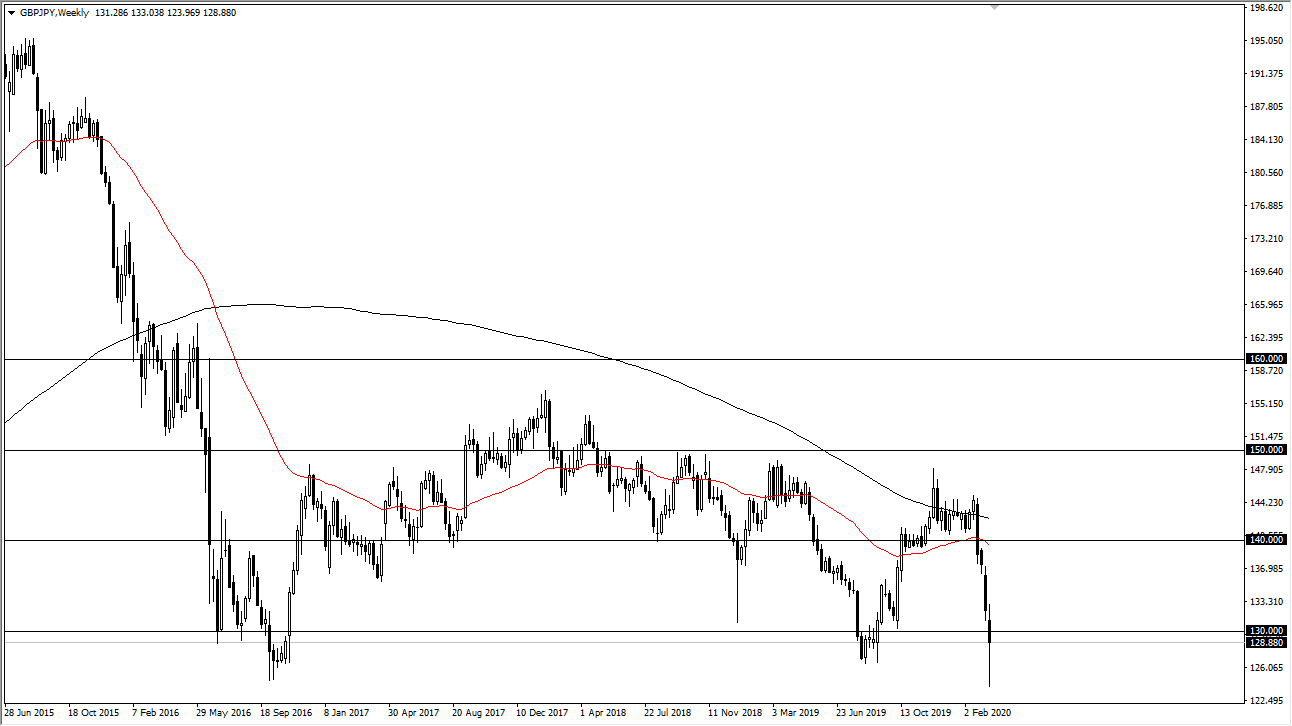

GBP/JPY

The British pound has fallen hard against the Japanese yen during the week but recovered later to form something similar to a hammer, but I think at this point we need to look at the ¥130 level as potential resistance. Even if we break above there, I believe that there are still sellers just waiting to get involved. That being said, rallies at this point are to be looked at with suspicion, unless of course we get some really positive “risk on” type of news. Right now, that seems to be very unlikely to happen in this potential environment.

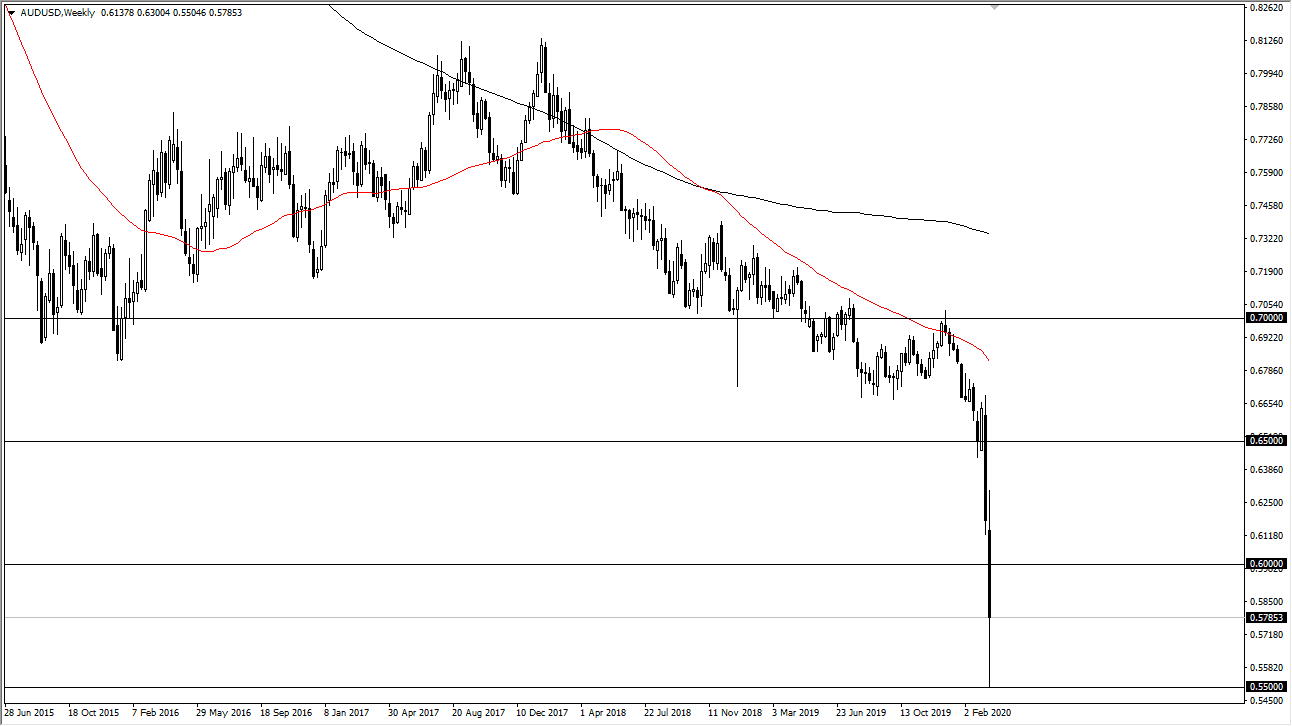

AUD/USD

The Australian dollar has initially tried to rally during the week but found enough resistance near the 0.63 level to turn things around and sliced through the 0.60 level like it wasn’t even there. In fact, we had a major “flush” down to the 0.55 handle before bouncing. At this point though, I think that rallies will continue to offer selling opportunities, especially near the 0.60 level and of course the 0.62 level after that. To the downside, I think that we will eventually try to break down below the 0.55 handle and go looking towards the 0.50 level. Remember, the Australian dollar is highly sensitive to the Chinese economy, which is now suffering at the hands of consumers that don’t want their goods.

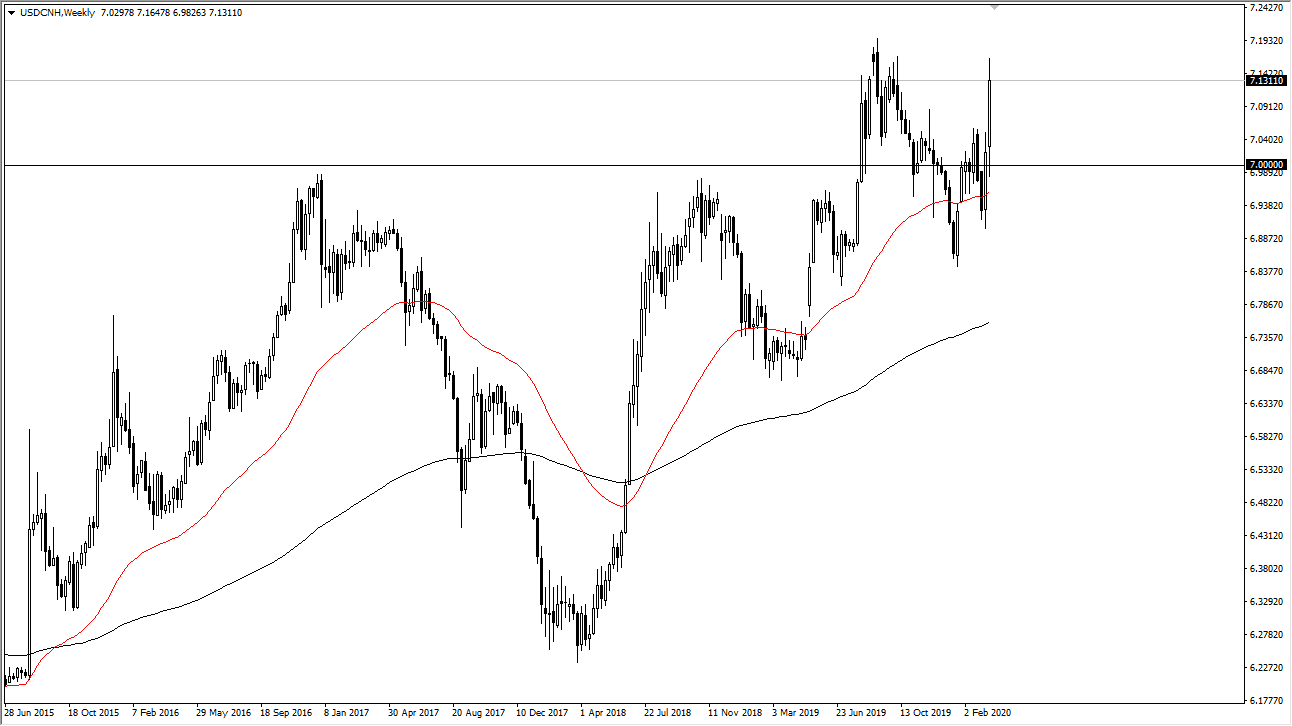

USD/CNH

Although not necessarily a major currency pair, it is a market that you should be paying attention to. Notice how the US dollar is pressing the highs again and looks like it is going to try to break out to the upside. I believe that short-term pullbacks will probably offer buying opportunities but if we break out above the recent highs, that shows more of a “risk off” type of indicator than anything that is necessarily tradable. This of course will be felt across all markets.