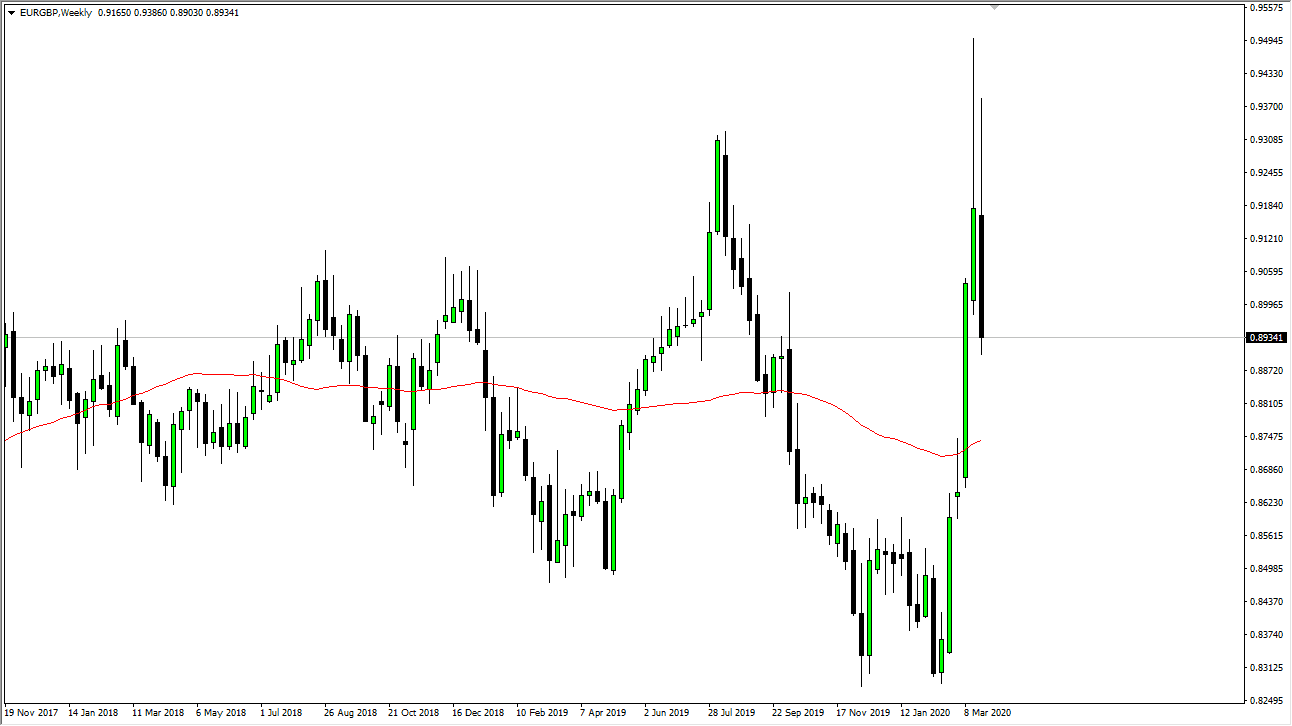

EUR/GBP

The Euro initially tried to rally during the week but then fell apart against the British pound as it had been far too overbought. At this point, it’s obvious that the market had gotten stretched, and now I think we are seeing a continuation of the back and forth pattern that this pair has featured. It’s very likely that any rallies at this point will probably be sold into this week, reaching down towards the 0.88 level, possibly even the 0.86 level relatively soon. I see the 0.9150 level as significant resistance.

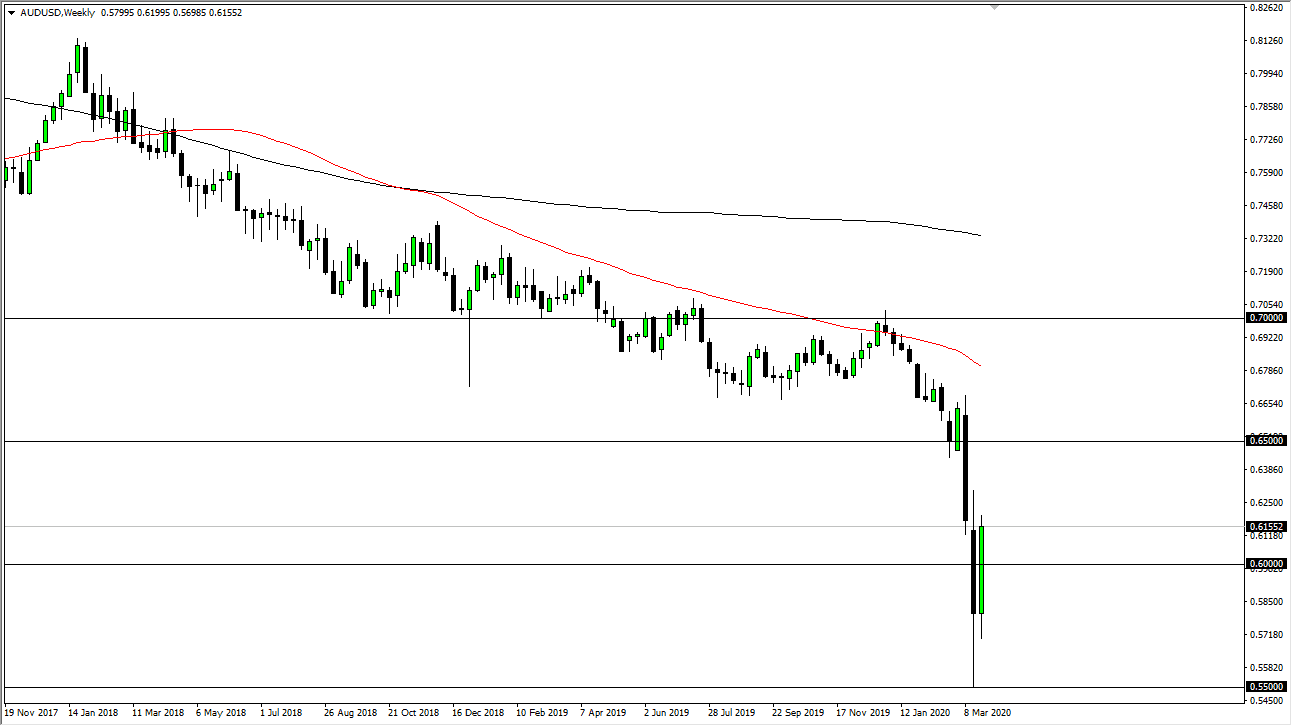

AUD/USD

The Australian dollar had a good week, breaking above the 0.61 level, showing signs of relief again. At this point, I don’t know if it’s quite ready to take off to the upside, so I think that what we are going to see is a pullback in the short term. This week could be a bit choppy but if this market is ever going to turn around and have a bullish run, we need to form some type of bottoming pattern in order to get to the upside. The 0.55 level underneath will more than likely be massive support. If we were to break down below the 0.55 handle, that could unleash a flood of selling into the 0.50 level. I believe that the 0.65 level above is the target for buyers, but I don’t think we get there this week.

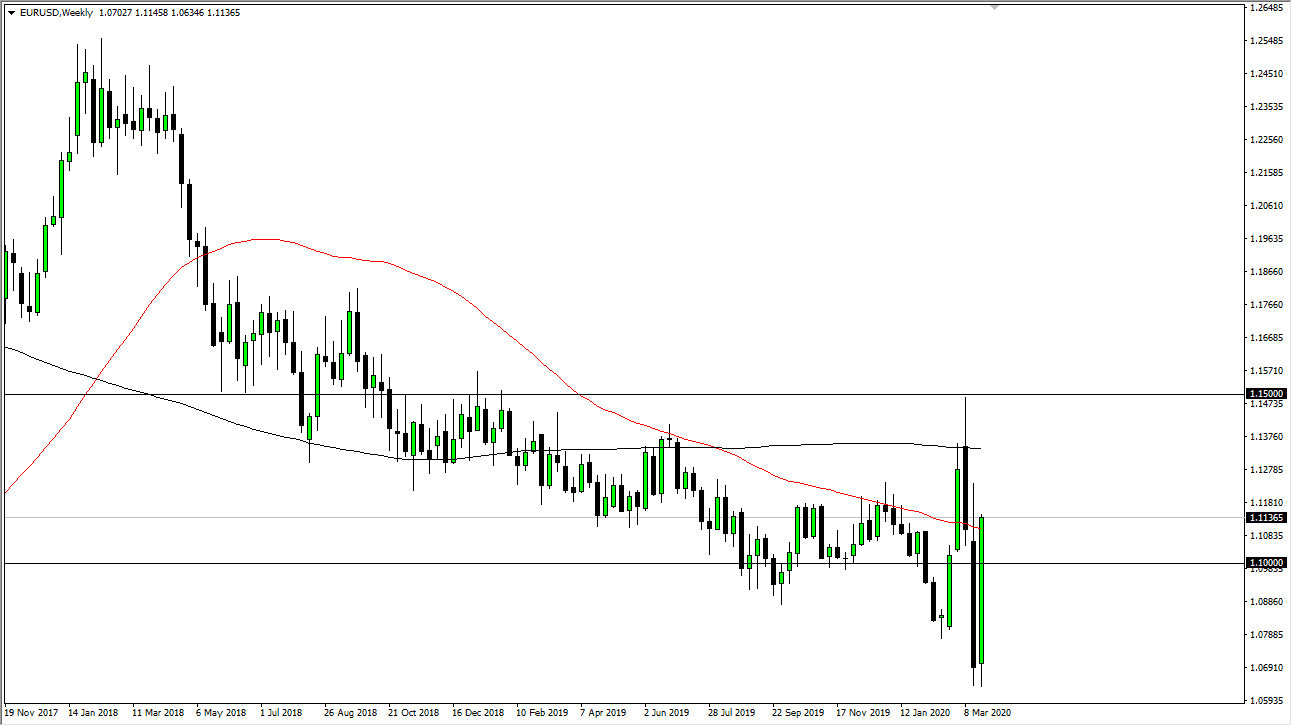

EUR/USD

The Euro had an extraordinary week, reaching above the 1.11 handle, but at this point it’s obvious that the Euro continues to be extraordinarily volatile and the fact that we closed towards the top of the candle tells me that we are probably going to see buyers on dips. I don’t think that this is going to be an easy move in one direction or the other, and I would expect a lot of back and forth choppy trading that is going to do a number on a lot of different people’s accounts. Keep your position size small but I suspect were probably going to try to rise again from here.

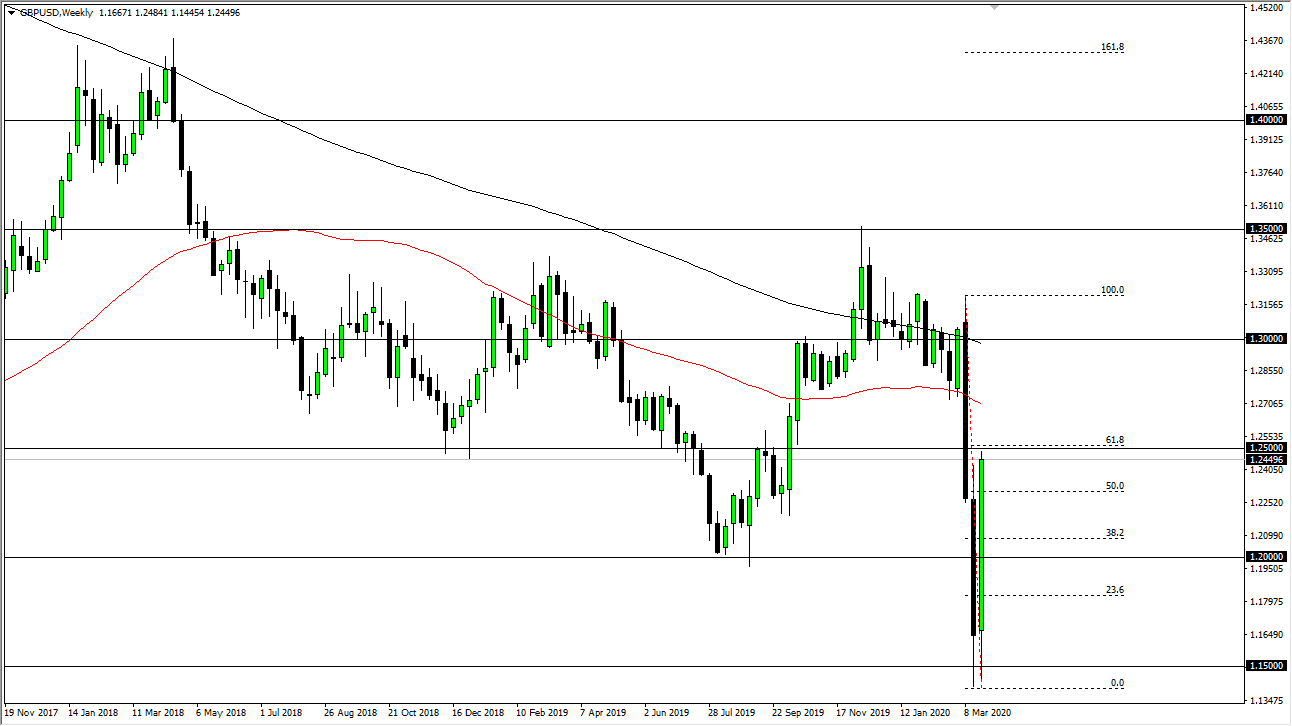

GBP/USD

The British pound had an explosive week, gaining roughly 1000 pips. At this point, the British pound is starting to test the 61.8% Fibonacci retracement level, so a short-term pullback might be an opportunity to buy the British pound “on the cheap.” Having said that, we could be looking at a move down to the 1.20 level before buyer step in and try to pick this up.