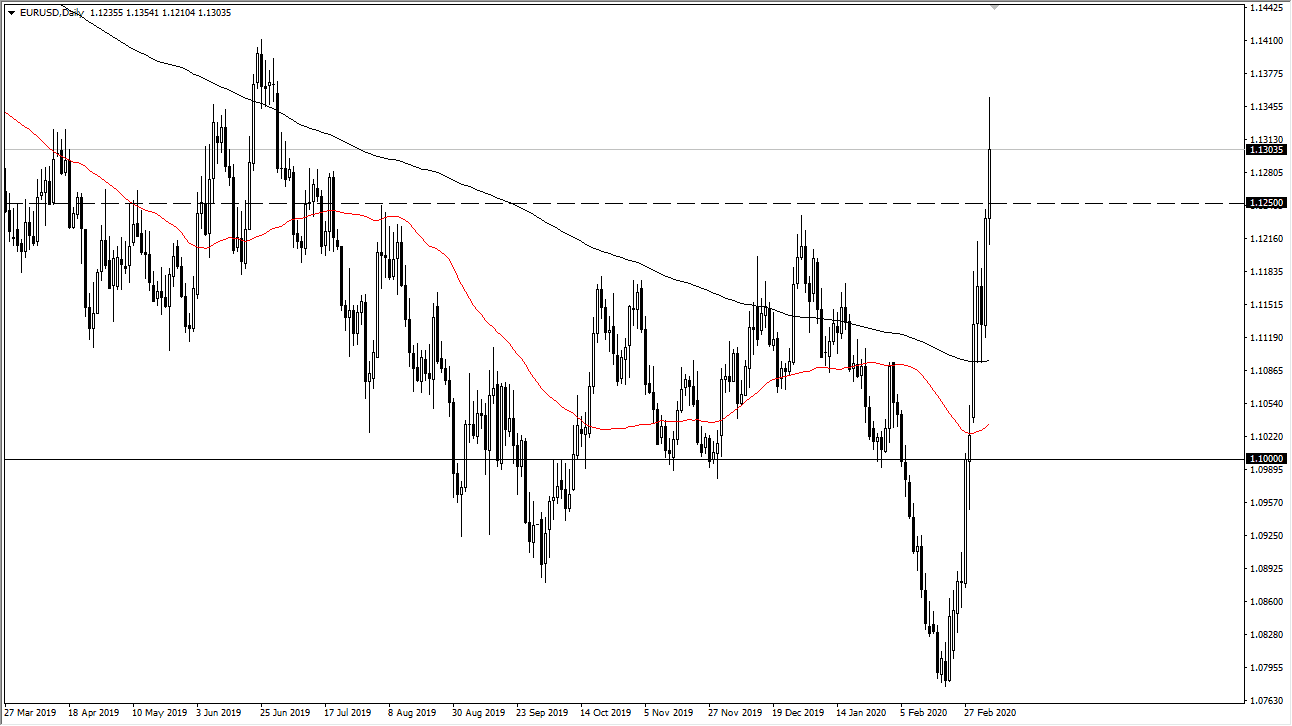

EUR/USD

The Euro has broken out significantly during the previous week against the US dollar and it is now obvious that we are going to continue to see US dollar weakness. The Federal Reserve moved in an emergency meeting to cut the interest rate by 50 basis points, something that is never good for currency. Furthermore, the Federal Funds Rate futures are pricing in another 50 basis points as far as a cut is concerned. That being the case, it’s very unlikely that the US dollar will strengthen for any significant amount of time. I anticipate a pullback due to the explosive nature of the breakout, but I would expect some type of bounce near the 1.1250 level.

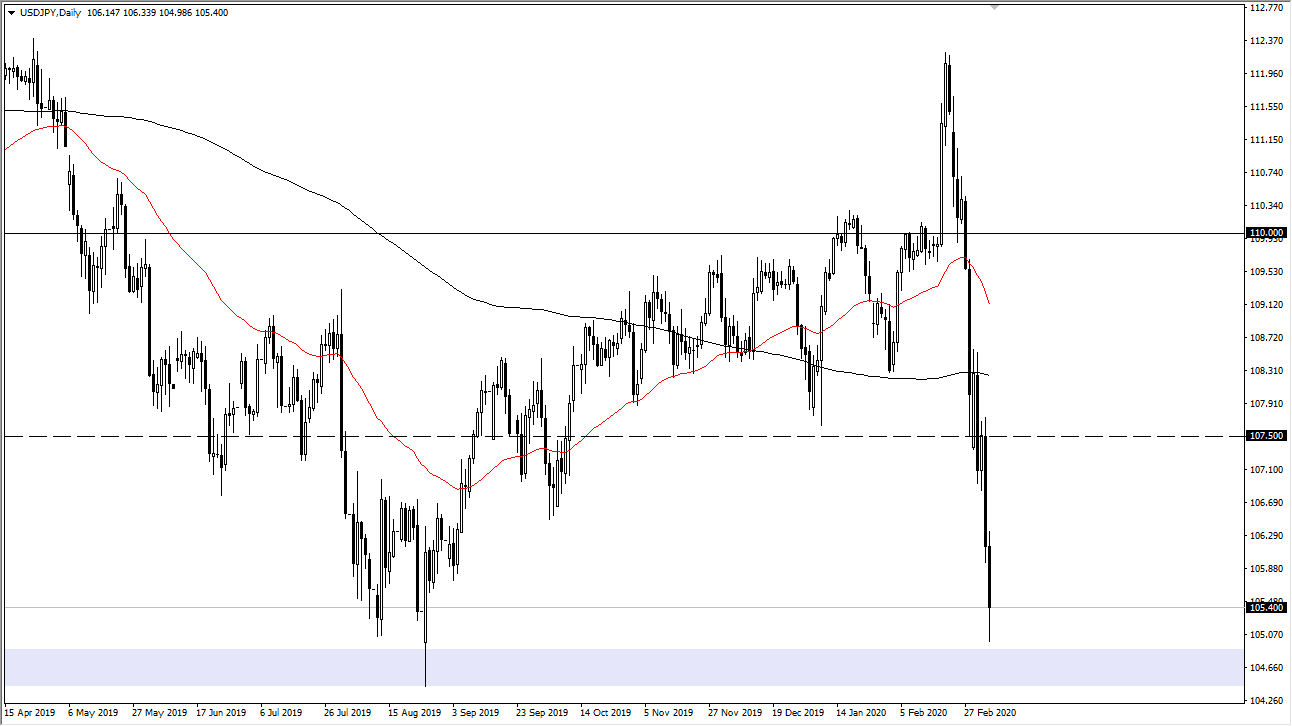

USD/JPY

The US dollar has been broken down significantly against the Japanese yen, reaching down towards the ¥105 level. That is the bottom of the larger consolidation area and therefore an area where I would expect a little bit of a bounce. However, I anticipate that the closer we get to the ¥107 level, the more likely we are to see sellers jump into the market and push the US dollar down. This will be especially true if we continue to get negativity coming out of the headlines. However, if we do turn around a break down below the ¥105 level, it could open up a move down to the ¥102 handle.

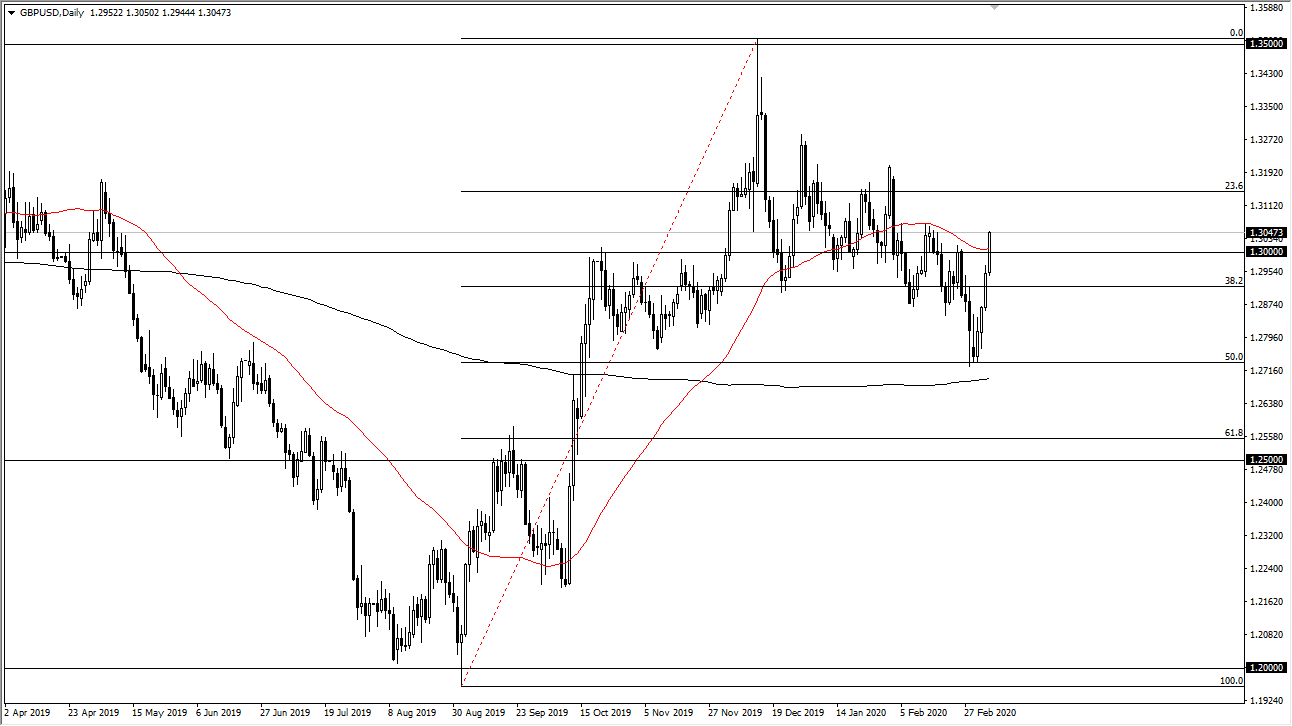

GBP/USD

The British pound has broken above the 1.30 level, and much like the Euro, it is enjoying US dollar weakness. I don’t necessarily know that the British pound is going to explode to the upside, but I think much like the Euro, it is a “buy on the dips” type of currency pair. The 1.32 level is the target and I do believe that we get there eventually. I don’t know if we get there this week, but clearly, it’s a market that can’t be sold with the Federal Reserve on its back and willing to sell out to Wall Street yet again.

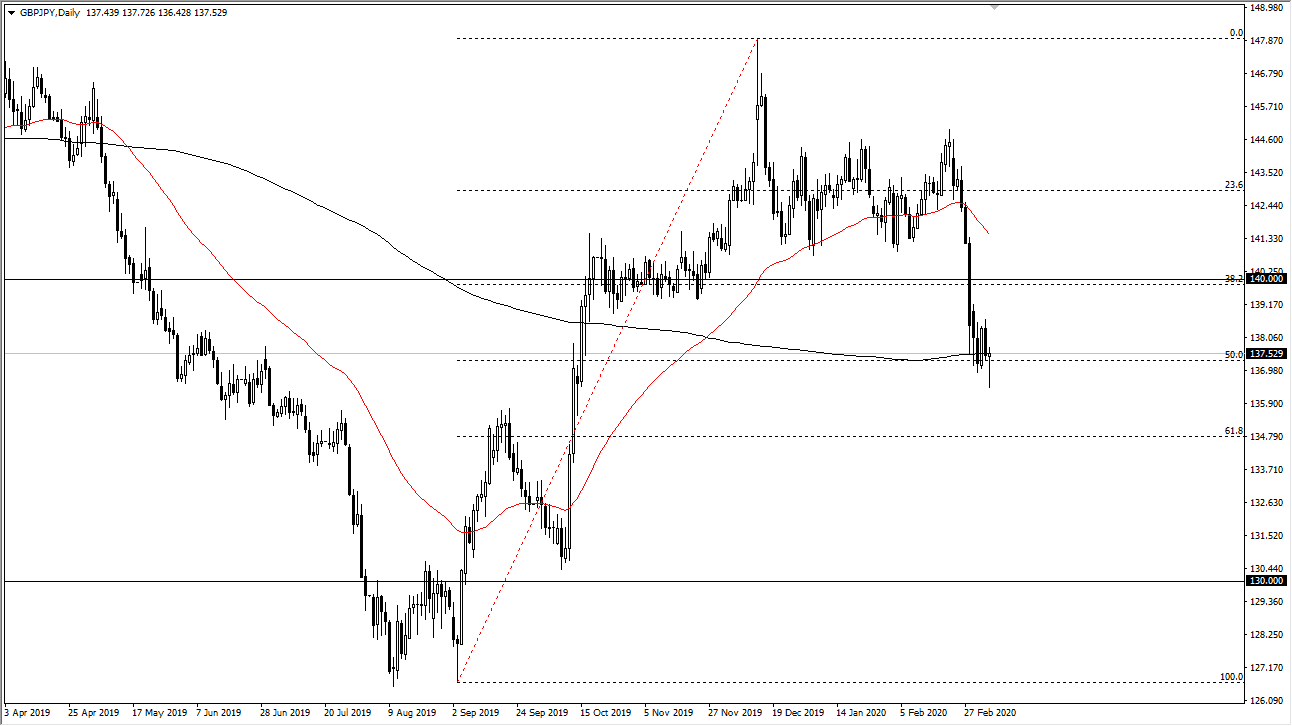

GBP/JPY

This could be one of the more interesting pairs this week. This is because we have formed a hammer right at 200 day EMA, and of course the 50% Fibonacci retracement level. If the British pound rallies against other currencies, this could be an interesting place to start buying. However, if we break down below the bottom of the candlestick for the Friday session, that opens up the door to the ¥135 level. This pair will move with risk appetite.