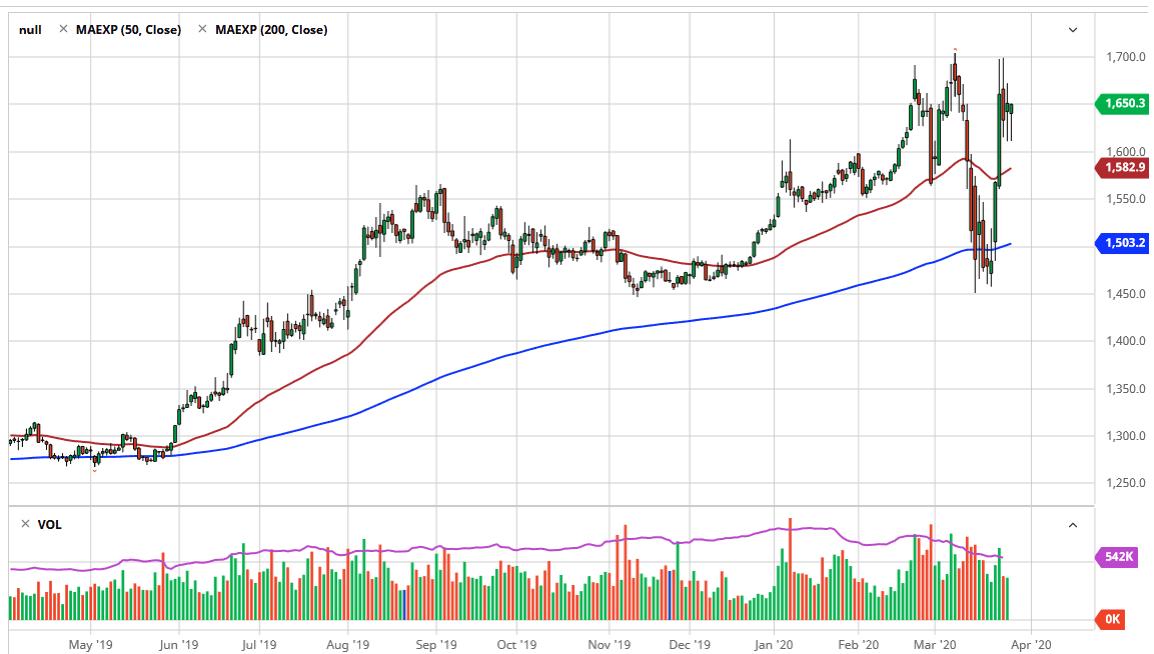

Gold markets pulled back initially during the trading session on Friday, just as we have during the last few days, and just as we did in those sessions, we had seen some buyers come back in and try to pick this thing up. Ultimately, the $1600 level should continue to show signs of support underneath, as the 50 day EMA is racing towards that level. That of course is an area that seems to be important due to the fact that it had been previous resistance.

The candlestick for the trading session about Thursday and Friday both look as if they are forming hammers, and this of course show signs of support underneath. At this being the case, it’s likely that the market goes towards the $1700 level above. The $1700 level of course is a large, round, psychologically significant figure, so to clear that area it’s likely that the markets would continue to go much higher, reaching towards the $1800 level, possibly even the $2000 level given enough time. With that being the case, it’s very likely that the $2000 level will cause a lot of headlines that will have people paying attention to the market and send in a lot of the “dumb money.” Because of this, I would anticipate a significant pullback from that area.

To the downside, if we were to break down below the 50 day EMA, it’s likely that the market then goes down to the 200 day EMA near the $1500 level. That’s an area that of course is a large, round, psychologically significant figure and therefore it’s likely that we will continue to see that price have an influence on the markets in general. Because of this, I believe that this is a market that will eventually find its footing on a pullback, as the concerns around the world will continue to cause major issues, and therefore it’s likely that gold will eventually offer the safety trade the people seem to associate with that most of the time. That being said, we had recently seen a massive a shot higher, so it would make sense to kind of grind sideways in order to find our footing, or perhaps even get a slight pullback. Ultimately, this is a market that will remain very volatile going forward, so given enough time I do think that the panic overwhelms, and we go higher.