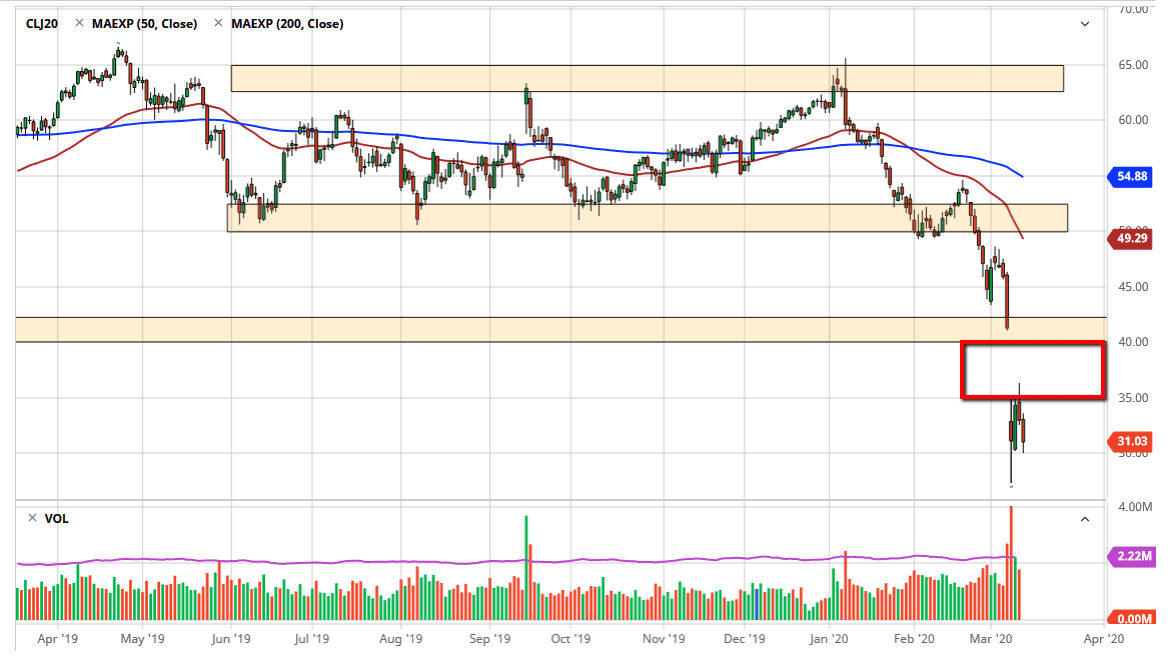

The West Texas Intermediate Crude Oil market fell again during the trading session on Thursday, reaching down towards the $30 level. We did bounce slightly during the day but then rolled right back over to close closer to the $31 level. There is obviously no lack of concern out there in the markets when it comes to risk appetite overall, so the fact that oil would roll over is not a huge surprise.

The crude oil market continues to struggle on multiple fronts, not the least of which is a serious concern about a lack of global demand. The biggest problem that markets are facing is that the global demand is going to be very slow due to the fact that the coronavirus will have people avoiding crowds, and of course travel is going to collapse. If that’s the case, then it’s obvious that there will be a lot less demand for crude oil.

The price war that Saudi Arabia has started in order to try to bury North American shale producers doesn’t help either, because quite frankly there is no reason to think that this “one-two punch” can do anything but put bearish pressure on price. There is a gap just above that will probably be looked upon by market participants as something that needs to be filled, but it’s difficult to imagine that it is going to be easy to do so. The $42 level above should be a “hard ceiling” for the market, and if the market were to rollover at that level, it is an ideal place to start selling. That being said, the market is likely to find the $30 level underneath as at least somewhat supportive, as market participants will have to get to use to the idea of oil trading in the 20s if we are to break down. At this point in time, if the market was to break above $42 level there would certainly be some type of news behind that move, and it would be an obvious sign that everything was changing. I don’t anticipate seeing that happen anytime soon, so I think it’s simply a situation where you fade rallies going forward as there should be more than enough reasons out there to keep this market low. At this point, there is no reason to be buying this market.