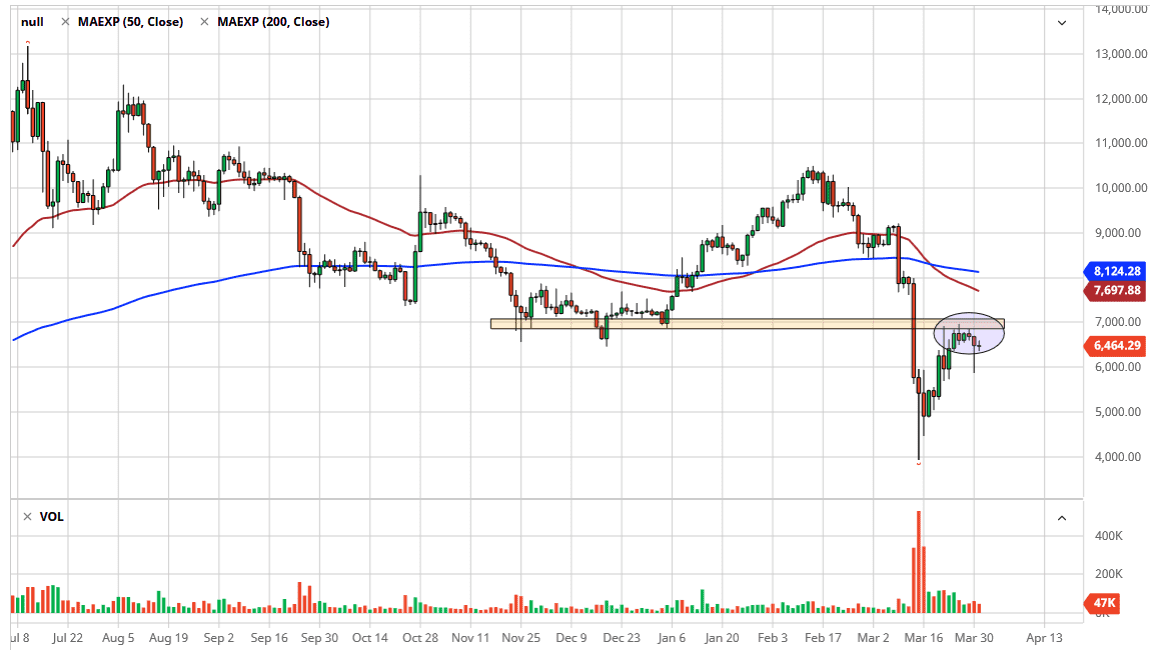

Bitcoin has gone back and forth during the trading session on Tuesday, as we continue to sit still. That being said, it suggests that Bitcoin is going to continue to struggle to break above the psychologically and structurally important $7000 handle, but I somewhat encouraged by the hammer that formed during the Monday session. This shows that the $6000 level is at the very least going to offer some support, so the question now is whether or not we can build up the necessary position size of order flow to finally break above the $7000 level.

All that being said, it’s interesting that Bitcoin hasn’t really been able to make a move one direction or another, due to the fact that the US dollar has been somewhat buoyant. I believe at this point Bitcoin traders are trying to figure out what it is they should be doing. I think once we get a clear move above the $7000 level, then the Bitcoin market should continue to go much higher. Having said that, it could open up a move up to the $8000 level. I think that the bottom of the Monday session should be paid attention to as well, because if we break down below that level it’s likely that the Bitcoin market will go looking towards the $5500 level, possibly even the $5000 level.

I think the one thing you can probably count on is that eventually the market will have to make some type of move. Currently, it doesn’t look like it really knows what to do and therefore I think we probably will see a lot of short-term chop. That is very possible, considering the way that the Forex market has been acting, one would think that the crypto market will act very much the same.

Risk aversion doesn’t seem to be helping one way or the other, and I do think at this point Bitcoin is probably going to be very uninspiring, but we have these obvious areas that we can trade from. Sometimes, the market sitting still tells you that eventually we are going to get a rather large move, that may be the case in this currency, but right now it seems as the lackluster performance of the Bitcoin market mirrors very closely the EUR/USD currency pair, showing that perhaps this is moving more or less on the value of the US dollar than anything else right now.