Bitcoin markets have rallied slightly during the trading session on Tuesday but gave back what little gains they made as we are waiting the Federal Reserve’s announcement. While most Bitcoin traders do not like to admit it, the reality is that crypto is truly starting to trade more like currency these days, and therefore paying attention to the Federal Reserve is going to be crucial as it could give you an idea as to where at least half of this equation will be going.

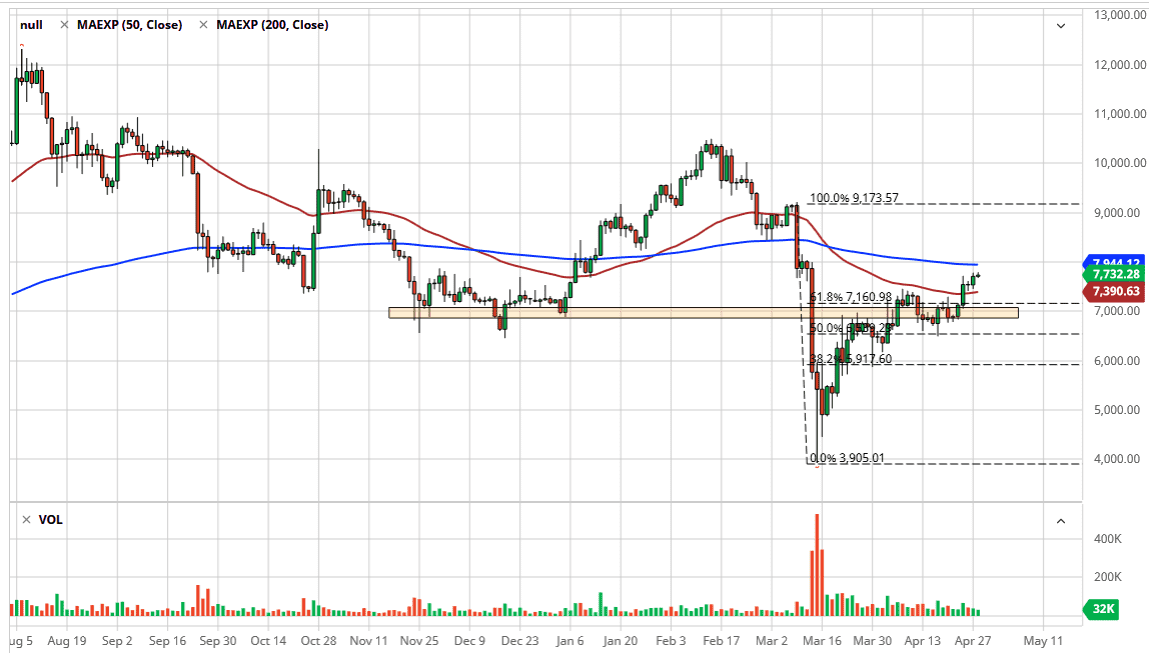

The 200 day EMA is sitting just above, and it should cause a bit of a longer-term resistance. The $8000 level above is an area where we have seen a lot of selling previously, and therefore it makes sense that not only would we have selling pressure in that area, but we would also have the 200 day EMA offering a bit of guidance as well. Having said that, Bitcoin has been rather resilient so it makes sense that this may end up being just a short-term pullback towards the $7000 level. Keep in mind that the Federal Reserve has an announcement coming out late on Wednesday, so that of course will have an influence on the US dollar and what it does. If there is a sudden surge of volatility, that could throw this market into a bit of a conniption in the short term.

That being said, if we simply turn around a break above the $8000 level, then the market could go looking towards $9000 next. As we have broken above the 61.8% Fibonacci retracement level, it is likely that we will continue to see more buyers eventually, but perhaps we have gotten a little bit overextended. If we do see a sudden surge of strength in the US dollar, then that could translate to lower prices over here. However, it looks as if there is enough upward momentum underneath to turn this market around on any pullback based upon potential value. Beyond that, there is also the halving coming up in May, so that of course will have traders looking forward in a positive light as well. If we were to turn around a break down below the $6500 level it could kill the uptrend, but right now that does not look likely to happen in the short term. Having said that, Bitcoin is an extremely volatile market.