BTC/USD: Bitcoin makes 2-month high price

Last Tuesday’s signals were not triggered as none of the key levels were hit that day.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered prior to 5pm Tokyo time Thursday.

Long Trade Ideas

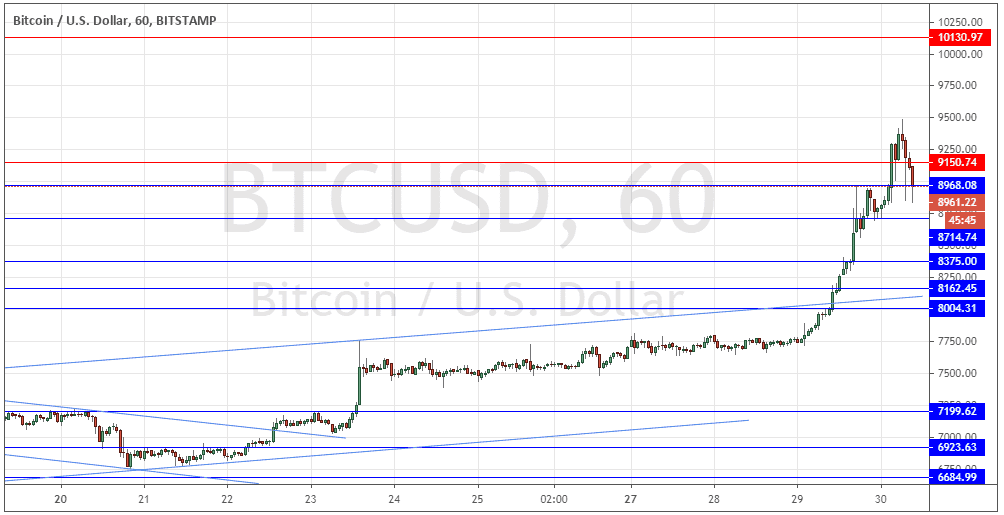

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $8,968, $8,715, $8,375, or $8,162.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry after a bearish price action reversal on the H1 time frame following the next touch of $9,150 or $10,131.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Tuesday that I would be prepared to take a short trade from a strong reversal at any of the resistance levels above $8,000 but until that price was reached, I saw the price as more likely to rise over the day. This was at least partially a good call, as the price not only rose over the day, but then went on to rise very strongly on Wednesday too, breaking through several resistance levels identified from $8,000 to $9,000.

The price has risen with strong momentum to make a new 2-month high but has sold off quite sharply after getting as high as $9,500. I think the price is likely to mostly hold up, it is just a question of which of the new support levels ends up being the one the provides the key support to prevent a further fall. Therefore, I am prepared to take a long trade from any bullish bounce at any of the support levels identified above, as there is likely to be some bullish momentum left in this movement.

Another factor which may be supporting the price of Bitcoin is that we are now only 11 days away from the next halving event. Halving events have tended to push the price of Bitcoin up as they approach.

Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.