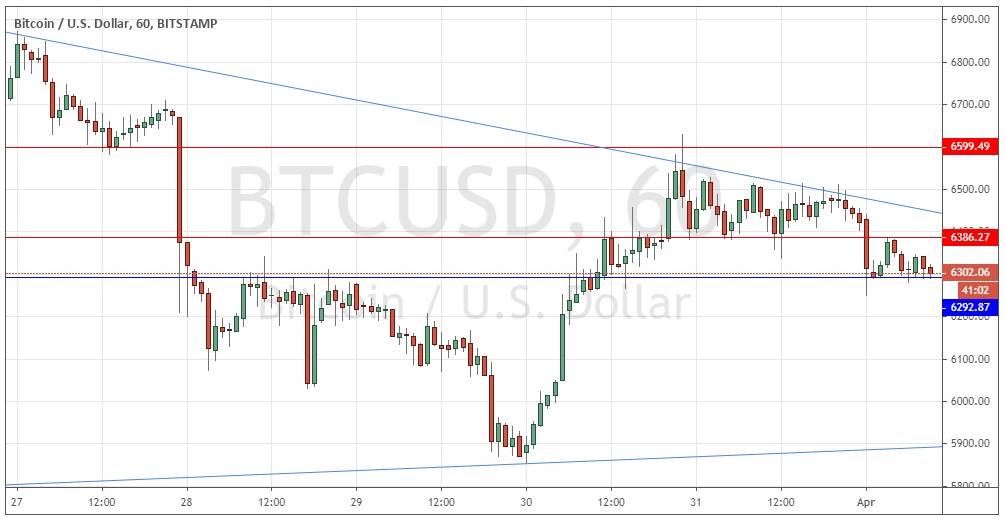

BTC/USD: $6,293 about to break down

Yesterday’s signals were not triggered as there was insufficiently bullish price action at both of the support levels which were reached yesterday.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be taken prior to 5pm Tokyo time Thursday.

Long Trade Ideas

Go long after a bullish price action reversal on the H1 time frame following the next touch of $6,396 or $6,293.

Put the stop loss $50 below the local swing low.

Adjust the stop loss to break even once the trade is $50 in profit by price.

Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to ride.

Short Trade Idea

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $6,600.

Put the stop loss $50 above the local swing high.

Adjust the stop loss to break even once the trade is $50 in profit by price.

Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday that the resistance factors looked stronger than the support and I thought that we could see a bearish reversal from $6,600. I was right to look towards the short side, although the price never quite reached that level at $6,600, as we have seen the price drop.

The price is currently sitting right on the support level at $6,293 which looks extremely likely to break down and it has lots of room to fall further. Another bearish factor is that the price is moving down within a consolidating triangle from the upper edge of the triangle.

There is every reason to be bearish, but I would wait for a break below $6,293 evidenced by two consecutive hourly closes below that level on rising short-term volatility. Risk sentiment is souring, and the USD is strengthening, which should help bears. Regarding the USD, there will be a release of the ADP Non-Farm Employment Change data at 1:15pm London time, followed by ISM Manufacturing PMI numbers at 3pm.

Regarding the USD, there will be a release of the ADP Non-Farm Employment Change data at 1:15pm London time, followed by ISM Manufacturing PMI numbers at 3pm.