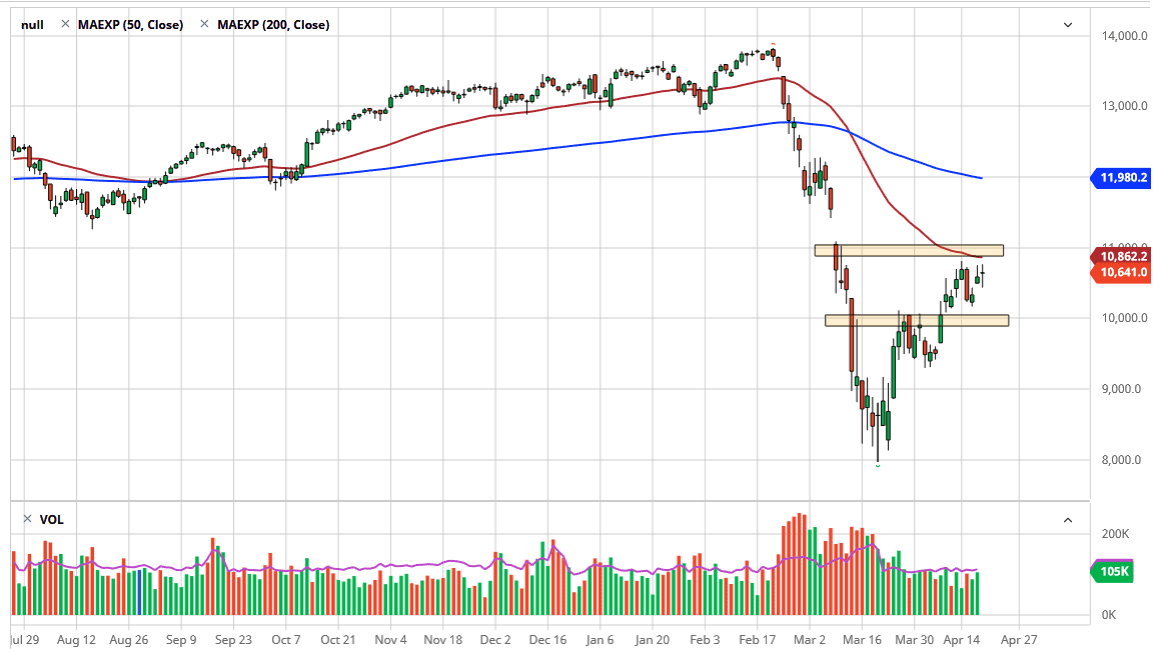

The German index went back and forth during the trading session on Monday as traders came back to work with very little in the way of news flow. Because of this, the market has simply gone sideways and has not done much during the trading session. The 50 day EMA above is offering resistance at 10,861. Having said that, there is also a significant amount of resistance just above at 11,000, so I think at this point it’s only a matter of time before we see a little bit of a pushback due to the large, round, psychologically significant figure, and the 50 day EMA. Furthermore, there is a gap just above that should come into play as well.

Keep in mind that the European Union continues to struggle overall, although there are some signs that a handful of European economies may start to try to open up. If that’s going to be the case, the market may have some bullish pressure in it, but at this point I think it’s only a matter of time before we get at least a pullback. Currently, we are trading between the 11,000 level and the 10,000 level underneath. All things being equal, I think we probably hang out in this general area, but I recognize that even if we do rally the gap will probably cause quite a few problems. It’s hard to imagine that we simply go straight up in the air, so I think a pullback is overdue. If we break down below the 10,000 level, that could spell more trouble but I think more than likely we are going to trying to test the waters here in this 1000 point range, trying to get a grip on where we are most comfortable, and whether or not the market has the momentum to finally take off to the upside for good. I am skeptical, but if we break above the 11,000 level you have to think that the gap gets filled at the very least. To the downside, if we were to break down below the 10,000 level, the 9500 level would be targeted, possibly even 8000 if we get any serious breakdown. Now that we have bounced, the question is whether or not we have the momentum to sustain this type of move? I suspect we will have the answer the question rather soon, so pay attention and wait for an impulsive candlestick.