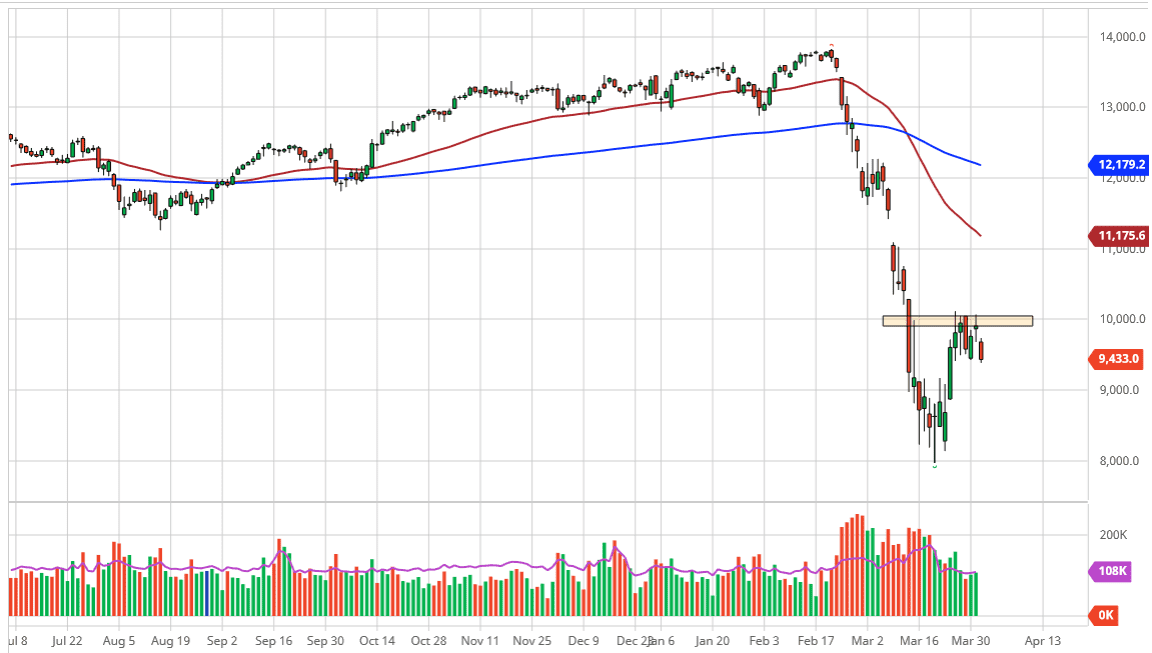

The German index gapped lower to kick off the trading session in the futures market on Wednesday, as the 10,000 level continues to cause major issues. Because of this, we have seen selling over the last several sessions, and of course the Wednesday session was even more negative. It made a “lower low” than the Monday session, showing signs of weakness going forward. Ultimately, this is a market that will continue to see a lot of noise, as the European Union struggles through the negativity that we see when it comes to the coronavirus figures, and of course the fact that there is so much economic uncertainty out there. With the slowdown of the global economy, it’s hard to imagine that the European Union would suddenly surge higher than the other areas. This is especially true when looking at the fact that the European Union will struggling beforehand.

The market has broken below the 9500 level, and it looks likely to go down towards the 9000 level. Ultimately, I think that the market could even break back below there and go looking towards the lows again. After all, the market will quite often reach for the lows again after this type of meltdown. Someday, when things start to show signs of strength again, this market will probably turn around and try to fill the gap above the 11,000 handle. However, we aren’t anywhere near that time at the moment.

Expect a lot of back and forth action going forward, but there certainly seems to be more aggression to the downside. Stocks in general of course continue to be shunned but there are certain amount of value hunters out there that are trying to hang on to this move. I believe this point the 8000 level needs to hold for any attempt to the downside to be abated and a potential bottoming put into this market. If that were to get broken, the bottom is somewhat unknown. On the other end, if we do break above the 10,000 level before dropping, that would be an extraordinarily bullish sign and bring the 11,000 level in focus, perhaps even the gap. It right around that area we also have the 50 day EMA so that is worth paying attention to as well. I do not believe that this market has the wherewithal to break out anytime soon though, so I prefer fading these rallies.