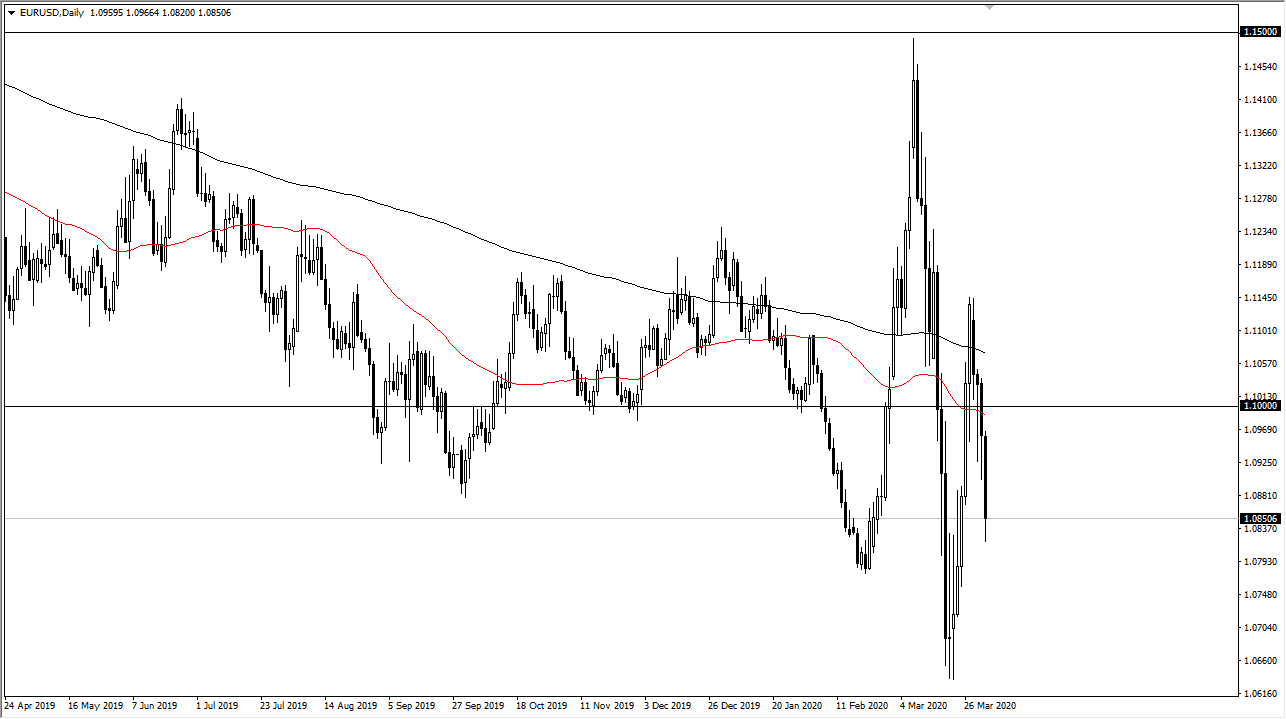

The Euro broke down rather significantly during the trading session on Thursday, reaching towards the 1.08 level, an area that I had suggested that could be targeted. The bounce from that area was slight at the end of the day, and as a result it’s likely that the market could very well reach towards the 1.10 level. At this point, fading rallies continues to probably work out the best way, because the jobs number during the day on Friday will more than likely cause a bit of volatility. That being said, the 1.10 level should offer plenty of resistance so I would be a bit surprised if the market were to turn around and to simply slice through there. Alternately, we could break down below the candlestick for the trading session on Thursday, and then we could reach towards the 1.07 level, possibly even the 1.06 level after that.

The market broke rather hard during the trading session but with the initial jobless claims in the United States showing a gain of over 6 million, this shows just how troublesome the global economy is going to be. After all, the coronavirus effects on the global economy have been much worse than anticipated. Ultimately, this means that there is going to be no growth to be had and what we have seen is a market that was jumping into treasuries rather quickly, which of course require US dollars. Furthermore, the European Union was a bit of a mess before all of this started so there’s no reason to think that it would be better now.

One thing that I would point out is that although the volatility has gone off of the chart seriously, what’s rather interesting is that the recent high is quite a bit lower than the one before. The question now is whether or not we can make a “lower low?” Without being the case, it would open up the door to the 1.05 level after that. That’s a level that clearly would be important based upon the longer-term charts. The next 24 hours could give us quite a bit of clarity as to where we go next. I am more than willing to short this pair if we get close to the 1.10 level during the Friday session, with a relatively tight stop loss as it can give us an opportunity to start selling again. The risk to reward ratio is quite nice in that region.