The Euro has gone back and forth during the trading session on Monday, as we continue to see a lot of noisy trading behavior. Ultimately, I believe that this market is going to continue to favor the downside, as the US dollar is considered to be a bit of a safety currency. I believe that the market will see plenty of noise that it needs to chew through, but I do favor fading this market as there is clearly a very negative tone to the European Union. There is a high demand for US paper, so the treasury markets should continue to keep the US dollar somewhat afloat. With most of the world going through a massive recession, that’s normally good for the US dollar all things being equal.

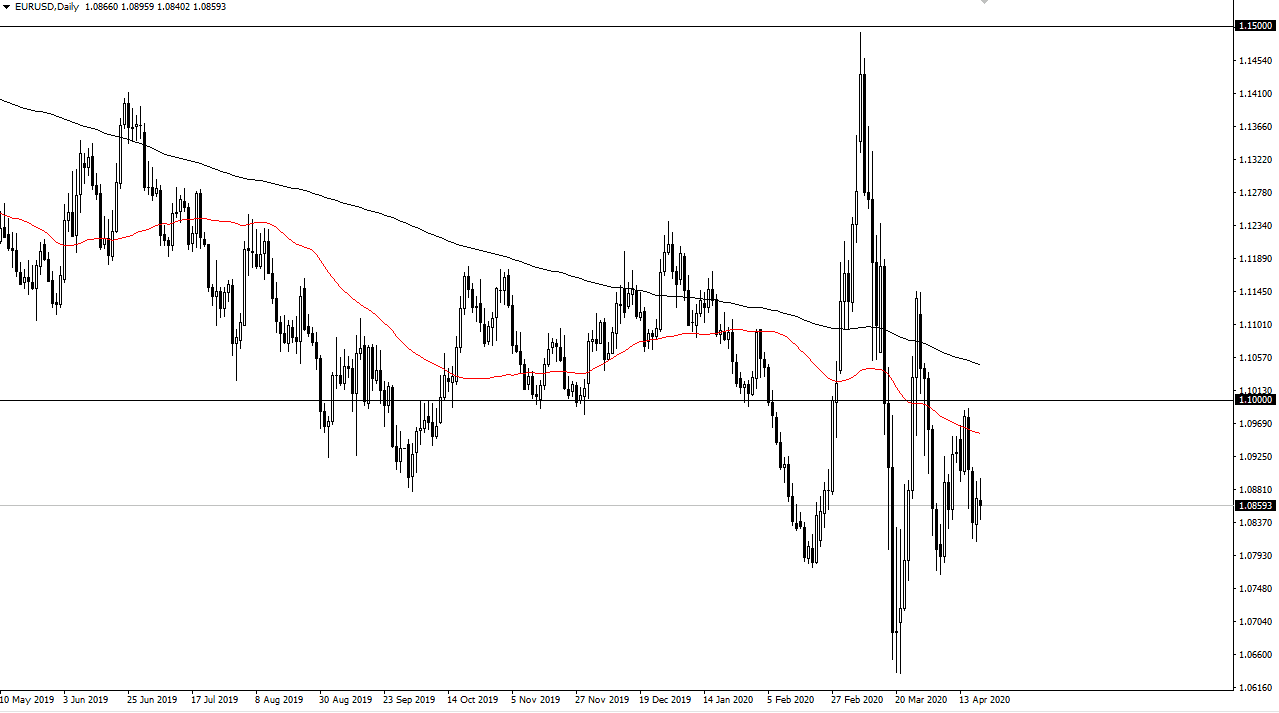

Looking at the chart, it’s obvious to me that there is a significant amount of resistance above at the 1.10 level, which I feel is the “ceiling” of the market, and therefore I would be a bit surprised to see the market break above there. In the meantime, it certainly looks as if we are getting a bit exhausted, and it should be noted that the most recent high was clearly lower than the one before it. Because of this, I think that every time it rallies you should be looking for an excuse to start selling.

Ultimately, I believe that the 1.08 level being broken to the downside opens up the possibility of the 1.0650 level being targeted next. That doesn’t mean that we get there right away, and I think that it will take a significant amount of momentum to make that happen. I think at this point what we are likely to see is a lot of back and forth with more downward pressure than anything else, which is typical of the Euro as it has been in a downtrend forever, but at the same time it’s a very choppy market overall. Ultimately, it’s a grind to the downside that I’m looking to. If we did somehow break above the 200 day EMA which is currently at the 1.1050 level, then you have to rethink the entire situation. I see nothing on this chart that suggests it’s going to happen anytime soon, which makes sense as the European Union struggles to gain any economic traction. Look at short-term charts as selling opportunities when they show signs of exhaustion. Unless you are a day trader, it’s difficult to trade this market right now.