The EUR/USD pair tried to take advantage of investors’ giving up the dollar as a safe haven, and therefore there was an opportunity for an upward correction, but gains did not exceed the 1.0888 resistance and with the European currency losing the momentum, the pair was unable to achieve more, and therefore it fell back to the 1.0817 level in the beginning of today’s trading. As we expected, the pair's gains will remain a selling target, as long as the coronavirus persists, the dollar will remain stronger on the long run. U.S. President Trump has great confidence with his desire to reopen the US economy that the recovery will be strong despite the disease. He believes that his government is fully prepared to reopen and take advantage of the massive stimulus plans it had adopted alongside the Federal Reserve Bank, who will announce their monetary policy decisions later today.

Although Europe is a hot spot for the epidemic, it is determined to reopen the economy, which was devastated by the World Trade War, and then the spread the coronavirus. On the economic side, the results of the survey from the French Statistical Office showed the deterioration of French consumer confidence at the fastest pace recorded in April after the government started measures to contain the coronavirus. Amid the closure, the Consumer Confidence fell to 95 in April from 103 in March. However, the reading was higher than economists' expectations of 83. The statistical office said that the index lost 8 points, its biggest drop since the survey was established in 1972 ″.

In April, the percentage of households thinking the time is suitable to make large purchases decreased, so the corresponding balance decreased 43 points to -59, the lowest level since the survey was established. Moreover, the balance of household view of their future financial position decreased by 15 points, the strongest drop in the survey history. The result came at -22, the weakest since May 2014.

On the same track from the United States of America, American consumer confidence eased in April as millions lost their jobs and there was an unprecedented deterioration of the index monitoring positions on business and current work conditions. The US consumer confidence index fell to 86.9, its lowest level in nearly six years, from 118.8 recorded in March. The index consists of consumers' assessment of current conditions and expectations about the future.

According to details of the statement, the percentage of people who say jobs are "plentiful" halved to 20% in April. March reading was 43.3%. The percentage indicating jobs are "hard to get" rose to 33.6%, from 13.8% in March. The index of current conditions fell from 166.7 to 76.4, an unprecedented decrease of 90 points. The outlook index, based on future expectations, improved slightly from 86.8 in March to 93.8 in April.

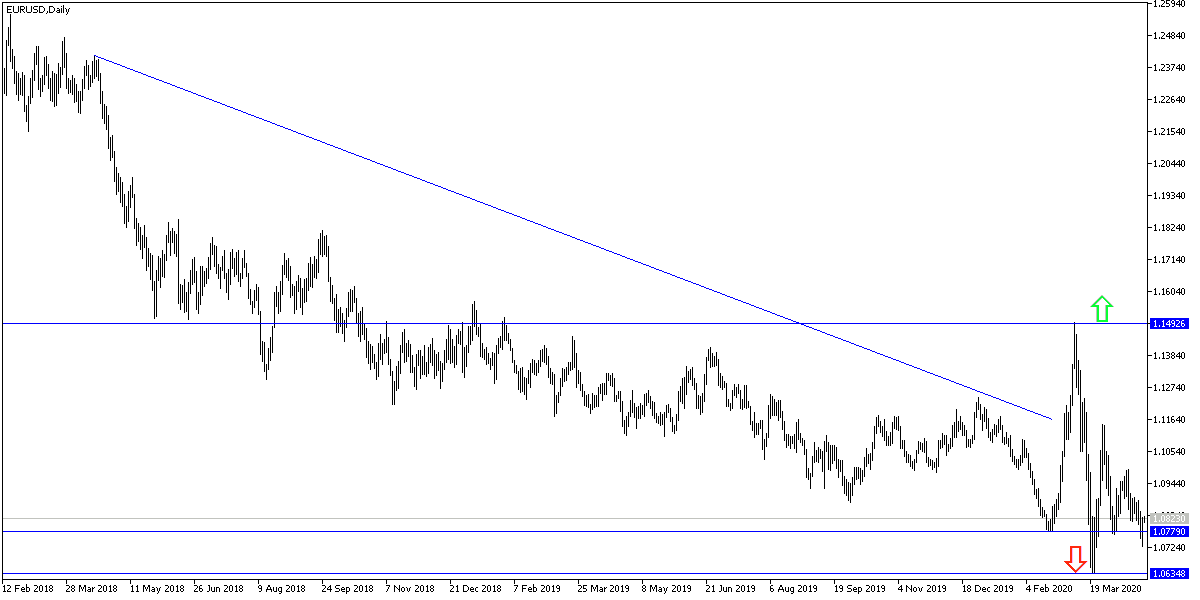

According to the technical analysis of the pair: expectations indicate that the US Federal Reserve will not change its monetary policy today and the largest interaction for the EUR/USD will be with the announcement of economic figures before the decisions, and with Governor Jerome Powell statements. On the long term, the general trend of the pair remains bearish, especially with its stability around and below the 1.0800 support, which confirms the bear's control over the performance, and accordingly, the closest support levels may be 1.0765 and 1.0690, and the last level confirms the technical indicators reaching strong oversold areas from which we can consider buying. The 1.1000 Psychological resistance still target for bulls to, if reached, it will change the direction of the pair.

As for economic calendar data: From the Eurozone, German Consumer Price Index will be released. From the United States, the rate of GDP growth, pending home sales and oil stocks data will be released, then the US Federal Reserve announcement and governor Jerome Powell statement.