The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Of course, the current market environment is one of crisis and very high volatility, and price movements are almost entirely dominated by the economic impact of the coronavirus pandemic. That is the dominant factor to consider in trading any market today.

Big Picture 12th April 2020

In my previous piece last week, I forecasted that the best trades were likely to be short of the S&P 500 Index and the AUD/USD currency pair below their respective lows made during the previous week. Neither of these lows were reached, so no trade was actioned by my forecast.

Last week’s Forex market saw the strongest rise in the relative value of the Australian Dollar, and the strongest fall in the relative value of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The world is not coming to an end, but we are living in an extraordinary time of global health crisis, the type of which has not been seen in one hundred years. There is a great deal of fear and panic, but it is important to remember that the evidence shows that the vast majority of people are going to survive and be healthy.

In time such as these, it is extremely difficult to make very short-term market forecasts, as the crisis can change focus day by day, strongly affecting sentiment and market movements. However, medium-term forecasts are easier to make as high levels of volatility tend to accompany see-sawing price movement.

We have seen the epicenter of the global pandemic move into the United States, especially New York, with fatalities rising strongly also in the U.K. It looks as if this wave may have already peaked in Italy and Spain, the European countries with the highest total death tolls to date.

All stock markets are now in technical bear markets (decline of more than 20% from peak). The U.S. stock market was temporarily boosted by a $2.2 trillion emergency stimulus package. Despite important questions remaining as to the sustainability of this rally even in the face of a huge drop in GDP and employment, last week saw stock markets close near their highs of the week.

It is clear that this crisis will enforce severe economic restrictions in all affected countries which will need to last for several weeks or even months. The only given is that stock markets and GDP generally will take severe hits, with Goldman Sachs now forecasting a 34% drop in U.S. GDP in the second quarter of 2020 and U.S. unemployment topping at 15%. The stock market crash we are seeing is comparable to 2008 and even 1929 so far. In fact, the speed of the initial drop of 20% from the all-time high price took only 15 market days to happen, compared to 30 days in 1929.

It seems clear that we will see a continued though maybe reduced level of high market volatility. Prices are likely to depend upon how the U.S.A. and European nations cope with the spread of the virus, and whether there are any signs of successful containment. There is some good news in many European countries (notably Spain and Italy) as the rate of increase in confirmed new infections slows down in many places. It should be remembered that deaths tend to log new infections by approximately 3 weeks.

We are also starting to see a few countries that have had relatively successful lockdown measures begin to release restrictions on the belief they have successfully dealt with a first wave of infections. These are smaller nations such as Denmark, Norway, Austria and the Czech Republic.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows last week printed a bearish inside candlestick which closed very near to the low of its range. It made a fairly strong move against the direction of its long-term trend after bouncing back last week on relatively high volatility. This is a sign of indecision, especially as we have declining volatility within a congested area which means next week’s movement is difficult to predict. Overall, next week’s price movement in the U.S. Dollar looks unpredictable and volatile.

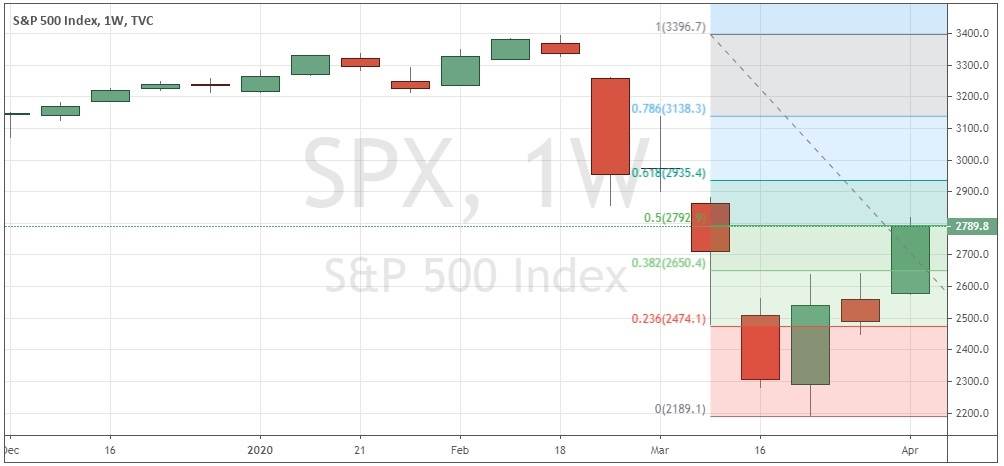

S&P 500 Index

The major U.S. stock market index – the biggest market index in the world – made an upwards move on declining volatility after falling last week, after closing at its lowest weekly close in three years three weeks ago. It is hard not to see further downwards movement as likely over the near to medium term due to the worsening, Great Depression-like situation regarding demand and output in both the U.S.A. and globally. This means that we are unlikely to have seen the bottom of this bear market yet. However, the price has regained almost half of its peak to trough drop. This 50% retracement level, marked within the price chart below, is a logical technical point at which we might see the bearish trend reassert itself and bring in some selling. The price closed right there at the end of last week.

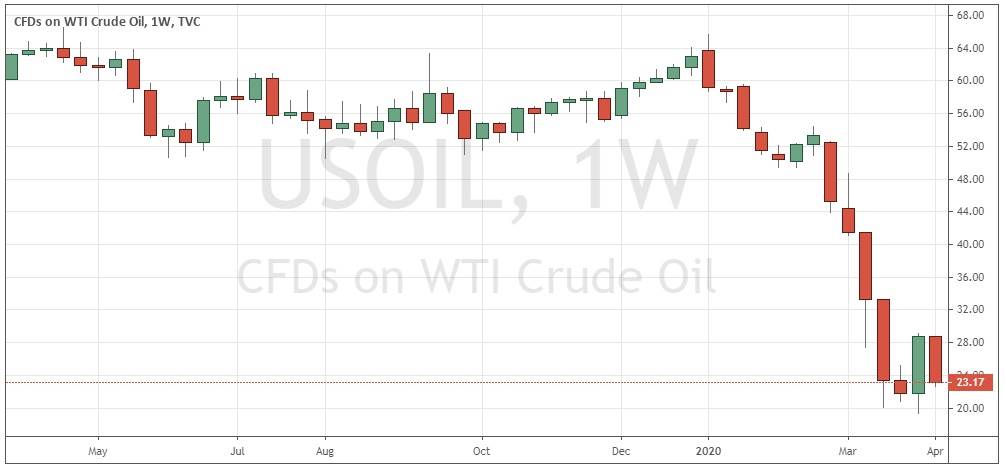

WTI Crude Oil

WTI Crude Oil made a relatively strong bearish move last week, falling by about 20% in value after recently reaching a low just below $20, after making its lowest weekly close in 18 years. The price is currently strongly affected by rumors of an output deal nearing resolution between Russia, Saudi Arabia, and OPEC generally. This means that we have very high volatility, but price movements are impossible to predict with any probability. Day traders may look to trade the volatile swings in either direction on price action, but this is a highly risky asset to be involved in right now.

AUD/USD

The AUD/USD currency pair made a strong upwards movement last week, with the AUD the biggest gainer and the USD the biggest loser of the week. This currency pair is tending to move in line with stock markets, which have seen a continuing recovery over the past week, despite the belief by many market analysts that further sharp downwards movement is inevitable. The price has recovered more than 50% of its recent loss, but due to the relatively high volatility, another strong fall remains quite likely.

Conclusion

This week I forecast the best trade is likely to be short of the S&P 500 Index if there is a close at a new 2-day low below 2790.